2022.03.10

요약:

자동차와 스마트폰, 데이터센터, 사물인터넷등은 점점 더 기술적으로 복잡해지고 있는데,

이는 마이크론에게는 좋은 소식이다.

더 향상된 기능과 데이터 소비는 메모리(디램)와 스토리지(낸드)에 대한 더 많은 수요를 의미한다.

Why Micron Technology Could Be the Nvidia of the 2020s | The Motley Fool

10년전인 2012년 엔비디아에 천달러를 투자했다면 지금은 57배인 57,000달러가 되었다.

현재 마이크론의 위치는 10년전 엔비디아와 비슷하다.

Key Points

- Several new markets are driving demand for Micron's technology, similar to what propelled Nvidia's growth.

- 몇개의 새로운 시장이 엔비디아의 성장을 이끌었듯이, 마이클론도 이와 비슷하게 몇몇의 새로운 시장이

- 수요를 창출하고 있ㄷ다.

- New use cases across artificial intelligence, IoT, and 5G were not contributors to Micron's growth six years ago, but they are now.

- 인공지능, 사물인터넷과 5G같은 새로운 분야는 6년전에는 마이크론의 성장 부문이 아니었으나

- 지금은 성장 분야가 되었다.

- The start of a quarterly dividend is one sign that management sees sustainable growth.

- 분기 배당은 경영진이 지속적인 성장이 가능하다는 것을 본다는 신호이다.

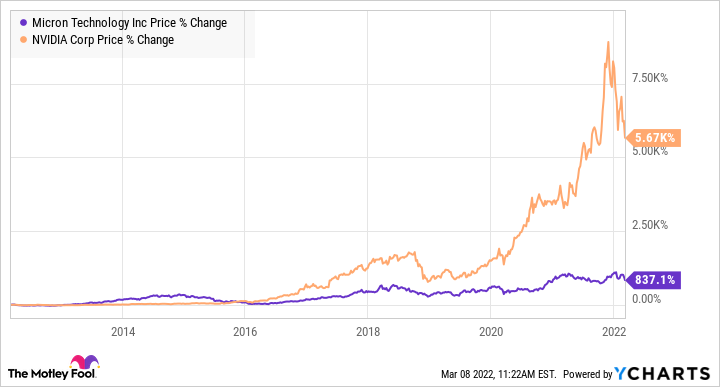

A $1,000 investment in Nvidia (NASDAQ:NVDA) in 2012 would be worth $57,000 today.

10년전인 2012년에 천달러를 엔비디아에 투자했으면 지금은 57,000달러가 되었을 것이다.

That's what can happen when you invest in a growing tech company that experiences expanding use cases for its products. Nvidia successfully applied its graphics processing units (GPUs) to new markets like the data center, as opposed to relying on demand from PC gamers, and revenue exploded.

그것은 자사의 제품이 지속적으로 새로운 사용처를 만드는 성장 기술주에 투자했을때 가능한 일이다.

엔비디아는 자사의 GPU를 데이터센터와 같은 새로운 시장에 적용시키면서 매출이 폭발적으로 증가하였다.

Micron Technology (NASDAQ:MU) could see a similar growth opportunity over the next decade.

마이크론도 다음 10년간 엔비디아와 비슷한 성장 기회를 볼수있다.

It's one of the leading producers of dynamic random-access memory (DRAM) modules and non-volatile flash memory (NAND) used in solid-state drives. Vehicles, phones, data centers, and the Internet of Things (IoT) are getting more complicated technologically, and that's good news for Micron.

자동차와 스마트폰, 데이터센터, 사물인터넷등은 점점 더 기술적으로 복잡해지고 있는데,

이는 마이크론에게는 좋은 소식이다.

More advanced features and data consumption means higher demand for its memory and storage solutions,

and Micron is already reporting strong revenue growth in 2022 because of these trends.

Could buying shares of Micron today lead to Nvidia-like returns over the next 10 years? Let's find out.

더 향상된 기능과 데이터 소비는 메모리와 스토리지에 대한 더 많은 수요를 의미한다.

마이크론은 이미 이런 추세때문에 2022년에 강한 실적 성장을 보고하고 있다.

지금 마이크론 주식을 매수하면 10년후 엔비디아와 같은 결실을 얻을 수있는지 살펴보겠다.

MU DATA BY YCHARTS

A lot has changed in six years

It's telling to compare Micron's annual report from fiscal 2015 to fiscal 2021. Six years ago, there was no mention of artificial intelligence, IoT, driver-assistance systems, or high-resolution smartphone cameras -- all of which are now contributing to Micron's growth in 2022.

2015년부터 2021년까지 마이크론의 연간 ㅂ보고서를 비교해보면, 6년전에는 인공지능, 사물인터넷,

운행보조 시스템이나 고해상도 스마트폰 카메라에관한 언급이 없었다.

하지만 이 모든것이 2022년에는 마이크론의 성장에 기여하고 있다.

Micron's mobile business unit grew 26% in fiscal 2021. New high-end smartphones are featuring larger 4K displays, advanced features, high-resolution video recording, and processors that enable real-time translation, image search, and scene detection. All of these technologies need higher levels of NAND and low-power double data rate DRAM, or LPDRAM, which is right up Micron's alley.

| Compute and networking | $12.28 billion | $9.18 billion | 34% |

| Mobile | $7.2 billion | $5.7 billion | 26% |

| Storage | $3.97 billion | $3.77 billion | 6% |

| Embedded | $4.2 billion | $2.76 billion | 53% |

| Total revenue | $27.7 billion | $21.4 billion | 29% |

DATA SOURCE: MICRON 10-K.

Cloud computing, which is included in Micron's storage business unit, is another monster growth opportunity.

This business reported 5.5% revenue growth last year, but more specifically, data-center revenue grew 70% over the year-ago quarter in the most recent quarter.

Last year, Micron was first to market with its 176-layer NAND flash memory that is used in data center solid-state drives (SSDs).

Another attractive business for Micron is the embedded business unit, including revenue from industrial, IoT, and automotive applications. Micron reported more than 80% year-over-year revenue growth in industrial IoT products last quarter, while auto revenue grew 25%.

Data center is the largest market for memory and storage. Management sees a strong ramp-up of data center SSD revenue continuing in the next quarter.

Mobile revenue increased 25% in the fiscal first quarter, and management sees continued growth in this market as the 5G upgrade cycle continues. Higher demand coming from the data center and mobile markets puts Micron on pace to have a record year in terms of revenue, based on management's outlook.

Signs of sustainable demand

Management sent two strong signals of sustainable long-term growth to shareholders last year.

First, it announced an investment of up to $150 billion through 2030 in manufacturing and research and development. Second, Micron initiated a quarterly dividend of $0.10 per share. Note that in 2012, just as Nvidia was about to deliver wealth-building returns to investors, the graphics specialist initiated its first-ever quarterly dividend. Investors should take Micron's dividend seriously.

Over the last year, Micron generated $3.9 billion in free cash flow on $29 billion in revenue. The dividend and capital spending plan say two things: Management expects growing demand for its technology, and it expects to generate sustainable growth in free cash flow.

Is Micron the next Nvidia?

Despite all these positive indicators, the stock continues to trade at an unbelievable value of just 8.3 times this year's profit forecast. The stock could certainly deliver market-beating returns to investors from this low valuation level.

However, there is one key difference between Micron and Nvidia that investors should know about. When Nvidia began its run 10 years ago, it was already the dominant leader in GPUs. Nvidia's only competition was Advanced Micro Devices. Micron doesn't have this luxury. The market for DRAM and NAND technology is much more competitive, with Micron currently sitting in third place behind Samsung and SK Hynix.

Still, Micron's expanding profit margin is evidence that it is doing something different. Over the last 10 years, Micron's operating margin has trended up from negative territory to a high 29%, which is well above the corporate average. It's close to Nvidia's operating margin of 37%.

MU OPERATING MARGIN (TTM) DATA BY YCHARTS

Last year's launch of 176-layer NAND and 1-alpha DRAM were breakthroughs that pushed Micron to a leadership position in the industry.

All in all, investors shouldn't count on earning a 50-fold return on investment, because that level of return is not common. But Micron is benefiting from powerful forces in the world of technology, such as increasing chip content in products we use every day that should lead to a growing business. There's a good chance the stock will significantly outperform the broader market through 2032.

------------------------------

2022.03.12

Top Analyst Reports for Eli Lilly, NIKE & Micron Technology (yahoo.com)

Shares of Micron have underperformed the S&P 500 index in the year-to-date period (-18.7% vs. -10.5%).

The Zacks analyst believes that Micron’s near-term profitability is likely to hurt by its planned salary hikes.

마이크론 주가는 S&P 500지수보다 더 떨어졌다.

잭스 애널은 마이클론의 이익이 직원의 급여 인상으로 훼손 받을 것으로 믿는다.

Additionally, higher level of customer inventory in the cloud, graphics and enterprise market is a key threat.

Soft server demand from several enterprise original equipment manufacturer (OEM) customers is also a concern.

게다가 클라우드 고객, 그래픽과 기업 고객들의 높은 재고 수준은 주요 위험 요소이다.

또 미약한 서버 수요 역시 위험 요소이다.

However, Micron has already witnessed growing demand for memory chips from cloud-computing providers and acceleration in 5G (fifth-generation) cellular network adoptions.

그러나 마이크론은 이미 클라우드 컴퓨팅 공급자로 부터의 증가하는 메모리 수요와 5G 네트워크 채택 가속화를

목격하고 있다

.

Rising mix of high-value solutions, enhancement in customer engagement and

improvement in cost structure are growth drivers as well.

Further, 5G adoption beyond mobile is likely to spur demand for memory and storage, particularly in Internet of Things (IoT) devices and wireless infrastructure.

더 나아가 스마트폰을 넘어서 5G 채택은 디램과 낸드 수요에 박차를 가하는 것같고,

특히 사물인터넷 기기와 무선 통신 인프라에서 수요가 강한 것같다.

'반도체-삼성전자-하이닉스-마이크론' 카테고리의 다른 글

| 3분기, D램 가격 오른다(2022.03.14) (0) | 2022.03.14 |

|---|---|

| 글로벌 스마트폰 AP 점유율 (0) | 2022.03.13 |

| 5월중순에서 6월말까지 낸드 부족할 것(2022.03.07) (0) | 2022.03.10 |

| 반도체 기판, FC-BGA/ FC-CSP (0) | 2022.03.07 |

| 마이크론은 5G스마트폰용 메모리 수요에 낙관적(2022.03.07) (0) | 2022.03.07 |