metastatic[mètəstǽtik]~(암세포등이)전이된

2021.08.12

2021년8월22일 AMD 종가는 106.50달러, 시총은 1291.81억달러이다.

아래 내용을 요약하면....

엑스레이,엠알아이, 씨티 장비와 초음파 장비등 의료 영상장비 시장의 매출은 4322억달러에 달하고,

이들을 지원하는 소프트웨어 서비스 시장은 2027년에는 달러에 달할 것이다.

AMD는 마이크로소프트와 협업한 소프트웨어와 자체 결합프로세서를 내장한 의료 영상 장비를판매하여 매출을 증대시킬 수있다.하지만 이런 사실이 시장에서는 거의 언급되지 않고 있다.(분석: 고해상도를 요구하는 의료 영상 장비 시장에서의 장비 매출에 비래해 일반 디램과 그래픽 디램의 매출이 증대할텐데, 이 역시 시장에서는 언급되지 않고 있다.)

뛰어난 성능, 멀티 디스플레이 가상화, 고해상도 이미지 화질을 통해 환자 치료 개선 AMD 임베디드 솔루션은 차세대 기능을 지원할 수 있는 다양한 기능과 고성능을 갖춘 소프트웨어 지정 솔루션을 제공할 뿐만 아니라, 개발 및 시스템 예산을 줄일 수 있는 확장 가능한 제품을 통해 의료용 이미징 응용 프로그램의 요구 사항을 충족시킬 수 있는 모든 기능을 제공합니다.

The Growing $432.23 Billion Medical Devices Industry Can Boost AMD (NASDAQ:AMD) | Seeking Alpha

The Growing $432.23 Billion Medical Devices Industry Can Boost AMD

성장하는 4322억달러 규모의 의료기기 산업이 AMD의 성장을 이끌 것.

Summary

- The stock of Advanced Micro Devices is +969.38% since my April 24, 2018 buy recommendation. I’m still endorsing it as a buy.

- AMD 주가는 2018년4월 매수 추천한 이후 969% 상승하였다. 나는 아직도 매수를 추천한다.

- My May 2021 CT scan can result said there are inflammatory vs. metastatic nodules in my right lung.

- This should convince us all AMD has a growth catalyst in medical.

- 나는 올해 5월에 CT촬영을 했는데, 결과는 오른쪽 폐에 염증과 암덩어리가 발견되었다.

- 이것은 우리들에게 AMD가 의료 분야에서 성장 촉매를 가진다는 것을 확인시켜 주었다.

- Ryzen Embedded is being marketed for medical imaging applications. RDA2 Radeon embedded GPUs are great for medical monitors.

- 라이젠 CPU의 장착을 의료 영상장비 부문의 마케팅에 활용하고 있다.

- RDA2 라데온 CPU와 GPU의 결합은 의료 영상 모니터에 커다란 효용을 발휘한다.

- Unlike with Intel, there’s no metastatic skepticism on AMD right now. Seeking Alpha’s Quant AI algorithm is Very Bullish on AMD.

- Success in embedded processors can offset AMD’s inability to challenge Nvidia’s big lead in consumer and data center discrete GPUs.

The prudent move is to take your profits on Advanced Micro Devices (AMD). AMD’s stock is already +969.38% since my April 2018 buy recommendation.

However, the still-growing $432.23 billion global medical devices business is much bigger than

the $36 billion PC gaming hardware industry. The investment thesis is you should go and buy more AMD.

AMD의 주식을 매도하여 수익을 확정하는 것은 분별있는 행동이다.

2018년4월 매수추천이후 969%가 상승했기 때문이다.

하지만아직도 성장하고 있는 글로벌 의료기기 산업은 360억달러에 달하는 PC게이밍 기기 산업보다 더 거대한

4322억달러에 달한다.

투자 이론상 AMD 주식을 더 가져가고, 더 매수하여야 한다.

Dr. Lisa Su is marketing Ryzen Embedded processors and Radeon graphics accelerators for medical imaging applications. Ryzen V1000 or V2000 inside X-Ray, MRI, CT scan, and ultrasound machines can help AMD maintain its 5-year revenue CAGR of 28.03%.

AMD 사장 리사수는 라아젠 CPU와 라데온 GPU를 결합해 의료용 영상 장지 시장에 진출하고 있다.

엑스레이,엠알아이, 씨티 장비와 초음파 장비등의 내부에 장착된 라이젠V1000과 2000은

AMD가 지난 5년간 연간 28.03% 성장을 달성하는데 도움이 되었다.

(분석: 그래픽카드에는 그래픽 디램이 당연히 장착되고 CPU가 장착되면 일반 디램도 장착되어야한다.

이런 메디칼 장비 시장에 사용되는 디램의 매출에 대하여 분석하는 애널리스트는 없다.)

Tesla’s (TSLA) decision to use embedded Ryzen APUs and RDNA 2-based GPUs on new Model S and Model X cars is a strong endorsement for Ryzen/Radeon inside medical devices.

We cannot specifically quantify the future economic benefits of medical imaging processors.

AMD is still obscure on how much does embedded processors generate per quarter. It is bundled with the $1.6 billion/quarter revenue of AMD’s Enterprise, Embedded and Semi-Custom segment.

테슬라는 신규 모델인 모델X와 모델S에 AMD의 CPU와 GPU를 장착하기로 결정했다.

이 사실은 의료기기에 내장된 라이젠과 라데온의 효능에 대한 강한 인증이기도 하다.

이는 AMD의 기업부문 매출을 분기당 16억달러씩 창출할 것이다.

AMD confirms Tesla’s new Model S and Model X will boast RDNA 2 GPUs

It appears that Elon Musk was not exaggerating when he stated in the past that the new Tesla Model S and Model X would feature PlayStation 5-level entertainment computing power. During its recent Computex keynote, AMD CEO Dr. Lisa Su confirmed that Tesla

www.teslarati.com

The global embedded processor market was worth $19.36 billion in 2019. It has an estimated CAGR of 8.2%, and it will be worth $32.53 billion by 2028.

Going forward, getting just 10% market share in global embedded processors can add $2 billion to AMD’s annual revenue. AMD loyalists will probably push the stock price above $130 if the Enterprise, Embedded and Semi-Custom segment consistently achieve $2 billion in quarterly sales.

글로벌 결합 프로세서 시장은 2019년 193.6억달러였다.

그것은 연율 8.2%로 성장하고, 2028년에는 325,3억달러의 시장이 될것이다.

결합 프로세서 시장의 점유율이 10%만돼도 AMD의 연간 매출이 20억달러 증가할 것이다.

만약 AMD의 결합프로세서 분기당 매출이 20억달러에 달한다면 AMD의 주가는

130달러를 넘어설 것이다.(현재가는 106달러)

(Source: Statista Premium)

AMD is a buy because it is marketing embedded processors and Radeon GPUs to multiple medical devices. AMD is even advertising its $7k EPYC server processors for AMD의 scanners and other expensive medical diagnostic machines.

AMD에 대해서는 매수 의견이다. AMD는 씨티스캐너와 다른 고가의 의료용 진단 장비에

7천달러의 에픽 서버 CPU를 판매하고 있다.

(Source: AMD)

Hospitals and doctors can justifiably jack up their pricey CT scan fees by 30%.

(jack up ~가격을 올리다)

They will be using modern EPYC/Ryzen processors and RDNA 2 Radeon GPUs. Selling $7K EPYC processors to profit-motivated healthcare professionals is more rewarding than selling $550 Ryzen 9 5900X processors to PC gamers.

병원과 의사는 값비싼 CT스캔 비용을 정당하게 올릴 수있다.

의료 전문가에게 이익 동기를 부여하는 7천달러짜리 에픽 프로세서를 판매하는 것이,

550달러짜리 라이젠 프로세서를 PC게이머에게 파는 것보다 보상이 클것이다.

What Matters Most

Yes, AMD is already winning market share in PCs against Intel (INTC).

AMD는 PC시장에서 인텔의 점유율을 뺏어 오고있다.

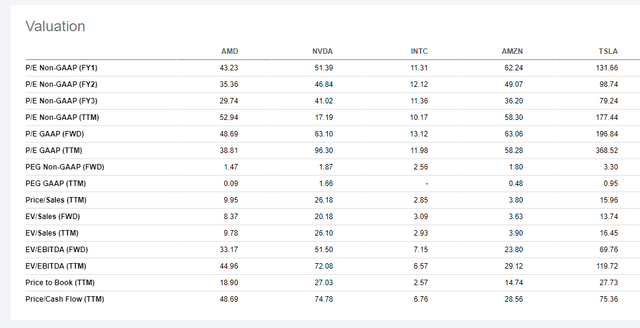

Unfortunately, this ad populum contention is overused. The high-valuation euphoria over AMD needs an injection of another viable growth catalyst. We can rationalize AMD’s pricey forward P/E of 48.69 by arguing AMD Ryzen has a bright future in medical imaging. After Tesla’s endorsement, hospital and medical clinic owners will trust Ryzen-powered medical monitors, bedside terminals, and anesthesia systems.

(Source: Seeking Alpha Premium)

AMD is relatively overpriced when compared against INTC. However, the chart above clearly illustrates that AMD is still cheaper than Nvidia (NVDA). AMD’s inability to disrupt Nvidia’s 81% market share in discrete graphics processing units (GPUs) makes AMD more affordable. NVDA’s big lead in consumer and data center GPUs is why it enjoys forward P/E of 63.10x, notably higher than AMD’s 48.69x. Going forward, an aggressive expansion in embedded processors might help push AMD’s forward P/E valuation to 60x or higher. Growth potential is still the no. 1 factor when assessing the investment quality of a company.

AMD’s stock already touts a 5-year price return of +1,530%. Seeking Alpha’s Quant Rating System is still Very Bullish on AMD. AMD’s quant rating score of 4.78 is largely thanks to its Growth grade of A. The Growth Grade of Intel is F. Seeking Alpha’s skeptical Neutral Quant Rating on Intel has metastasized to Wall Street analysts and Seeking Alpha contributors. They also have a cynical Neutral view on INTC.

(Source: Seeking Alpha Premium)

AMD has lower valuation ratios but it has better growth performance stats than NVDA. The 3-year revenue CAGR of AMD is 28.23%. This is significantly higher than NVDA’s 20.58% and Intel’s pitiful 5.43%. Nvidia’s EBITDA 3-year CAGR is only 18.79%, again significantly lower than AMD’s 73.97%. AMD is a buy because AMD’s impressive growth performance will only get better. NVDA has no embedded x86 processor to sell. Intel is mighty busy trying to slow down Ryzen’s growth in PC processors. Intel cannot focus on embedded x86 processors for medical imaging because EPYC is helping AMD breach 10% market share in server processors.

AMD needs a fast-growing embedded processors business because its data center and consumer GPUs are not growing fast enough when compared against Nvidia. AMD can just sell high-margin processors and GPUs to profit-first motivated healthcare professionals. This will help AMD keep its A+ Profitability Grade from Seeking Alpha. Hell has frozen over, AMD has a higher net income margin than Intel, 25.76% versus 23.91%.

(Source: Seeking Alpha Premium)

What About Windows 365 and Windows 11?

The strict TPM 2.0 requirements of Windows 11 are obvious tailwinds for all the processors and GPU products of AMD. Business and ordinary users will just have to buy new desktop and laptop computers if they want Windows 11’s hardened hardware-based security and better gaming/application performance. AMD has more than 165 processors that are already Windows 11 compliant. However, a big majority of computer owners do not really know the processors inside their laptops and desktop computers. PC vendors will likely abuse the “you-should-buy-a-new-Windows 11-computer” marketing opportunity.

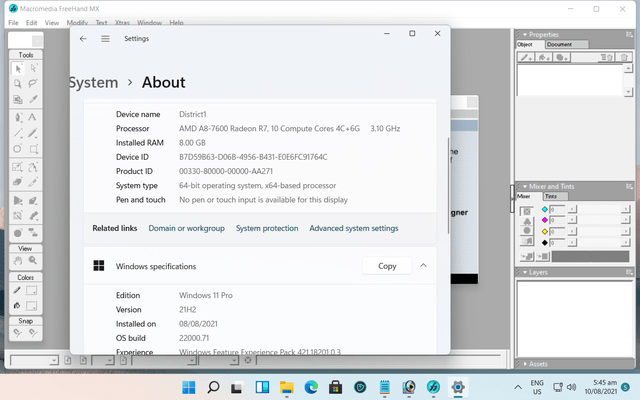

There are very few people in this planet that can actually defeat the UEFI/Secure Boot/TPM 2.0 hardware requirements of Windows 11. I am one of them. I am not going to release online the method I used to force install Windows 11 on a 7-year-old AMD desktop PC. It is not selfish on my part if I want people with old computers to buy new $500 to $1,000 AMD-powered Windows 11 laptops. The motherboard used in the desktop screenshot below is Asus A68HM-K (no embedded TPM 2.0 or TPM 1.2 chip)

(Source: Motek Moyen, the selfish redhat hacker)

The Windows 11 instance for Windows 365 Cloud PC will probably be available by October or November. People who do not want to buy new Windows 11 computers can pay $20 to $163 per month to rent a Windows 11 Cloud PC. Going forward, AMD can do low-ball pricing for EPYC and Threadripper and become a processor supplier for Microsoft’s (MSFT) Windows 365 subscription service. Microsoft might buy lots of $5,500 64-core Threadripper Pro 3995WX if it gets a hefty discount for Windows 365 infrastructure roll-out. Microsoft can do 16 virtual instances of that 64-core Threadripper Pro. People can rent $50/month for a Windows 11 Cloud PC instance with 4-core Threadripper Pro 3995WX and 16GB RAM.

The subscription-only Windows 365 Cloud PC is a long-term tailwind for AMD EPYC and Threadripper Pro products. Ultra-fast 300mbps fiber internet speed is now even available in our rural, COVID 2019-stricken province.

Conclusion

I heed the Very Bullish quant rating of AMD. We should all go long on AMD as soon as possible. The $432.23 billion medical equipment industry is a little-discussed tailwind for AMD. Going forward, AMD can attract many healthcare equipment manufacturers to use its Windows 11 embedded/non-embedded Athlon, Ryzen, Threadripper, and EPYC x6 processors.

AMD has low total debt load and a strong net operating cash flow of $2.7 billion. AMD can afford to build its own healthcare-centric cloud computing platform powered by AI/deep-learning capable EPYC/Radeon products.

(Source: Seeking Alpha Premium)

Dr. Lisa Su can start in China and try AMD-branded healthcare SaaS (Software-as-a-Service). AMD has the processors and the deep learning GPUs to actually become a SaaS player. The healthcare SaaS industry is expected to be worth $90.46 billion by 2027. It will be easier to sell Ryzen Embedded products to healthcare professionals if they are bundled with AMD-made healthcare SaaS AI-infused cancer or diabetes management cloud software suite. AMD becoming a mini-Microsoft Azure for healthcare is a lovely scenario.

Dr. Lisa Su should use AMD’s strong cash flow to give some gifts to decision-makers at top medical device builders. More often than not, decision-makers will still prefer a brand over another if they get monetary or non-monetary gifts.

'엔비디아-마이크로소프트-AMD-인텔' 카테고리의 다른 글

| 엔비디아 2021년2분기 실적 (0) | 2021.08.20 |

|---|---|

| 인텔 그래픽카드 내년 1분기 출시 (0) | 2021.08.20 |

| 엔비디아- 데이터센터부문 연율 40% 성장(2021.06.11) (0) | 2021.06.13 |

| 암호화폐 채굴이 칩수요에 미치는 영향 (0) | 2021.06.13 |

| 엔비디아는 구형 그래픽 카드를 다시 생산(2021.02.11) (0) | 2021.02.13 |