2021.11.25

NAND Flash Revenue Rises by 15% QoQ for 3Q21 Thanks to Demand from Smartphone and Data Center Markets, Says TrendForce

2021년3분기 낸드 매출은 전분기대비 15% 증가

The growth of the NAND Flash market in 3Q21 was primarily driven by strong demand from the data center and smartphone industries, according to TrendForce’s latest investigations.

3분기 낸드 매출은 스마트폰과 데이터센터의 강한 수요로 증가했다.

More specifically, NAND Flash suppliers’ hyperscaler and enterprise clients kept up their procurement activities that began in 2Q21 in order to deploy products based on new processor platforms.

특히 하이퍼스케일 데이터센터와 기업 고객들의 올초부터 시작된 메모리 확보 노력이 지속되었다.

Major smartphone brands, on the other hand, likewise expanded their NAND Flash procurement activities during the quarter as they prepared to release their new flagship models. As such, clients in both server and smartphone industries made significant contributions to the revenue growth of the NAND Flash industry for 3Q21.

주요 스마트폰 고객들ㄹ도 신규 스마트폰 발매로 메모리 확보 노력이 진행되었다.

이와같이 스마트폰과 서버산업 모두 3분기 낸드 매출 증가에 상당히 기여하였다.

At the same time, however, suppliers also warned that orders from PC OEMs began showing signs of decline.

On the whole, the industry’s quarterly total NAND Flash bit shipment increased by nearly 11% QoQ for 3Q21,

and the overall NAND Flash ASP rose by nearly 4% QoQ for the same quarter.

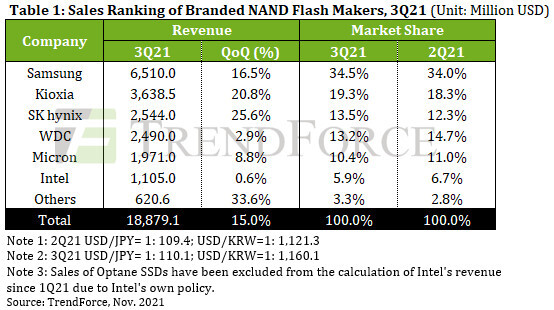

Thanks to rising prices and expanding shipments, the quarterly total NAND Flash revenue increased by 15% QoQ to a new record high of US$18.8 billion in 3Q21.

하지만 낸드 제조사들은 PC OEM회사들로부터의 주문이 감소하고 있다고 경고했다.

3분기 낸드 빗그로스는 전분기대비 11%이고, 평균 판매가격은 4% 증가하여, 전체적으로 3분기 매출은

15% 증가한 188억달러에 달했다.

Moving into 4Q21, the impact of the ongoing component gaps has widened to numerous application segments of the NAND Flash market as the capacity crunch in the foundry market remains unresolved. Currently, NAND Flash components are in abundance relative to other kinds of key components. For OEMs and ODMs, the differences between the NAND Flash inventory level and the inventory levels of other components have been growing over the past several months. Therefore, they have to scale back orders and reduce stock for NAND Flash. As inventory adjustments are happening, NAND Flash contract prices will start to drop and thus bring about an end to the several quarters of strong revenue growth enjoyed by suppliers.

2021년4분기 들어가면서 낸드 메모리와 다른 부품간(예를들면 낸드컨트롤러)의 다른 재고 수준은 파운드리

용량 부족으로 해결되지 못하고 심화되고 있다.

그래서 OEM과 ODM 회사들은 지난 몇개월간 다른 부품과의 재고 수준을 맞추기 위해 낸드 재고를 줄이려해왔다.

그래서 그동안 상승했던 낸드 가격은 상승을 멈추고 하락하기 시작할 것이다.

Samsung

Owing to procurement demand from hyperscalers and smartphone brands, the NAND Flash market generally remained in shortage in 3Q21, thereby driving up Samsung’s ASP by 10% QoQ. Even so, Samsung’s NAND Flash bit shipment increased by only about 5% QoQ due to weakening demand from PC OEMs and low inventory levels of certain other components carried by Samsung’s clients. Samsung’s NAND Flash revenue for 3Q21 reached US$6.51 billion, a 16.5% QoQ increase.

Kioxia

Although orders from PC OEMs began to wane, Kioxia still benefitted from orders from its major smartphone and data center clients in 3Q21, during which Kioxia’s NAND Flash bit shipment underwent a major QoQ increase exceeding 15%. As the NAND Flash market remained in a shortage situation, Kioxia’s ASP increased by about 4% QoQ, resulting in a revenue of US$3.64 billion, which represents a 20.8% QoQ increase and the highest single-quarter revenue in Kioxia’s history.

SK hynix

Among all NAND Flash suppliers in 3Q21, SK hynix registered the highest growth in bit shipment at more than 20% QoQ. This performance can be attributed to several reasons: the cyclical upturn in procurement activities from smartphone brands, persistently strong demand from the data center segment, and inventory-clearing by SK hynix in anticipation of weak demand in the upcoming off-season. Thanks to an ASP increase of about 5% QoQ, SK hynix’s NAND Flash revenue for 3Q21 reached US$2.54 billion, a 25.6% QoQ increase.

Western Digital

Although Western Digital’s PC OEM clients reduced their SSD orders due to supply chain disruptions, and demand from the retail end also remained weak, Western Digital was able to increase its NAND Flash bit shipment by 8% QoQ in 3Q21 due to enterprise SSD demand from the data center segment and NAND Flash demand from smartphone brands for the release of new smartphone models. Nevertheless, Western Digital’s ASP fell by 3% QoQ because the company increasingly focused on major clients and high-density products. Western Digital’s NAND Flash revenue for 3Q21 reached US$2.49 billion, a 2.9% QoQ increase.

Micron

Demand from the data center segment remained strong, and clients continued to adopt Micron’s 176L products. However, Micron’s shipment share in the smartphone market lagged behind that of other NAND Flash suppliers. Furthermore, its PC OEM clients were starting to be affected by the uneven supply of semiconductor chips. In light of these factors, Micron’s NAND Flash bit shipment increased by a modest 4% QoQ. On the other hand, the NAND Flash market remained in a severe shortage in 3Q21, thereby driving up Micron’s ASP by about 5% QoQ. Hence, Micron’s NAND Flash revenue for 3Q21 reached US$1.97 billion, an 8.8% QoQ increase.

Intel

Although persistently strong demand from the data center segment led to a massive price hike for enterprise SSDs and a nearly 6% increase in Intel’s ASP in 3Q21, the company was unable to fully meet its client demand since it could not procure sufficient upstream components. This lack of upstream components resulted in a severe decline of about 5% QoQ in Intel’s NAND Flash bit shipments and offset the upward momentum generated by an increase in Intel’s ASP. Intel’s NAND Flash revenue for 3Q21 reached a mere US$1.11 billion, a slight 0.6% QoQ increase.

'반도체-삼성전자-하이닉스-마이크론' 카테고리의 다른 글

| 디램과 낸드 가격, 내년 1분기가 바닥(2021.11.30) (0) | 2021.11.30 |

|---|---|

| 삼성전자, 차세대 차량용 시스템반도체 3종 공개(2021.11.30) (0) | 2021.11.30 |

| HP와 델컴퓨터는 양호한 실적 발표로 상승(2021.11.25) (0) | 2021.11.25 |

| 미즈호증권, 마이크론 매수로 상향(2021.11.23) (0) | 2021.11.24 |

| 반도체 후공정업체 3분기 매출 증가(2021.11.23) (0) | 2021.11.23 |