웨스턴디지털의 회계년도 2022년2분기는 2021년10월부터 12월말까지.

Western Digital Reports Fiscal Second Quarter 2022 Financial Results | Western Digital

News Summary

- Second quarter revenue was $4.83 billion, up 23% year-over-year (YoY).

- Cloud revenue increased by 89%, Client revenue declined by 1%, and Consumer revenue remained flat YoY.

- 클라우드부문 매출은 전년 동기대비 89%증가했고, 클라이언트 매출은 1%하락, 소비자향 매출은 비슷했다.

- Second quarter GAAP earnings per share (EPS) was $1.79 and non-GAAP EPS was $2.30. Non-GAAP EPS included $70 million in COVID-related expenses.

- Generated operating cash flow of $666 million and free cash flow of $407 million.

- Completed debt refinancing transaction and reduced gross debt balance to $7.40 billion.

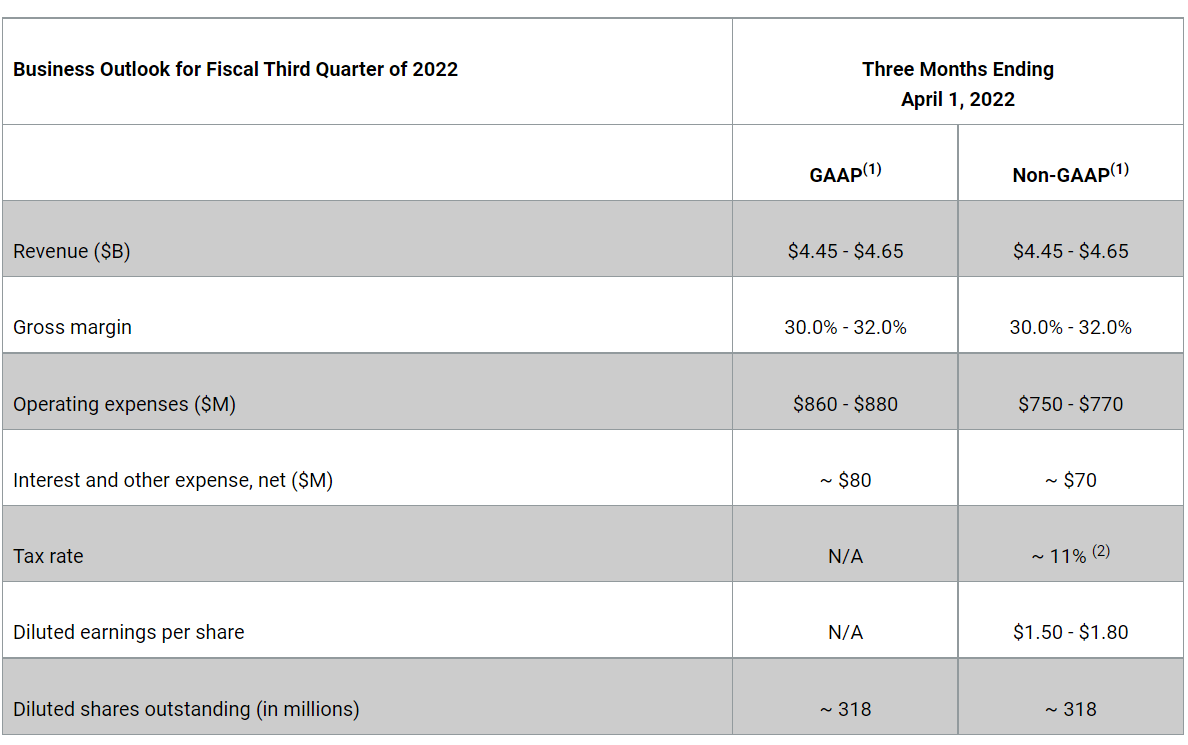

- Expect fiscal third quarter 2022 revenue to be in the range of $4.45 billion to $4.65 billion with non-GAAP EPS in the range of $1.50 to $1.80

Western Digital Corp. (Nasdaq: WDC) today reported fiscal second quarter 2022 financial results.

"I'm proud of the Western Digital team for delivering another quarter of strong results that exceeded guidance, even in the midst of ongoing supply chain disruptions and COVID-related challenges," said David Goeckeler, Western Digital CEO. "While we continue to experience strong demand across our end markets, these challenges continue to present a headwind to near-term results. We've executed well in building a solid foundation for future profitable growth driven by innovative products within our flash and hard drive businesses. As these transitory headwinds subside, we expect to emerge in a stronger position to drive better through-cycle results, creating value for our shareholders, employees and customers."

The company generated $666 million in cash flow from operations, made a total debt repayment of $2.21 billion, issued $1.00 billion in notes and ended the quarter with $2.53 billion of total cash and cash equivalents. During the quarter, the company fully repaid the remaining balance of its Term-Loan B-4 in an amount of $943 million, and repaid $1.27 billion on its Term-Loan A-1. In addition, the company closed a public offering of $1.00 billion aggregate principal amount in senior unsecured notes, bringing total gross debt outstanding to $7.40 billion at the end of the fiscal second quarter.

Additional details can be found within the company's earnings presentation, which is accessible online at investor.wdc.com.

Financial and Investor Information | Western Digital

The Investor Relations website contains information about Western Digital's business for stockholders, potential investors, and financial analysts.

investor.wdc.com

Cloud represented 40% of total revenue. Supply chain disruptions impacted cloud hard drive deployments at certain customers, which led to a sequential decline in exabyte shipments in the fiscal second quarter.

However, healthy overall demand for capacity enterprise drives, along with Western Digital's leadership position at the 18 terabyte capacity point, drove a greater than 50% year-over-year increase in exabyte shipments.

클라우드부문 매출이 전체 매출의 40% 차지한다.

Client accounted for 38% of total revenue. The continued ramp of 5G phones helped offset declines in both client SSD and client hard drive revenue. Within mobile, shipments of BiCS5 products into leading 5G smartphones increased over 60% sequentially and 50% year-over-year, led by strong content growth.

기업 고객 매출은 전체 매출의 38% 차지.

Consumer represented 22% of total revenue. With a strong holiday season, retail flash led the sequential growth in Consumer. The WD_BLACK premium SSD product line, optimized for the best gaming experience, continues to gain momentum, with revenue increasing approximately 50% sequentially and doubling in calendar year 2021.

소비자향 매출은 전체 매출의 22% 차지.

(1) Non-GAAP gross margin guidance excludes amortization of acquired intangible assets and stock-based compensation expense, totaling approximately $10 million to $20 million. The company's non-GAAP operating expenses guidance excludes amortization of acquired intangible assets; stock-based compensation expense; and employee termination, asset impairment and other charges, totaling approximately $100 million to $120 million. The company's non-GAAP interest and other expense guidance excludes approximately $10 million of convertible debt activity. In the aggregate, non-GAAP diluted earnings per share guidance excludes these items totaling $120 million to $150 million. The timing and amount of these charges excluded from non-GAAP gross margin, non-GAAP operating expenses, non-GAAP interest and other expense, net and non-GAAP diluted earnings per share cannot be further allocated or quantified with certainty. Additionally, the timing and amount of additional charges the company excludes from its non-GAAP tax rate and non-GAAP diluted earnings per share are dependent on the timing and determination of certain actions and cannot be reasonably predicted. Accordingly, full reconciliations of non-GAAP gross margin, non-GAAP operating expenses, non-GAAP interest and other expense, non-GAAP tax rate and non-GAAP diluted earnings per share to the most directly comparable GAAP financial measures (gross margin, operating expenses, interest and other expense, tax rate and diluted earnings per share, respectively) are not available without unreasonable effort.

(2) The non-GAAP tax rate provided is based on a percentage of non-GAAP pre-tax income. Due to differences in the tax treatment of items excluded from our non-GAAP net income and because our tax rate is based on an estimated forecasted annual GAAP tax rate, our estimated non-GAAP tax rate may differ from our GAAP tax rate and from our actual tax rates.