2021.12.28

디지탈트윈이 사용될 곳: 제조업,도시계획, 의료분야.

4. 메타버스의 미래는 디지털 트윈 (brunch.co.kr)

메타버스 제조, 디지털 트윈으로 완성! (lgcns.com)

"5년 후 54조" 네이버가 사활 거는 디지털트윈 시장과 수혜주 - YouTube

Omniverse Platform for 3D Design Collaboration and Simulation | NVIDIA

A NEW ERA OF 3D DESIGN COLLABORATION AND SIMULATION

3D 설계 협업 및 시뮬레이션의 새로운 시대

NVIDIA Omniverse™ is an easily extensible, open platform built for virtual collaboration and real-time physically accurate simulation.

Creators, designers, researchers, and engineers can connect major design tools, assets, and projects to collaborate and iterate in a shared virtual space.

Developers and software providers can also easily build and sell Extensions, Apps, Connectors,

and Microservices on Omniverse’s modular platform to expand its functionality.

NVIDIA Omniverse™는 가상 협업 및 물리적으로 정확한 실시간 시뮬레이션을 위해 구축된

쉽게 확장 가능한 개방형 플랫폼입니다.

제작자, 디자이너, 연구원 및 엔지니어는 주요 디자인 도구, 자산 및 프로젝트를 연결하여

공유 가상 공간에서 협업하고 반복할 수 있습니다.

또한 개발자와 소프트웨어 제공업체는 그들의 기능을 확장하기 위해 Omniverse의 모듈식 플랫폼에서

확장 기능, 앱, 커넥터 및 마이크로서비스를 쉽게 구축 및 판매할 수 있습니다.

Live Collaboration Between Users and Applications

Bring together users and top industry 3D design tools in real time on a single, interactive platform.

Workflows are simplified as updates, iterations, and changes are instantaneous with no need for data preparation.

사용자와 애플리케이션 간의 실시간 협업.

단일 대화형 플랫폼에서 사용자와 업계 최고의 3D 설계 도구를 실시간으로 통합합니다.

업데이트, 반복 및 변경이 데이터 준비 없이 즉각적으로 이루어지므로 워크플로가 간소화됩니다.

Real-time Speed,

Offline Quality

Omniverse delivers scalable, real-time ray tracing and path tracing.

Achieve beautiful, physically accurate, and photorealistic visuals in real time.

실시간 속도, 오프라인 품질.

Omniverse는 확장 가능한 실시간 광선 추적 및 경로 추적을 제공합니다.

아름답고 물리적으로 정확하며 사실적인 영상을 실시간으로 얻을 수 있습니다.

Simulate Reality with

RTX Technology

Build it once, render it anywhere. Stream NVIDIA RTX™ technology-rendered photorealism to any of your devices. Share your work with ease and ensure that it’s presented as it should be.

RTX 기술로 현실을 시뮬레이트한다.

한 번 빌드하고 어디에서나 렌더링할 수 있습니다. NVIDIA RTX™ 기술로 렌더링된 포토리얼리즘을 모든 장치로

스트리밍하십시오. 작업을 쉽게 공유하고 원래대로 표시되는지 확인합니다.

--------------------------------------------------------------

아래는 인공지능에 강점을 보유한 엔비디아가 인공지능 매출 증가로

현재 882조원인 시가총액이 수조달러(원화 수천조원)가 될수도 있다는 글입니다.

12월29일 마감한 미국 시장에서 엔비디아의 주가는 300.01 달러이고

시총은 7476.25억달러(원화 약 882조원)이다.

Nvidia's Trillion-Dollar AI Opportunity (NASDAQ:NVDA) | Seeking Alpha

Summary

- NVIDIA's dominance in AI is underappreciated.

- AI에서 NVIDIA의 우위는 과소 평가되었다.

- The company satisfies all the conditions to grow its competitive advantage in AI over time.

- 회사는 시간이 지남에 따라 AI에서 경쟁력을 높일 수 있는 모든 조건을 충족학고 있다.

- AI could grow into a multi-trillion dollar opportunity for NVIDIA.

- AI는 NVIDIA가 시가총액이 수조 달러가 될수있는 기회를 준다.

AI is a watershed moment for the world. Humans’ fundamental technology is intelligence.

We’re in the process of automating intelligence so that we can augment ours.

The thing that’s really cool is that AI is software that writes itself, and it writes software that no humans can.

Jensen Huang, Founder, and CEO of NVIDIA

AI는 전 세계의 분수령이 되는 순간입니다. 인간의 기본 기술은 지능입니다.

우리는 우리의 능력을 향상시킬 수 있도록 지능을 자동화하는 과정에 있습니다.

정말 멋진 점은 AI가 스스로 작성하는 소프트웨어이고 인간이 할 수 없는 소프트웨어를 작성한다는 것입니다.

-엔비디아 창업자겸 사장, 젠슨 황-

NVIDIA (NVDA) does not get enough credit for its highly dominant position in artificial intelligence, a rapidly emerging class of technology that will likely disrupt every industry and centralize economic power in the hands of its masters.

The market's increasing recognition of NVIDIA's sustainable competitive advantage in artificial intelligence (AI) and AI's long growth runway will likely sustain the stock's outperformance and premium valuation.

NVIDIA(NVDA)는 모든 산업을 혼란에 빠뜨리고 주인의 손에 경제력을 집중시킬 가능성이 있는 빠르게 부상하는

기술인 인공 지능 분야에서 매우 지배적인 위치에 있다는 충분한 믿음을 얻지 못했습니다.

인공 지능(AI) 및 AI의 장기 성장 활주로에서 NVIDIA의 지속 가능한 경쟁 우위에 대한 시장의 인식이 높아짐에 따라

주식의 성과와 프리미엄 가치가 유지될 것입니다.

AI & Economic Centralization

AI is exciting to the investment community because it gives those who wield it unprecedented abilities and economics. Revolutionary breakthroughs in artificial neural networks (or deep learning) in the 2010s enabled algorithms to "learn" and thus introduce a new level of machine intelligence never available before, allowing the algorithms to accomplish breathtaking new feats such as defeating the world's top Go players and disrupting the translation industry.

AI는 그것을 휘두르는 사람들에게 전례 없는 능력과 경제성을 제공하기 때문에 투자 커뮤니티에 흥미진진합니다.

2010년대 인공 신경망(또는 딥 러닝)의 혁신적인 혁신으로 알고리즘이 "학습"되어 이전에는 사용할 수 없었던

새로운 수준의 기계 지능을 도입하여 알고리즘이 세계 최고의 바둑 선수를 물리치는 것과

번역 산업을 뒤흔드는 것과 같은 놀라운 새로운 업적을 달성할 수 있게 되었습니다.

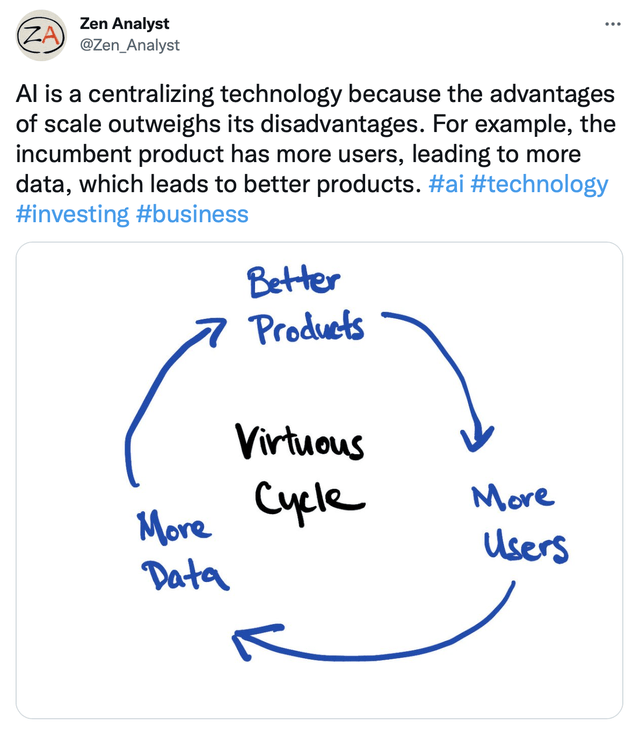

Importantly, for investors, modern neural network algorithms are a "centralizing" technology since the advantage of scale outweighs the disadvantages. The practical implication is that companies that can position themselves at the center should enjoy an unusually strong and sustainable competitive advantage in the niche where it dominates.

Source: Zen Analyst

Companies most likely to be in this enviable position should satisfy three conditions.

First, there is a massive shortage of AI experts, so only very well-funded companies or those with massive cash flow can sustain world-class AI teams. In 2017, Tencent (OTCPK:TCEHY) estimated that there are only 300,000 AI researchers worldwide, far short of the millions demanded by the market. The lack of skilled people and difficulty hiring topped the list of challenges in AI to this day.

Second, AI delivers the greatest value to companies with the greatest data assets, which correlates with the scale of the enterprise. It takes a massive amount of data to train neural networks, and naturally, the best AI talents prefer to work in data-rich environments. It is no surprise that companies that are most excited about AI are also the ones with the greatest data assets, for example, Alphabet (GOOG), Microsoft (MSFT), Amazon (AMZN), Meta Platforms (FB), Apple (AAPL), and Netflix (NFLX).

Third, combining top AI talent and massive data to produce breakthrough products requires a management team with a strong engineering and computer science background. This condition explains why Amazon, Alphabet, Microsoft, and NVIDIA lead in AI when other data-rich companies such as Bank of America (BAC) and UnitedHealth Group (UNH) do not.

Once a breakthrough AI product is brought to market, for example, Google's AI language translation service, one that is significantly better than alternatives, a virtuous cycle begins that further reinforces the competitive advantage of the product. First, the superior product garners more users. Second, more users interacting with the product generates more data. Third, the incremental data is then used to improve the product.

Source: Zen Analyst

This virtuous flywheel increases the competitive advantages of the incumbents as long as they do not fall apart due to complacency and corruption.

NVIDIA's Dominance

NVIDIA satisfies all three conditions for maintaining and growing its dominant position in AI.

First, NVIDIA is one of the most profitable and fastest-growing companies globally, making its stock-based compensation highly attractive to scarce AI talents. The company is expected to generate $13.7 billion in EBITDA this current fiscal year (ended January 2022), up 73% y/y.

Second, NVIDIA has access to a massive amount of data through its computing hardware business, CUDA parallel computing platform, gaming platforms such as GeForce Now, and software platforms such as Omniverse.

In addition to providing AI talent a data-rich environment, the company also occupies an overwhelmingly dominant position in AI chips, making the company one of the exciting places to work for AI talent. According to JPR, NVIDIA has an 83% share of the Q2 2021 PC discrete GPUs, the preferred chip for AI training and inference. Likewise, NVIDIA GPUs also dominate the data center with over 80% market share in AI workloads.

Third, in my view, NVIDIA's management ranks among the most innovative in history. Jensen Huang founded NVIDIA in 1993 and has been at the frontier of innovation in GPUs, gaming graphics, accelerated computing in data centers, AI, and the Metaverse. Today, at 58-years-old, Jensen is still deeply committed as the company's CEO, and his vision gets a tremendous amount of respect from Wall Street to Main Street.

It is no wonder that AI talents are flocking to work at NVIDIA. According to a 2017 Glassdoor survey, NVIDIA ranked second among top employers hiring AI talent. According to a study released by Glassdoor, as of 2021, NVIDIA ranked the second-best place to work in the U.S. Given how well the company and the stock have done and the high level of employee satisfaction, NVIDIA should not have problems attracting some of the best AI talents in the world.

AI Market Opportunity

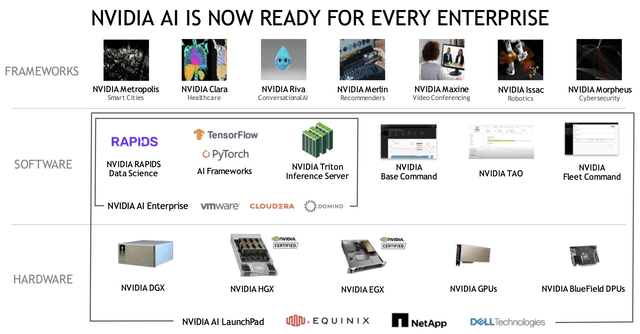

NVIDIA has a massive AI portfolio that could serve every enterprise:

Source: NVIDIA

Due to the size of its AI portfolio, it is challenging to put an exact number on NVIDIA's AI addressable market for three reasons. First, NVIDIA has products up and down the stack, from applications interacting with the end-user to hardware sitting in the data center and at the edge. Second, NVIDIA's AI technologies are horizontal (giving a limited set of capabilities to every industry) and vertical (offering a broad set of capabilities to specialized industries). Third, AI will play a crucial but not exclusive role in rapidly emerging opportunities such as the metaverse.

To get a sense of the scale of the opportunities for NVIDIA's AI portfolio, let's take a look at a few examples.

Omdia forecasts the global artificial intelligence software market will grow rapidly in the coming years, reaching around $126 billion by 2025. The overall AI market includes various applications such as natural language processing, robotic process automation, and machine learning.

I sized the current metaverse opportunity for NVIDIA at a minimum of $360 billion, with the potential to grow into the trillions. In my view, AI will play a crucial role in the metaverse, but so will blockchain, consumer electronics such as virtual reality goggles, and GPU chips. I suspect that AI will initially play a small role in the metaverse relative to blockchain and hardware, but its importance will increase in five to ten years.

However, NVIDIA's CEO, Jensen Huang, has much bigger ambitions: he believes the intelligence market is sized in the trillions. For example, he believes that AI will transform the multi-trillion transportation industry through autonomous driving, to name one industry.

Valuation

(Note: all consensus and historical data in this section are from FactSet.)

While there is little disagreement that NVIDIA is an excellent company, many investors balk at NVIDIA's price action and premium valuation.

In my opinion, the stock's valuation is justified by its growth rate, the strength of its core business, and multiple "free options" attached to the stock. However, NVIDIA may not be appropriate for investors who would like to avoid large drawdowns given the stock's 1.95 52-week beta and the business's rapid growth, which could hit unexpected speed bumps.

NVDA currently trades at 58x next-twelve-month consensus EPS or a 180% premium to the S&P 500. Given the stock's ~126% YTD rally and premium valuation, many investors fear chasing a winner. Furthermore, given the passionate discussions around the metaverse (see my recently published Meta Platforms article for more background information), bears will argue that NVDA's valuation is being propped up by "hype."

I disagree with this conclusion because I believe NVDA's valuation is justified by the performance of its core business, while Omniverse has not yet materially contributed to results. For a detailed discussion of the Omniverse, please read my article NVIDIA: Lord Of The Metaverse.

NVDA's EPS grew 73% y/y in FY20 and is expected to grow another 74% in FY22 (FY ending January). By the end of this year, the company is expected to generate earnings per share ~200% higher than its 2019 earnings. Over the same period, the S&P 500's EPS grew 26%. Looking ahead, consensus EPS for NVDA's FY23 implies a 19% y/y growth rate, a number the company should easily beat given the strong momentum of its businesses and its long history of beating earnings estimates. However, even 19% is well above the S&P 500's expected 8% EPS growth in the same period.

In addition, I believe NVDA's above-market EPS growth rate will be more sustainable than the average S&P 500 company, given its near-monopoly in discrete GPUs and the secular trends driving its business. Among the most important secular drivers is the rise of AI and the metaverse.

Risks

We know NVIDIA has a near-monopoly in discrete GPUs, the dominant chip used to power gaming, accelerated computing, and AI. The company enjoys network effects, flywheel effects, platform dominance, and a superior R&D budget, putting it head and shoulders above competitors. Its primary end markets -- gaming, data center, and AI -- are also growing well above global GDP.

In my view, the most significant risk for NVIDIA is regulatory and not competitive or market-based. I see two primary regulatory risks: anti-monopoly and geopolitics.

First, the company's dominance and size make it a threat to market competition, likely resulting in regulatory pressures. NVIDIA could face regulatory risks similar to those experienced by Microsoft twenty years ago and by Meta Platforms, Apple, and Alphabet today.

We already see early signs of government pressure on NVIDIA. For example, even US regulators object to the company's pending acquisition of ARM Holdings.

Second, as a semiconductor company with significant China revenues, NVIDIA risks being caught in the cross-hair of the US-China semiconductor war. Revenue from billings to China, including Hong Kong, was 23% of NVIDIA's revenue for the fiscal year 2021. As the leader in AI, a key area of geopolitical contest, NVIDIA's risk of being caught in geopolitics is likely much greater than the average semiconductor company.

'마이크로소프트 -엔비디아-AMD-인텔' 카테고리의 다른 글

| 인텔, 4분기 실적 발표(2022.01.26) (0) | 2022.01.27 |

|---|---|

| 넷플릭스, 시간외 거래에서 20% 하락(2022.01.21) (0) | 2022.01.21 |

| 마이크로소프트의 2022년 최우선 관심사는 데이터관리 분야(2021.12.18) (0) | 2021.12.19 |

| 엔비디아, 데이터센터향 매출이 지배할 것이다(2021.12.17) (0) | 2021.12.18 |

| 애플만 3.16% 상승 이유(2021.12.01) (0) | 2021.12.01 |