2023.11.09

Mortgage rates drop by most in a year, unleashing more homebuyer demand (yahoo.com)

Mortgage rates drop by most in a year, unleashing more homebuyer demand

미국 모기지 금리 1년만에 최대폭 하락하면서 미국 주택구입자들의 수요 억제를 해소했다.

Mortgage rates dropped this week for the second straight week — presenting a double-edged sword for homebuyers.

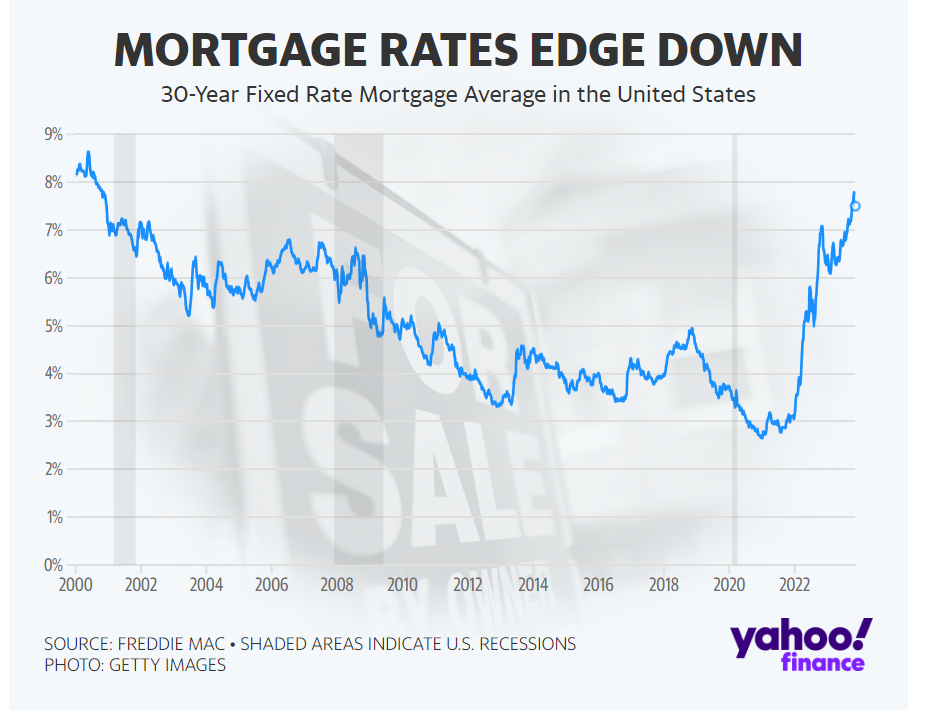

The average rate on the 30-year mortgage decreased to 7.5% from 7.76% last week, according to Freddie Mac on Thursday. That marked a more than a quarter-point drop, the largest one-week decline since November 2022.

미국 모기지 금리는 2주 연속 하락했다.

목요일에 프레디 맥에 따르면 30년 고정 모기지의 평균 금리는 지난 주의 7.76%에서 7.5%로 감소했습니다.

이는 2022년 11월 이후 가장 큰 일주일 동안의 하락으로, 약 0.25 포인트 이상의 하락을 나타냈습니다.

While the recent softening of rates makes financing cheaper for homebuyers, it may also create a new set of challenges. More buyers may return to a still limited-supply market and push home prices higher as competition heats up.

Read more: Mortgage rates at over 20-year high: Is 2023 a good time to buy a house?

최근 금리의 약화로 인해 주택 구매자들에게는 자금 조달이 더 저렴해지는 동시에 새로운 일련의 어려움이 발생할 수 있습니다. 더 많은 구매자들이 여전히 제한된 공급 시장으로 돌아와 경쟁이 격화되면서 주택 가격을 높여 나갈 수 있습니다.

"I think if interest rates drop, we're going to have so much demand on the sidelines that comes into the market," Dr. Jessica Lautz, deputy chief economist at the National Association of Realtors, told Yahoo Finance. "It could bid up home prices unless we have more housing inventory."

"이자율이 하락한다면, 시장으로 들어오는 주변의 수요가 많아질 것으로 생각합니다," 미국 부동산협회(National Association of Realtors) 부총재 경제학자 Jessica Lautz 박사는 야후 파이낸스에 말했습니다.

"주택 재고가 늘어나지 않는 한, 주택 가격을 높여 나갈 수 있습니다."

Demand moves with interest rates

Many buyers who have mostly given up on buying a home in the last six months are waiting for rates to drop to return to the market. Nearly two-thirds of buyers are waiting for mortgage rates to fall before buying a home, a BMO survey of 2,500 people this summer found.

That was on display with the most recent drop in rates. Homebuyers pounced on the relief.

지난 6개월 동안 주택 구매를 거의 포기한 많은 구매자들이 금리 하락을 기다리며 시장으로 돌아오기를 기다리고 있습니다. 올 여름 2,500명을 대상으로 한 BMO 조사에 따르면 구매자의 거의 2/3가 주택을 구매하기 전에 모기지 금리가 떨어지기를 기다리고 있다고 밝혀졌습니다.

최근 금리 하락에서 이는 뚜렷하게 드러났습니다. 주택 구매자들은 이 완화 조치에 빠르게 반응했습니다.

'경제-수출입 동향' 카테고리의 다른 글

| 블랙 프라이데이 쇼핑 - 온라인 및 오프라인 매출 증가(2023.11.26) (2) | 2023.11.26 |

|---|---|

| 일본 니케이 30년만에 최고치 (2) | 2023.11.20 |

| 외국인들이 한국 국채를 엄청나게 사는 이유(2023.07.05) (0) | 2023.07.05 |

| 2023년 6월 수출입 동향 (0) | 2023.07.01 |

| 미국의 물가 정보 (0) | 2023.05.14 |