2021.03.31

마이크론 회계년도 2021년2분기 실적 발표.

오늘 아침 마감된 미국장에서 마이크론은 1.93% 상승.

마감후 실적 발표에서 시장 예상치를 상회한 실적과 3분기 호실적 가이던스로 마감후 1.90% 상승 중.

1.매출은 62.4억달러로 시장 예상치 62.1억달러 상회.

주당 순이익도 0.98달러로 시장 예상치 0.95달러 상회.

전년 동기 대비 매출은 50%, 주당 순이익은 118% 증가.

2. 2021년3분기(3월~5월) 실적 예상치

매출 71억달러, 주당 순이익 1.62달러로 시장 예상치 상회로 시간외 거래에서 1.9% 상승.

시장 예상치는 매출 67.9억달러, 주당 순이익 1.32달러.

1년전 3분기 매출은 53.1억달러, 주당 순이익은 0.82달러.

3.월스트리트에 따르면 마이크론은 일본 낸드 생산업체 키옥시아(옛 도시바 메모리)를 매수하기위해

알아보는 중이라고 했다.

Micron defends ‘disciplined’ capital spending amid chip shortage - MarketWatch

Micron’s stock MU, +1.93% rose 3.5% after hours, following a 1.9% gain in the regular session to close at $88.21, boosted by a Wall Street Journal report that Micron is exploring a deal to buy Japanese chip maker Kioxia.

------------------------------------------------

MU 88.21 1.67 1.93% : Micron Technology, Inc. - Yahoo Finance

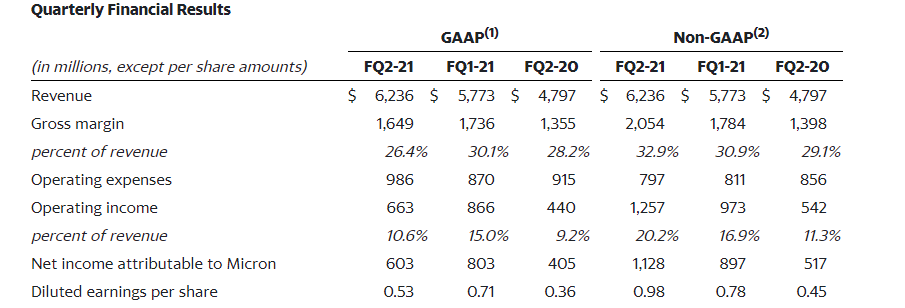

- Revenue of $6.24 billion versus $5.77 billion for the prior quarter and $4.80 billion for the same period last year

- 매출 62.4억달러 달성( 전분기 매출 57.7억달러/ 전년 동기 매출 48억달러)

- GAAP net income of $603 million, or $0.53 per diluted share

- 갭 순이익은 6.03억 달러, 주당 순이익 0.53달러.

- Non-GAAP net income of $1.13 billion, or $0.98 per diluted share

- 논갭 순이익 11.3억달러, 주당 순이익 0.98달러.

- Operating cash flow of $3.06 billion versus $1.97 billion for the prior quarter and $2.00 billion for the same period last year

- 영업이익으로 인한 현금 흐름 30.6억달러(전분기 19.7억달러, 전년 동기 20억달러)

“Micron’s strong fiscal second quarter performance reflects rapidly improving market conditions and continued solid execution,” said Micron Technology President and CEO Sanjay Mehrotra. “Our technology leadership in both DRAM and NAND places Micron in an excellent position to capitalize on the secular demand driven by AI and 5G, and to deliver new levels of user experience and innovation across the data center and intelligent edge.”

마이크론의 2분기 강한 실적은 현재 빠르게 좋아지고 있는 시장 상황과 지속적인 영업력을 반영한 결과라고 마이크론 사장은 언급했다.

Investments in capital expenditures, net(2) were $2.88 billion for the second quarter of 2021, which resulted in adjusted free cash flows(2) of $174 million. Micron ended the quarter with cash, marketable investments, and restricted cash of $8.57 billion, for a net cash(2) position of $1.95 billion.

2분기 투자는 28.8억달러이고, 현금 흐름은 1.74억달러이다.

Business Outlook

The following table presents Micron’s guidance for the third quarter of 2021:

다음은 3분기(3월~5월) 실적 예상치.

매출 $7.1 billion ± $200 million

주당순이익은 갭 $1.52 ± $0.07(논갭 $1.62 ± $0.07)

|

FQ3-21 |

GAAP(1) Outlook |

Non-GAAP(2) Outlook |

|

Revenue |

$7.1 billion ± $200 million |

$7.1 billion ± $200 million |

|

Gross margin |

40.5% ± 1% |

41.5% ± 1% |

|

Operating expenses |

$930 million ± $25 million |

$875 million ± $25 million |

|

Interest (income) expense, net |

$27 million |

$25 million |

|

Diluted earnings per share |

$1.52 ± $0.07 |

$1.62 ± $0.07 |

Further information regarding Micron’s business outlook is included in the prepared remarks and slides, which have been posted at investors.micron.com.

-----------------------------------------------------------

MU Stock Rises As Micron Beats Wall Street's Q2 Targets | Investor's Business Daily

The Boise, Idaho-based company earned an adjusted 98 cents a share on sales of $6.24 billion in the quarter ended March 4. Analysts expected Micron earnings of 95 cents a share on sales of $6.21 billion. On a year-over-year basis, Micron earnings jumped 118% while sales climbed 30%.

매출은 62.4억달러로 시장 예상치 62.1억달러 상회.

주당 순이익도 0.98달러로 시장 예상치 0.95달러 상회.

전년 동기 대비 매출은 50%, 주당 순이익은 118% 증가.

On March 3, Micron raised its sales and earnings guidance for the quarter. The earnings report also follows news that Micron is ceasing development of 3D XPoint chips, which has been a drag on earnings.

"Micron's strong fiscal second-quarter performance reflects rapidly improving market conditions and continued solid execution," Chief Executive Sanjay Mehrotra said in a news release.

He added, "Our technology leadership in both DRAM and Nand (memory chips) places Micron in an excellent position to capitalize on the secular demand driven by AI and 5G, and to deliver new levels of user experience and innovation across the data center and intelligent edge."

In after-hours trading on the stock market today, MU stock climbed 2%, near 90.

During the regular session Wednesday, MU stock rose 1.9% to 88.21.

For the current quarter, Micron expects to earn an adjusted $1.62 a share on sales of $7.1 billion.

That's based on the midpoint of its guidance for the fiscal third quarter. Wall Street was modeling Micron earnings of $1.32 a share on sales of $6.79 billion. In the year-earlier period, Micron earnings were 82 cents a share on sales of $5.31 billion.

The DRAM market is "in severe shortage," which has led to higher prices, Mehrotra said on a conference call with analysts. Meanwhile, the Nand market is showing signs of stabilization, he said.

DRAM chips act as the main memory in PCs, smartphones and other devices, working closely with central processing units. Nand flash provides longer-term data storage. DRAM accounted for 71% of Micron's revenue last quarter, with Nand flash chips contributing 26% of sales.

In the second quarter, Micron posted record sales for Nand chips for smartphones and for automotive memory and storage chips. Micron also benefited from healthy notebook PC demand and an improving data center market.

MU stock is on IBD's Big Cap 20 stock list.

-----------------------------------------------------------

-------------------------------------------------------

Micron Technology, Inc. 10-Q Apr. 1, 2021 1:49 PM | Seeking Alpha

마이크론

'반도체-삼성전자-하이닉스-마이크론' 카테고리의 다른 글

| 삼성전기(2021.03.29) 목표가 27만원 -키움증권 (0) | 2021.04.02 |

|---|---|

| 4월 매수해야할 종목-전자, 자동차(2021.04.02) (0) | 2021.04.02 |

| 미국 마이크론 매수 신호 발생(2021.03.26) (0) | 2021.03.27 |

| 삼성전자, 업계 최초 HKMG 공정 적용 고용량 DDR5 메모리 개발 (0) | 2021.03.25 |

| 마이크론은 애플 제품의 판매 약세에 대한 우려로 하락(2021,03.24) (0) | 2021.03.24 |