2023.10.17

Q4 DRAM Contract Prices Set to Rise, with Estimated Quarterly Increase of 3-8%, Says TrendForce

2023년4분기 디램 고정 가격은 전분기대비 3~8%상승할 것으로 트렌드포스는 예상했다.

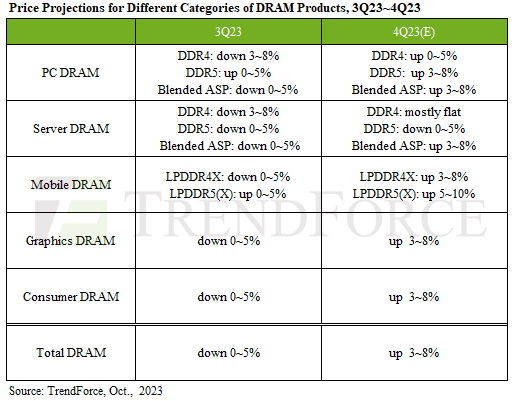

TrendForce reports indicate a universal price increase for both DRAM and NAND Flash starting in the fourth quarter. DRAM prices, for instance, are projected to see a quarterly surge of about 3-8%. Whether this upward momentum can be sustained will hinge on the suppliers' steadfastness in maintaining production cuts and the degree of resurgence in actual demand, with the general-purpose server market being a critical determinant.

PC DRAM: DDR5 prices, having already surged in the third quarter, are expected to maintain their upward trajectory, fueled by the stocking of new CPU models. This forthcoming price hike cycle for both DDR4 and DDR5 is incentivizing PC OEMs to proceed with purchases. Although manufacturers still have substantial inventory and there's no imminent shortage, Samsung has been nudged to further slash its production. However, facing negative gross margins on DRAM products, most manufacturers are resistant to further price reductions, instead pushing for aggressive increases. This stance sets the stage for an anticipated rise in DDR4 prices by 0–5% and DDR5 prices by around 3–8% in the fourth quarter. Overall, as DDR5 adoption accelerates, an approximate 3–8% quarterly increase is projected for PC DRAM contract prices during this period.

Server DRAM: Buyer inventory of DDR5 has climbed from 20% in Q2 to 30–35% recently. However, with only 15% being actually utilized in servers in Q3, market uptake is slower than expected. Meanwhile, Samsung's intensified production cutbacks have notably shrunk DDR4 wafer inputs, causing a supply crunch in server DDR4 stocks. This scenario leaves no leeway for further server DDR4 price reductions. In response, manufacturers, aiming to enhance profits, are accelerating DDR5 output.

Looking ahead, Q4 forecasts anticipate stable server DDR4 average prices, while server DDR5 is set to maintain a declining trajectory. With DDR5 shipments on the rise and a notable 50-60% price disparity with DDR4, the blended ASP for the range is poised for an upswing. This leads to an estimated 3–8% quarterly hike in Q4 server DRAM contract prices.

Mobile DRAM: Inventories have bounced back to healthy levels sooner than other sectors, thanks to price elasticity driving an increase in per-device capacity, and revitalizing purchasing enthusiasm in 2H23. On the other hand, although Q4 smartphone production hasn't reached the previous year's levels for the same period, a seasonal increase of over 10% is still supporting demand for mobile DRAM. However, it's crucial to note that current manufacturer inventories remain high, and production cuts haven't yet altered the oversupply situation in the short term. Nevertheless, manufacturers, under profit margin pressures, are insisting on pushing prices upward. For products where inventory is more abundant, such as LPDDR4X or those from older manufacturing processes, the estimated contract price increase will be about 3–8% for the quarter. In contrast, LPDDR5(X) appears to be in tighter supply, with projected contract price increases of 5–10%.

Graphics DRAM: A niche market dynamic and an acceptance of price hikes among buyers suggest sustained procurement of mainstream GDDR6 16Gb chips, preparing for expected price increases in 2024. The launch of NVIDIA's new Server GPU L40s in the third quarter is facilitating the depletion of existing manufacturer inventories. Furthermore, gaming notebooks are excelling in sales, surpassing the general notebook market this year. Consequently, manufacturers are experiencing less inventory stress for graphics DRAM than they are for commodity DRAM. This landscape sets the stage for an anticipated 3-8% hike in graphics DRAM contract prices for the fourth quarter.

Consumer DRAM: Samsung initiated significant production reductions starting in September to diminish its surplus of older inventory. These cuts are projected to hit 30% by the fourth quarter. With the anticipation of steadily declining inventories, manufacturers are looking to increase consumer DRAM contract prices, aiming for hikes of more than 10%, to avoid incurring losses. However, even though some producers raised their prices at September's close, demand continues to be lackluster, with purchasing and stock-up efforts not as strong as anticipated. This deviation in pricing goes against the expected supply-demand balance, suggesting a more modest estimated rise of 3–8% in consumer DRAM contract prices for the fourth quarter—below manufacturers' initial targets.

----------------------------------------------------

Suppliers Scale Back Production, Q4 NAND Flash Contract Prices Projected to Climb 8~13%, Says TrendForce

공급자들의 생산 축소로 4분기 낸드 계약 가격은 전분기대비 8~13% 상승할 것으로 트렌드포스는 예상했다.

TrendForce research indicates a significant rise in NAND Flash contract prices in the fourth quarter, with an anticipated hike of approximately 8~13%. This increase has been largely attributed to stringent production controls exercised by suppliers. However, the outlook for 2024 suggests challenges in maintaining this upward price trajectory. The continuation of this rising trend hinges on persistently reducing output and the resurgence of demand for enterprise SSDs within the server market. Without solid demand, the momentum of this price surge could falter.

Client SSD: Active price increases by suppliers and module makers have motivated PC OEMs to stock up at relatively lower price points, leading to procurement volumes higher than actual demand. Suppliers aiming to expand bit shipments have launched promotions in Q3, leaving little room for further price declines for client SSDs. Meanwhile, reduced production of mainstream processes and fewer suppliers for high-end client SSDs have endowed suppliers with better bargaining power. Consequently, both high-end and low-end products are expected to increase concurrently, with 4Q23 PC client SSD contract prices projected to rise by 8~13%.

Enterprise SSD: North American CSPs still hold significant amounts of inventory, but demand from some server brands has recovered compared to 1H23, gradually increasing stocking momentum. In China, orders have picked up as CSPs’ inventories have dropped to reasonable levels, coupled with increased demand during the peak season for second-tier e-commerce vendors. Overall, procurement demand for enterprise SSDs in the fourth quarter is expected to grow. With NAND wafer prices leading the increase since August and suppliers adopting a firmer stance in negotiations, Q4 enterprise SSD contract prices are projected to rise by approximately 5~10%.

eMMC: The second half of the year primarily relies on TV shipments and certain smartphone demand for support, yet actual purchasing momentum is not vigorous. Amid suppliers’ aggressive price-hiking stance—extending from wafers to finished products—module makers have also raised quotes to reflect increased costs. Buyers, with relatively low inventory, have no choice but to procure in advance, thereby driving up eMMC prices, with suppliers increasing targets for size, capacities, and applications. Concurrently, due to production costs extending to mainstream processes for eMMC, availability is dwindling, and clients may not fully receive their requested volumes. Therefore, eMMC contract prices in 4Q23 are expected to grow by approximately 10~15%.

UFS: The stage is set for a procurement boost in the fourth quarter, thanks to a trifecta of new releases, seasonal stocking, and some brands playing market share defense. Smartphone OEMs, wary of a changing tide, are scrambling to bump up component reserves to safe levels. UFS 4.0 has experienced the most significant price increase due to its limited supply as well as the product’s reliance on advanced manufacturing processes. While other mature UFS products have ample stock and numerous suppliers, OEMs are unwilling to continue selling at low prices for a loss. Instead, they have chosen to adjust and increase prices. It’s estimated that UFS contract prices will see a quarterly increase of 10~15% in the fourth quarter.

NAND Flash Wafer: After Samsung reduced its production by a staggering 50%, other suppliers have followed suit, adopting a conservative approach to wafer investment. This reduction in production—ongoing for over six months for specific processes and capacities—has led to a pronounced, structural tightness in supply across the market. This development positions suppliers favorably, granting them significant leverage over pricing. Observations for the fourth quarter indicate a dearth of affordable supplies available for purchase, yet buyers are persisting in maintaining substantial inventory levels, continuing their procurement efforts unabated. In light of these conditions, suppliers are presently vying to elevate prices swiftly beyond cash costs. Projections for the fourth quarter suggest an uptick in NAND Flash wafer contract prices of approximately 13~18%.

'반도체-삼성전자-하이닉스-마이크론' 카테고리의 다른 글

| DDR4 D램 가격 15% 껑충…반도체 '업턴' 시작되나(2023.11.01) (0) | 2023.11.01 |

|---|---|

| HBM 공급 부족 3년 더 간다(2023.10.30) (0) | 2023.10.30 |

| D램 고정가 보합세 전환…4분기 반등 전망 커져(2023.10.05) (0) | 2023.10.05 |

| 마이크론 4분기(6-8월) 실적발표(2023.09.28) (0) | 2023.09.28 |

| 삼성전자, 북미 고객사 주문량 증가…4분기 기대감↑-KB (0) | 2023.09.26 |