2023.08.24

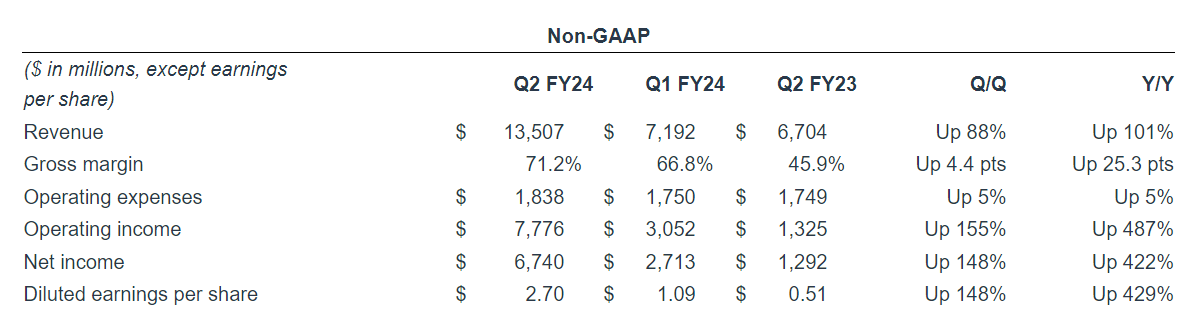

엔비디아 2분기(5-7월) 매출은 전분기(72억달러)대비 88% 증가, 작년 동기대비 101% 증가한 135.1억 달러,

순이익은 전분기(1.09달러)대비 148% 증가, 작년 동기대비 429% 증가한 주당 2.70달러로 발표.

현재 분기(8-10월) 매출 전망을 160억 달러(시장 전망치 126억달러)로 발표.

엔비디아의 분기별 매출(단위: 달러)은 생성형 AI 출현후 급격히 증가.

67억달러(2022년2분기)---> 59억 (2022년3분기)--> 60억(2022년4분기)-->72억 (2023년1분기)--> 135억(2023년2분기)--->160억 (2023년3분기 예상치)

엔비디아 사장 젠슨 황은 일반 컴퓨터 사용 시대에서 가속 컴퓨팅과 생성형 컴퓨팅 시대로 전환하는

새로운 컴퓨터 시대가 도래했다고 말했다.

"A new computing era has begun," Nvidia CEO Jensen Huang said in a statement.

"Companies worldwide are transitioning from general-purpose to accelerated computing and generative AI."

-----------------------------------------------------

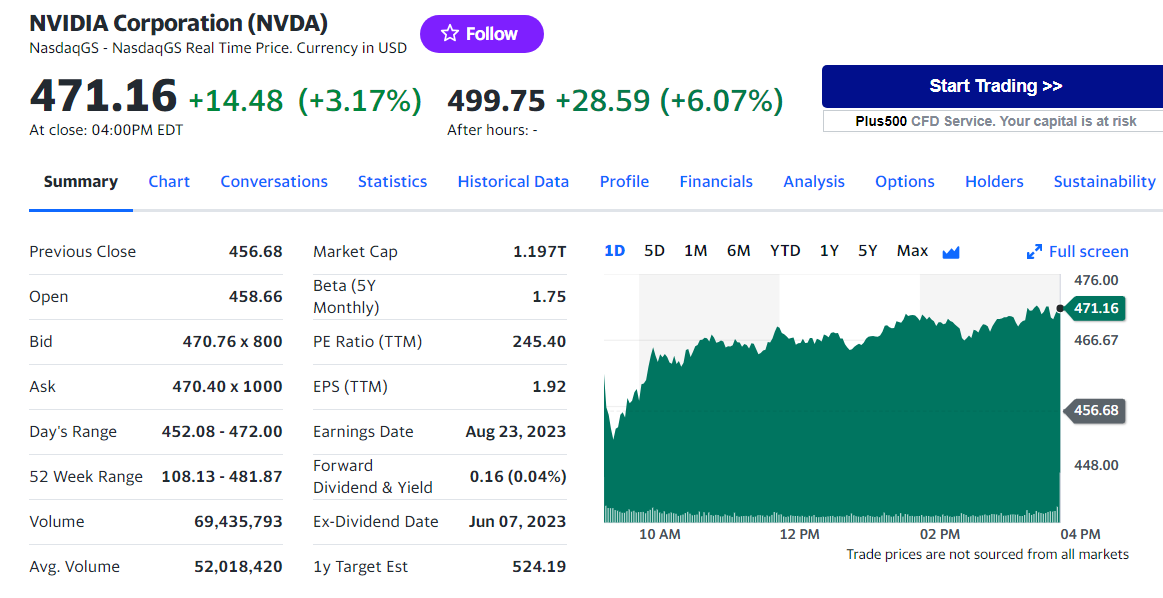

현재 PER를 계산해 봤습니다.

1분기 주당순이익은 1.09달러, 2분기는 2.70달러니까 상반기 주당 순이익은 3.79달러입니다.

3분기는 2분기보다 매출이 증가((18% 증가 예상)하므로 EPS도 2.70달러이상 나오겠지만, 하반기 2개분기 EPS를

5.40로 계산하면 2023년 연간 EPS는 최소 9.19달러가 됩니다.

그래서 2023년 현재 엔비디아의 PER는 471달러/9.19달러=51.25배가 됩니다.

------------------------------------------------------

In the second quarter of fiscal 2024, the company’s revenues from the Datacenter business jumped 171%

year over year and 141% sequentially, mainly due to growing investments in generative AI.

회계년도 2분기에 회사의 데이터센터 사업으로부터의 매출은 전년대비 171% 증가하고 전분기대비로는

141% 증가하였으며, 이는 주로 생성형 AI에 대한 투자의 증가로 인한 것이었습니다.

---------------------------------------------

2023.08.25

[홍장원의 불앤베어] 월가의 엔비디아 분석을 해부해 보았습니다 - YouTube

2분기 영업이익률 50% 상회

2분34초--> H100은 올해 50만개 판매, 2024년 4배인 200만개 판매 예상.

현재 개당 5천만원, 원가는 1천만원 정도로 추정.

2분42초--> 엔비디아 숏친 사람들 이유는 중국의 가수요로 매출이 증가했다고 하지만

실제로 2분기 중국향 매출은 25% 정도로 이전 분기와 비슷하다고 함.

PEG=PER/EPS 성장률

-------------------------------------------------

엔비디아 2분기 매출 135.1억달러…월가 예상치 상회 - SBS Biz

엔비디아 2분기 매출 135.1억달러…월가 예상치 상회

[엔비디아 로고 (로이터=연합뉴스)]엔비디아 2분기 실적이 발표된 가운데, 시장 예상치를 웃돈 것으로 나타났습니다.현지시간으로 23일, 엔비디아는 장 마감 이후2분기 실적을 발표했습니다.엔비

biz.sbs.co.kr

----------------------------------------------------------------

2023.08.24

Nvidia (NVDA) reported second quarter earnings after the bell Wednesday that blew away already sky-high expectations for the graphics chip giant as the AI hype train keeps pushing markets forward.

The company reported revenue of $13.51 billion, a 101% jump from last year, while adjusted earnings came in at $2.70 per share, up 429% from last year. Analysts had expected revenue to come in at $11.04 billion with earnings per share totaled $2.07, according to data from Bloomberg.

Nvidia also issued current quarter revenue guidance of $16 billion, plus or minus 2%, far outpacing Wall Street's already lofty expectations for $12.5 billion in revenue.

Shares of the graphics chipmaker rose as much as 9% in after-hours trading on Wednesday to a record high of $515 per share.

Nvidia (NVDA)는 수요일 마감 후 이미 고공행진을 이어가던 AI 열풍으로 시장을 밀어붙이면서 기대를 크게 뛰어넘는

2분기(5-7월) 실적을 발표했습니다.

이 회사는 작년 동기대비 101% 증가한 135.1억 달러의 매출을 발표했으며, 조정된 순이익은 작년 동기대비 429%

증가한 주당 2.70달러로 발표되었습니다. 블룸버그의 데이터에 따르면 분석가들은 매출이 110.4억 달러,

주당 순이익이 2.07달러로 예상하고 있었습니다.

Nvidia는 또한 현재 분기(8-19월) 매출 전망을 160억 달러로 발표했으며, 이는 이미 월스트리트의 높은 기대치인

125억 달러의 매출을 크게 능가하는 수치입니다.

이 회사의 주식은 수요일 애프터마켓 거래에서 최대 9% 상승하여 주당 515달러의 사상 최고치에 이르렀습니다.

Nvidia's report had been seen as a key test for the ongoing AI hype cycle, which has pushed companies of all stripes to dive into the technology in hopes of cashing in on the mania. But none has seen the actual fortunes of their business change to extent already being enjoyed by Nvidia.

"A new computing era has begun," Nvidia CEO Jensen Huang said in a statement.

"Companies worldwide are transitioning from general-purpose to accelerated computing and generative AI."

Nvidia의 보고서는 계속되는 AI 열풍 주기에 있어서 중요한 시험이라 여겨졌습니다. 이 열풍은 모든 업계의 기업들이 기술에 뛰어들어 열기를 불고 이 광풍을 누리기 위해 노력하게 만들었습니다. 그러나 이 중에서는 이미 Nvidia만큼의 실제 비즈니스 운명이 변화된 기업은 없었습니다.

"Nvidia의 CEO 제슨 황은 성명에서 '새로운 컴퓨팅 시대가 시작되었다'고 말했습니다.

"전 세계 기업들이 일반 목적의 컴퓨팅에서 가속 컴퓨팅과 생성 AI로의 전환을 이루어가고 있습니다."

By segment, Nvidia reported data center revenue of $10.3 billion and gaming revenues of $2.5 billion, topping forecasts for $8 billion and $2.4 billion, respectively. The company also announced a new $25 billion share repurchase plan and said it intends to buy back stock during its current fiscal year.

Investors were already expecting Nvidia to deliver a blowout quarter, after the company said revenue in its latest would be about $11 billion, plus or minus 2%.

Huang added: "During the quarter, major cloud service providers announced massive NVIDIA H100 AI infrastructures. Leading enterprise IT system and software providers announced partnerships to bring NVIDIA AI to every industry. The race is on to adopt generative AI."

부문별로 보면, Nvidia는 데이터 센터 매출이 103억 달러, 게이밍 매출이 25억 달러로 발표했으며, 이는 각각 80억 달러와 24억 달러에 대한 예측을 상회했습니다. 이 회사는 또한 새로운 250억 달러의 주식 재매수 계획을 발표했으며, 현재 회계 연도 동안 주식을 다시 매입할 의사를 밝혔습니다.

투자자들은 이미 Nvidia가 최근 분기의 매출이 110억 달러에서 ±2% 정도로 예상된다고 밝힌 뒤에 이미 이런 대대적인 분기 실적을 발표할 것으로 기대하고 있었습니다.

황은 덧붙여 "이번 분기 동안 주요 클라우드 서비스 제공업체들이 대규모 NVIDIA H100 AI 인프라를 발표했습니다. 주요 기업용 IT 시스템 및 소프트웨어 공급업체들은 각 산업으로 NVIDIA AI를 가져오기 위한 파트너십을 발표했습니다. 생성 AI 도입을 위한 경쟁이 시작되었습니다"라고 덧붙였습니다.

The rapid increase in demand for Nvidia's chips lead some on Wall Street to question whether its key supplier TSMC could produce as many graphics processors as Nvidia's customers needed.

In July, for instance, Tesla (TSLA) CEO Elon Musk said the company would "take Nvidia hardware as fas as Nvidia will deliver it to us."

"Tremendous respect for [CEO] Jensen [Huang] and Nvidia," Musk added. "They've done an incredible job."

The AI craze kicked into high gear in November 2022 when OpenAI debuted its generative AI app, ChatGPT.

While artificial intelligence has been around for some time, ChatGPT's popularity as one of the fastest-growing apps in history put the technology firmly on Wall Street’s radar.

Since then, tech companies ranging from Microsoft (MSFT) and Google (GOOG, GOOGL) to Meta (META) have debuted or announced that they’re working on their own generative AI tools and software.

Nvidia의 칩에 대한 급격한 수요 증가로 월스트리트의 일부 인사들은 핵심 공급업체인 TSMC가 Nvidia의 고객들이 필요로 하는 만큼의 그래픽 프로세서를 생산할 수 있는지 의문을 제기했습니다.

예를 들어, 테슬라 (TSLA)의 CEO 엘론 머스크는 7월에 회사가 "Nvidia가 제공하는 만큼 빠르게 Nvidia 하드웨어를 사용할 것"이라고 말했습니다.

"제슨 [황]과 Nvidia에 대한 무한한 존경심이 있습니다," 머스크는 덧붙였습니다. "그들은 놀라운 일을 해냈습니다."

AI 열풍은 2022년 11월에 OpenAI가 생성 AI 앱인 ChatGPT를 선보이면서 크게 가속화되었습니다.

인공지능은 어느 정도 시간 동안 존재해 왔지만, ChatGPT의 인기는 역사상 가장 빠르게 성장하는 앱 중 하나로 기술을 월스트리트의 관심 영역으로 확고히 만들었습니다.

그 이후로 Microsoft (MSFT)와 Google (GOOG, GOOGL) 등의 기술 기업들은 각자의 생성 AI 도구와 소프트웨어를 선보이거나 그것에 대한 작업을 진행 중이라고 발표했습니다.

---------------------------------------

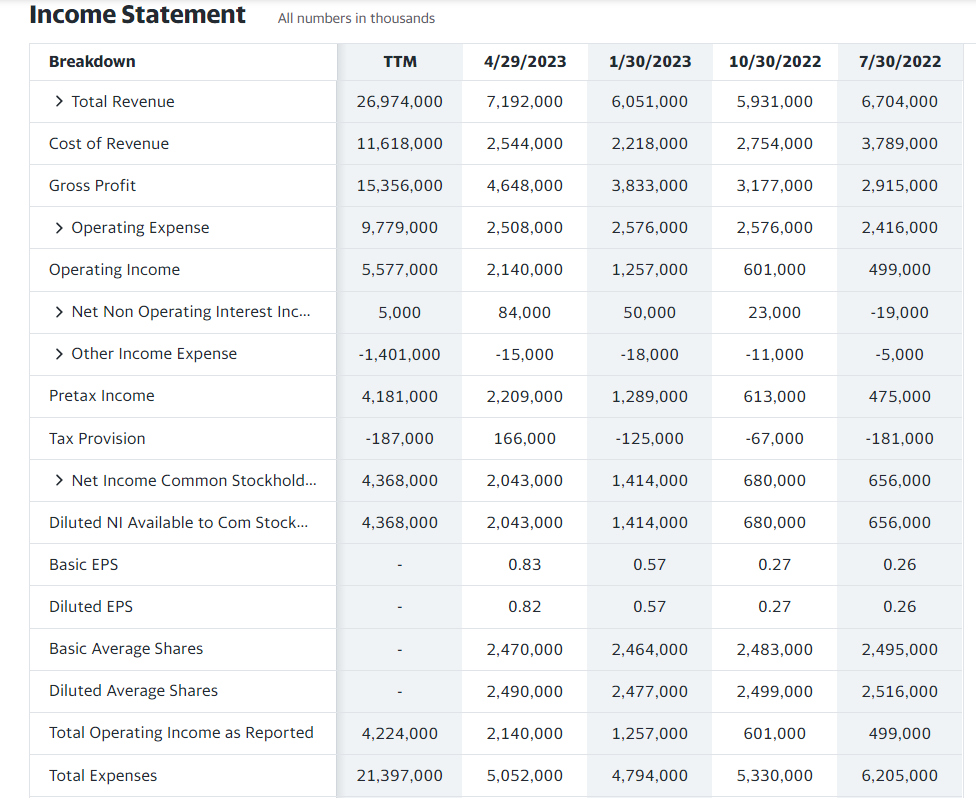

다음은 엔비디아의 분기별 손익계산서.

----------------------------------------

NVIDIA Announces Financial Results for Second Quarter (globenewswire.com)

- Record revenue of $13.51 billion, up 88% from Q1, up 101% from year ago

- Record Data Center revenue of $10.32 billion, up 141% from Q1, up 171% from year ago

SANTA CLARA, Calif., Aug. 23, 2023 (GLOBE NEWSWIRE) -- NVIDIA (NASDAQ: NVDA) today reported revenue for the second quarter ended July 30, 2023, of $13.51 billion, up 101% from a year ago and up 88% from the previous quarter.

GAAP earnings per diluted share for the quarter were $2.48, up 854% from a year ago and up 202% from the previous quarter.

Non-GAAP earnings per diluted share were $2.70, up 429% from a year ago and up 148% from the previous quarter.

“A new computing era has begun. Companies worldwide are transitioning from general-purpose to accelerated computing and generative AI,” said Jensen Huang, founder and CEO of NVIDIA.

“NVIDIA GPUs connected by our Mellanox networking and switch technologies and running our CUDA AI software stack make up the computing infrastructure of generative AI.

“During the quarter, major cloud service providers announced massive NVIDIA H100 AI infrastructures. Leading enterprise IT system and software providers announced partnerships to bring NVIDIA AI to every industry. The race is on to adopt generative AI,” he said.

During the second quarter of fiscal 2024, NVIDIA returned $3.38 billion to shareholders in the form of 7.5 million shares repurchased for $3.28 billion, and cash dividends. As of the end of the second quarter, the company had $3.95 billion remaining under its share repurchase authorization. On August 21, 2023, the Board of Directors approved an additional $25.00 billion in share repurchases, without expiration. NVIDIA plans to continue share repurchases this fiscal year.

NVIDIA will pay its next quarterly cash dividend of $0.04 per share on September 28, 2023, to all shareholders of record on September 7, 2023.

Q2 Fiscal 2024 Summary

Outlook

NVIDIA’s outlook for the third quarter of fiscal 2024 is as follows:

- Revenue is expected to be $16.00 billion, plus or minus 2%.

- GAAP and non-GAAP gross margins are expected to be 71.5% and 72.5%, respectively, plus or minus 50 basis points.

- GAAP and non-GAAP operating expenses are expected to be approximately $2.95 billion and $2.00 billion, respectively.

- GAAP and non-GAAP other income and expense are expected to be an income of approximately $100 million, excluding gains and losses from non-affiliated investments.

- GAAP and non-GAAP tax rates are expected to be 14.5%, plus or minus 1%, excluding any discrete items.

Highlights

NVIDIA achieved progress since its previous earnings announcement in these areas:

Data Center

- Second-quarter revenue was a record $10.32 billion, up 141% from the previous quarter and up 171% from a year ago.

- Announced that the NVIDIA® GH200 Grace™ Hopper™ Superchip for complex AI and HPC workloads is shipping this quarter, with a second-generation version with HBM3e memory expected to ship in Q2 of calendar 2024.

- Announced the NVIDIA L40S GPU — a universal data center processor designed to accelerate the most compute-intensive applications — available from leading server makers in a broad range of platforms, including NVIDIA OVX™ and NVIDIA AI-ready servers with NVIDIA BlueField® DPUs, beginning this quarter.

- Unveiled NVIDIA MGX™, a server reference design available this quarter that lets system makers quickly and cost-effectively build more than 100 server variations for AI, HPC and NVIDIA Omniverse™ applications.

- Announced NVIDIA Spectrum-X™, an accelerated networking platform designed to improve the performance and efficiency of Ethernet-based AI clouds, which is shipping this quarter.

- Joined with global system makers to announce new NVIDIA RTX™ workstations with up to four new NVIDIA RTX 6000 Ada GPUs, as well as NVIDIA AI Enterprise and NVIDIA Omniverse Enterprise software, expected to ship this quarter.

- Launched general availability of cloud instances based on NVIDIA H100 Tensor Core GPUs with Amazon Web Services, Microsoft Azure and regional cloud service providers.

- Partnered with a range of companies on AI initiatives, including:

- ServiceNow and Accenture to develop AI Lighthouse, a first-of-its-kind program to fast-track the development and adoption of enterprise generative AI capabilities.

- VMware to extend the companies’ strategic partnership to ready enterprises running VMware’s cloud infrastructure for the era of generative AI with VMware Private AI Foundation with NVIDIA.

- Snowflake to provide businesses with an accelerated path to create customized generative AI applications using their own proprietary data.

- WPP to develop a generative AI-enabled content engine that lets creative teams produce high-quality commercial content faster, more efficiently and at scale while staying fully aligned with a client’s brand.

- SoftBank to create a platform for generative AI and 5G/6G applications based on the GH200, which SoftBank plans to roll out at new, distributed AI data centers across Japan.

- Hugging Face to give developers access to NVIDIA DGX™ Cloud AI supercomputing within the Hugging Face platform to train and tune advanced AI models.

- Announced NVIDIA AI Workbench, an easy-to-use toolkit allowing developers to quickly create, test and customize pretrained generative AI models on a PC or workstation and then scale them, as well as NVIDIA AI Enterprise 4.0, the latest version of its enterprise software.

- Set records in the latest MLPerf training benchmarks with H100 GPUs, excelling in a new measure for generative AI.

Gaming

- Second-quarter revenue was $2.49 billion, up 11% from the previous quarter and up 22% from a year ago.

- Began shipping the GeForce RTX™ 4060 family of GPUs, bringing to gamers NVIDIA Ada Lovelace architecture and DLSS, starting at $299.

- Announced NVIDIA Avatar Cloud Engine, or ACE, for Games, a custom AI model foundry service using AI-powered natural language interactions to transform games by bringing intelligence to non-playable characters.

- Added 35 DLSS games, including Diablo IV, Ratchet & Clank: Rift Apart, Baldur’s Gate 3 and F1 23, as well as Portal: Prelude RTX, a path-traced game made by the community using NVIDIA’s RTX Remix creator tool.

Professional Visualization

- Second-quarter revenue was $379 million, up 28% from the previous quarter and down 24% from a year ago.

- Announced three new desktop workstation RTX GPUs based on the Ada Lovelace architecture — NVIDIA RTX 5000, RTX 4500 and RTX 4000 — to deliver the latest AI, graphics and real-time rendering, which are shipping this quarter.

- Announced a major release of the NVIDIA Omniverse platform, with new foundation applications and services for developers and industrial enterprises to optimize and enhance their 3D pipelines with OpenUSD and generative AI.

- Joined with Pixar, Adobe, Apple and Autodesk to form the Alliance for OpenUSD to promote the standardization, development, evolution and growth of Universal Scene Description technology.

Automotive

- Second-quarter revenue was $253 million, down 15% from the previous quarter and up 15% from a year ago.

- Announced that NVIDIA DRIVE Orin™ is powering the new XPENG G6 Coupe SUV’s intelligent advanced driver assistance system.

- Partnered with MediaTek, which will develop mainstream automotive systems on chips for global OEMs, which integrate new NVIDIA GPU chiplet IP for AI and graphics.

CFO Commentary

Commentary on the quarter by Colette Kress, NVIDIA’s executive vice president and chief financial officer, is available at https://investor.nvidia.com.

Conference Call and Webcast Information

NVIDIA will conduct a conference call with analysts and investors to discuss its second quarter fiscal 2024 financial results and current financial prospects today at 2 p.m. Pacific time (5 p.m. Eastern time). A live webcast (listen-only mode) of the conference call will be accessible at NVIDIA’s investor relations website, https://investor.nvidia.com. The webcast will be recorded and available for replay until NVIDIA’s conference call to discuss its financial results for its third quarter of fiscal 2024.

Non-GAAP Measures

To supplement NVIDIA’s condensed consolidated financial statements presented in accordance with GAAP, the company uses non-GAAP measures of certain components of financial performance. These non-GAAP measures include non-GAAP gross profit, non-GAAP gross margin, non-GAAP operating expenses, non-GAAP income from operations, non-GAAP other income (expense), net, non-GAAP net income, non-GAAP net income, or earnings, per diluted share, and free cash flow. For NVIDIA’s investors to be better able to compare its current results with those of previous periods, the company has shown a reconciliation of GAAP to non-GAAP financial measures. These reconciliations adjust the related GAAP financial measures to exclude acquisition termination costs, stock-based compensation expense, acquisition-related and other costs, IP-related costs, legal settlement costs, contributions, other, gains and losses from non-affiliated investments, interest expense related to amortization of debt discount, and the associated tax impact of these items where applicable. Free cash flow is calculated as GAAP net cash provided by operating activities less both purchases of property and equipment and intangible assets and principal payments on property and equipment and intangible assets. NVIDIA believes the presentation of its non-GAAP financial measures enhances the user’s overall understanding of the company’s historical financial performance. The presentation of the company’s non-GAAP financial measures is not meant to be considered in isolation or as a substitute for the company’s financial results prepared in accordance with GAAP, and the company’s non-GAAP measures may be different from non-GAAP measures used by other companies.

-------------------------------

2023.08.24

Huang isn't wrong. Nvidia has become the main supplier of the generative AI industry. The company's A100 and H100 AI chips are used to build and run AI applications, notably OpenAI's ChatGPT. Demand for these demanding applications has grown steadily over the last year, and infrastructure is shifting to support them.

A number of cloud service providers recently announced plans to adopt Nvidia H100 AI hardware in their data centers, according to Huang, who added that enterprise IT system and software providers also announced partnerships to bring Nvidia AI to every industry.

"The race is on to adopt generative AI,” he said.

Nvidia reported revenue of $13.51 billion in the second quarter, a figure that crushed Wall Street expectations and was double the $6.7 billion it generated in the same period last year. Analysts polled by Yahoo Finance forecast Q2 revenue of $11.22 billion.

Nvidia reported GAAP net income of $6.18 billion compared to $656 million it earned in the same year-ago period — upwards of a ninefold gain. Nvidia's net income skyrocketed even from the first quarter when it reported earnings of $2.04 billion. Its earnings per diluted share for the quarter were $2.48, up 854% from the same period last year. Analysts polled by Yahoo finance expected earnings per diluted share of $2.09.

황의 말이 틀리지 않습니다. Nvidia는 생성 AI 산업의 주요 공급업체로 성장했습니다. 이 회사의 A100 및 H100 AI 칩은 주목할 만한 AI 애플리케이션을 구축하고 실행하는 데 사용되며, 특히 OpenAI의 ChatGPT에서 사용됩니다. 이러한 고수요 애플리케이션에 대한 수요는 지난 1년 동안 꾸준히 증가하고 있으며, 인프라가 이를 지원하기 위해 변화하고 있습니다.

황에 따르면, 몇몇 클라우드 서비스 제공업체는 최근 자사의 데이터 센터에서 Nvidia H100 AI 하드웨어를 도입할 계획을 발표했으며, 기업용 IT 시스템 및 소프트웨어 공급업체도 각 산업으로 Nvidia AI를 가져오기 위한 파트너십을 발표했습니다.

"생성 AI 도입을 위한 경쟁이 시작되었습니다," 그는 말했습니다.

Nvidia는 2분기에 135.1억 달러의 매출을 발표했으며, 이는 월스트리트의 기대치를 크게 뛰어넘은 수치로, 작년 동기 67억 달러의 두 배에 해당합니다. Yahoo Finance가 조사한 분석가들은 2분기 매출을 112.2억 달러로 예측했습니다.

Nvidia는 GAAP 기준으로 61.8억 달러의 순이익을 발표했으며, 작년 동기대비 6.56억 달러에서 큰 폭의 증가를 기록했습니다. Nvidia의 순이익은 심지어 첫 분기의 20.4억 달러 순이익에서도 크게 증가했습니다. 해당 분기의 주당 diluted 주당 이익은 2.48달러로, 작년 동기대비 854% 증가했습니다. Yahoo Finance 조사에 따르면, 분석가들은 diluted 주당 이익을 2.09달러로 예측했습니다.

'엔비디아-마이크로소프트-AMD-인텔' 카테고리의 다른 글

| 엔비디아, H200 발표(2023.11.14) (0) | 2023.11.14 |

|---|---|

| 엔비디아가 상승하지 못하는 이유(2023.08.26) (0) | 2023.08.26 |

| 엔비디아, '24년2분기 HBM3E 장착한 GH200 출시(2023.08.09) (0) | 2023.08.09 |

| 마이크로소프트 애저(클라우드) 매출 전분기대비 하락(2023.07.26) (0) | 2023.07.26 |

| 캐시우드는 엔비디아 주식을 보유하고 있지 않음(2023.06.17) (0) | 2023.06.18 |