2023.06.17

돈나무 언니 캐시우드는 엔비디아 주식을 보유하고 있지 않음.

대신에 엔비디아 칩을 만드는 TSMC와 장비회사 테라다인 주식을 매수함.

These businesses stand to gain a great deal from the proliferation of generative artificial intelligence services.

Cathie Wood, the CEO of Ark Invest, famously sold shares of Nvidia at the beginning of 2022. Since then, surging demand for the company's industry-leading artificial intelligence (AI) data center chips sent the stock screaming higher.

이러한 기업들은 생성적인 인공지능 서비스의 보급으로 많은 이익을 얻을 수 있습니다.

Ark Invest의 CEO인 Cathie Wood는 2022년 초에 Nvidia 주식을 매도했습니다.

이후로 이 회사의 산업을 선도하는 인공지능 (AI) 데이터 센터 칩에 대한 폭발적인 수요가

주식 가격을 급등시켰습니다.

Wood hasn't changed her tune regarding Nvidia, but she's as confident as ever about the future of AI and its implications for the stock market. On Monday, June 12, she bought over 98,000 shares of Taiwan Semiconductor Manufacturing Co. (TSM -0.58%), also known as TSMC. The very next day, she bought over 270,000 shares of Teradyne (TER 0.88%) for Ark Invest's exchange-traded funds.

These two stocks probably don't rise to the top of your mind when you think about AI -- but they should.

Without their help, Nvidia's operation would quickly cease to function.

우드는 Nvidia에 대한 태도를 변경하지 않았지만, 인공지능의 미래와 주식 시장에 대한 확신은 여전합니다.

6월 12일 월요일에는 Taiwan Semiconductor Manufacturing Co. (TSM -0.58%)인 TSMC의 주식을 98,000주 이상 구매했습니다. 다음 날에는 Teradyne (TER 0.88%)의 주식을 Ark Invest의 상장 지수 펀드를 위해 270,000주 이상 구매했습니다.

이 두 주식은 아마도 AI를 생각할 때 가장 먼저 떠오르지는 않겠지만, 그럴 가치가 있습니다.

이들(TSMC와 테라다인)의 도움 없이 Nvidia의 운영은 빠르게 중단될 것입니다.

Why Wood prefers TSMC stock to Nvidia right now At the moment,

Nvidia shares are trading at around 218 times trailing-12-month earnings, and 54 times forward-looking earnings.

This implies many years of strong and uninterrupted growth,

which is something we've never seen from the highly cyclical semiconductor industry.

현재 Nvidia 주식은 과거 12개월 이익에 대해 약 218배,

예상 이익에 대해서는 약 54배의 주가 수익비율로 거래되고 있습니다.

이는 매우 순환적인 반도체 산업에서 우리가 본 적이 없는 오랜 기간의 강력하고 중단되지 않는 성장을 의미합니다.

Nvidia is one of dozens of chip designers, but it's "fabless" -- it outsources its chipmaking to other companies.

And there are only a few foundries on Earth that can make its chips. When it comes to reliably producing Nvidia's most advanced semiconductors, intended for AI data centers, TSMC is often the only option.

Nvidia는 수십 개의 칩 디자이너 중 하나이지만, 공장이 없는 "팹리스(fabless)"입니다.

즉, 칩 제조를 다른 회사에 아웃소싱합니다. 그리고 Nvidia의 칩을 생산할 수 있는 파운드리는

지구상에 몇 개 없습니다.

AI 데이터 센터용으로 고급 반도체를 신뢰성 있게 생산할 때, TSMC가 종종 유일한 선택지입니다.

Considering TSMC's ability to produce chips at a scale that none of its competitors can match, recent news that the foundry will raise prices should come as no surprise.

News that TSMC was getting heaps of orders from Nvidia drove the stock higher this year. Despite the run-up, it still appears reasonably valued, at around 16 times trailing earnings.

경쟁사들이 따라올 수 없는 규모로 칩을 생산할 수 있는 TSMC의 능력을 고려할 때, 최근 TSMC가 가격을 인상할 것이라는 소식은 놀랄 일이 아닙니다.

Nvidia로부터 수많은 주문을 받고 있다는 소식은 올해 TSMC 주식을 상승시켰습니다.

하지만 이러한 상승에도 불구하고, 현재 주가는 과거 이익에 대해 약 16배 정도로 합리적인 가치로 보입니다.

\

Why Wood prefers Teradyne stock to Nvidia When fabless companies like Nvidia hire TSMC to manufacture their products, many also insist that TSMC buy test equipment from Teradyne. Semiconductor and system testing are the largest parts of its business, but Teradyne also has a relatively fast-growing robotics segment.

우드가 Nvidia 대신 Teradyne 주식을 선호하는 이유는 다음과 같습니다.

Nvidia와 같은 팹리스 회사들이 TSMC에 제품 생산을 맡길 때, 많은 회사들은 TSMC가 Teradyne으로부터 테스트 장비를 구매하도록 요구합니다. Teradyne은 반도체 및 시스템 테스트가 그 주요 사업 부분이지만, 상대적으로 빠르게 성장하고 있는 로봇 분야도 가지고 있습니다.

TSMC has been Teradyne's largest customer for years. Thanks to its robotics segment, though, Teradyne relies on TSMC for less than 10% of total revenue these days.

TSMC은 여러 해 동안 Teradyne의 가장 큰 고객이었습니다. 그러나 Teradyne은 로봇 분야를 통해 최근에는 TSMC에 대한 수익의 10% 미만을 의존하고 있습니다.

Teradyne's testing platform makes it fairly easy for manufacturers to run simultaneous testing of many devices in parallel; this helps retain clients and attract new ones. Diverse revenue streams make Teradyne a relatively safe bet compared to Nvidia, but it's still subject to economic cycles that affect semiconductor sales and manufacturing in general.

In the first quarter of 2023, total revenue fell 22% year over year. Investors expecting surging demand for generative AI applications such as ChatGPT also expect demand for Teradyne's testing platform to rebound. The stock is trading at around 29 times trailing-12-month earnings.

Teradyne의 테스트 플랫폼은 제조업체가 많은 기기를 병렬로 동시에 테스트하는 것을 비교적 쉽게 만듭니다.

이는 고객을 유지하고 새로운 고객을 유치하는 데 도움이 됩니다. 다양한 수익원은 Teradyne을 Nvidia와 비교하여 비교적 안전한 선택으로 만듭니다.

그러나 그것도 반도체 판매와 제조에 영향을 미치는 경제 사이클에 영향을 받을 수 있습니다.

2023년 1분기에는 총 수익이 전년 동기 대비 22% 감소했습니다. ChatGPT와 같은 생성적인 인공지능 응용 프로그램에 대한 급증하는 수요를 기대하는 투자자들은 Teradyne의 테스트 플랫폼에 대한 수요가 회복될 것으로 예상하고 있습니다.

해당 주식은 과거 12개월 이익에 대해 약 29배 정도로 거래되고 있습니다.

--------------------------------

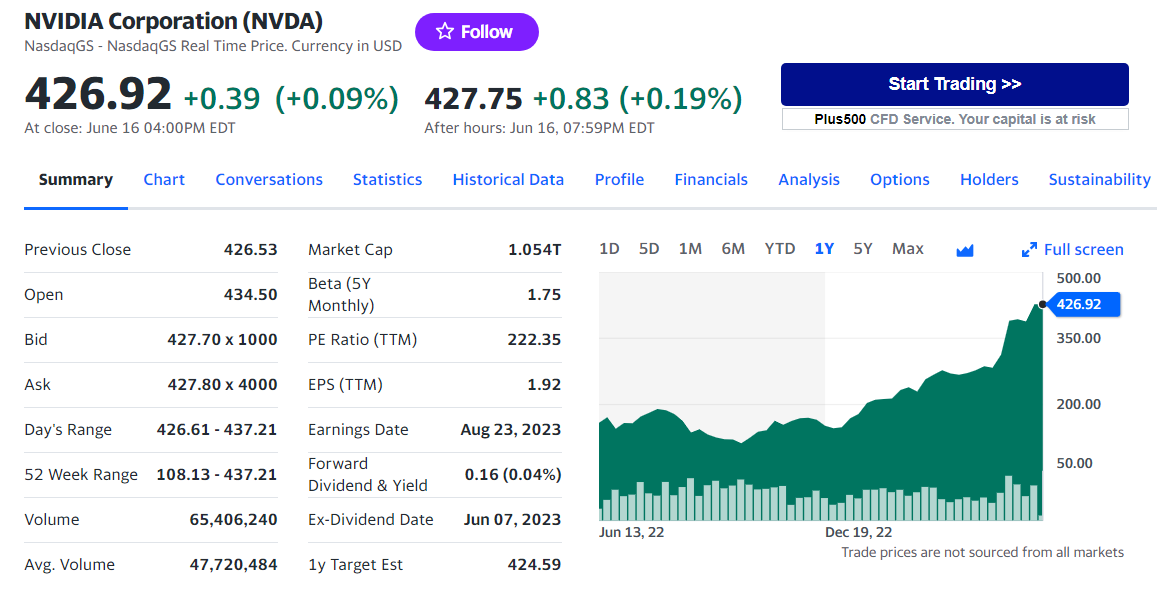

1.엔비디아 연간 그래프

2. TSMC 연간 그래프

3. 테라다인 연간 그래프

'엔비디아-마이크로소프트-AMD-인텔' 카테고리의 다른 글

| 엔비디아, '24년2분기 HBM3E 장착한 GH200 출시(2023.08.09) (0) | 2023.08.09 |

|---|---|

| 마이크로소프트 애저(클라우드) 매출 전분기대비 하락(2023.07.26) (0) | 2023.07.26 |

| AI 주식을 구매하기 전에 모든 투자자가 던져야 할 세 가지 질문(2023.06.18) (3) | 2023.06.18 |

| AMD는 가장 최첨단 칩인 MI300x를 공개(2023.06.13) (0) | 2023.06.14 |

| Nvidia는 새로운 DGX GH200 AI 슈퍼컴퓨터를 공개 (0) | 2023.06.02 |