2022.05.07

Micron: Outstanding Opportunity For A Data-Centric Inflationary Future (NASDAQ:MU) | Seeking Alpha

Summary

- Micron has suffered a torrid slide in 2022, despite an impeccable quarter during the supply-chain turmoil and a 'Strong Buy' rating on SA Quant since 1 April '22.

- 마이크론은 공급망 혼란가운데 나무랄데 없는 분기 실적과 '22년 4월 1일 이후 SA Quant에서의

- '강력 매수' 등급에도 불구하고 2022년에 극심한 하락을 겪었습니다.

- Mr. Market's memory is plagued by the boom/bust cycles in digital memory pricing of yesteryear,

- which consistently hampered Micron's earnings profile, thence the valuation rating.

- Mr. Market의 메모리는 작년의 디지털 메모리 가격의 호황/불황 주기로 인해 어려움을 겪었습니다.

- 이는 Micron의 수익 프로필을 지속적으로 방해하여 평가 등급을 매겼습니다.

- The paradigm shift in the digital memory industry, in both the supply and demand curves,

- has been totally ignored by Mr. Market to date.

- 공급곡선과 수요곡선 모두에서 디지털 메모리 산업의 패러다임 전환은 현재까지 Mr. Market에 의해

- 완전히 무시되었습니다.

- This article examines strong evidence that pricing of digital memory will be far rosier,

- a result of deeper and wider demand as well as orderly supply expansions by an oligopoly.

- 이 기사는 과점에 의한 공급 확대뿐 아니라 더 깊고 폭넓은 수요의 결과로 디지털 메모리 가격이

- 훨씬 더 오를 것이라는 강력한 증거를 조사합니다.

- Future earnings will exhibit a sustained upward trajectory, obliging the valuation to rerate upwards.

- Micron offers an outstanding investment opportunity in a data-centric future laced with inflationary uncertainty.

- 마이크론의 미래 수익은 지속적인 상승 궤적을 보여 밸류에이션을 상향 조정해야 합니다.

- Micron은 인플레이션 불확실성이 얽힌 데이터 중심 미래에 탁월한 투자 기회를 제공합니다.

This article explores why Micron (NASDAQ:MU) offers an outstanding opportunity today.

The proposition rests on four main pillars:

이 기사에서 Micron이 오늘날 탁월한 기회를 제공하는 이유를 살펴봅니다.

이 제안은 4가지 주요 기둥에 기반을 두고 있습니다.

- Pricing of digital memory will exhibit an upward trajectory, a stark contrast to the cyclical past.

- 디지털 메모리의 가격은 과거 순환적인 것과 극명한 대조를 이루는 상승세를 보일 것입니다.

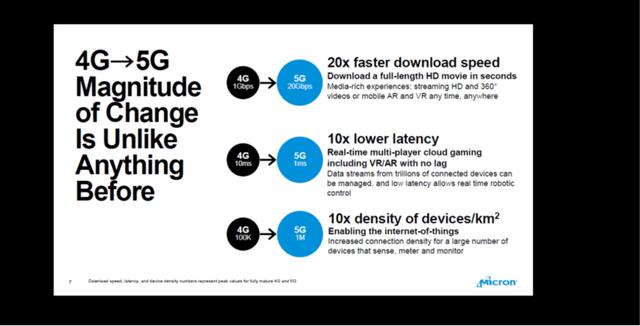

- Digital memory has become the backbone of our data-centric lives - whether it's our 5G cell phones or AI employed in the cloud, all that extra data needs to be stored (NAND or non-volatile flash memory), then processed (DRAM or dynamic random-access memory) on digital memory.

- In simple terms, digital memory is taking a progressively larger role in the life of both, the consumer and the enterprise

- 디지털 메모리는 데이터 중심적 삶의 중추가 되었습니다. 5G 휴대폰이든 클라우드에서 사용되는 AI이든, 모든 추가 데이터는 저장(NAND 또는 비휘발성 플래시 메모리)한 다음,

- 디지털 메모리엣서 처리(DRAM 또는 동적 랜덤 액세스 메모리)됩니다. 간단히 말해서 디지털 메모리는 소비자와 기업 모두의 삶에서 점점 더 큰 역할을 하고 있습니다.

- Supply of digital memory has consolidated from a myriad of players fighting to keep up with a rapidly changing technology landscape to an oligopoly of disciplined suppliers keen to earn a decent return on the enormous capital outlay required to make DRAM/NAND today.

- 디지털 메모리의 공급은 빠르게 변화하는 기술 환경을 따라잡기 위해 고군분투하는 수많은 플레이어에서 오늘날 DRAM/NAND를 만드는 데 필요한 막대한 자본 지출로 상당한 수익을 얻고자 하는 규율 있는 공급업체의 과점으로 통합되었습니다.

- The cost structure of DRAM/NAND is far more dependent on manufacturing efficiency than input costs. Micron has more control over its cost base than say, a consumer-goods company that faces a myriad of raw material inputs. This results in far less operational risk for Micron to sustain/improve margins than say, a Kraft Heinz (KHC) or a McDonald's (MCD) that may face margin compression from price-hikes in a variety of raw material inputs.

- DRAM/NAND의 비용 구조는 투입 비용보다 제조 효율성에 훨씬 더 많이 의존합니다. Micron은 수많은 원자재 투입에 직면해 있는 소비재 회사보다 비용 기반을 더 잘 통제하고 있습니다. 그 결과 다양한 원자재 투입량의 가격 인상으로 인해 마진 압박에 직면할 수 있는 Kraft Heinz(KHC) 또는 맥도날드(MCD)보다 Micron이 마진을 유지/개선하는 운영 위험이 훨씬 적습니다.

- Micron's rating (EV/EBITDA ratio) is abnormally low, especially in regard to its future earnings profile. This results in an outstanding risk-reward proposition for the Micron investor, both in absolute terms and in relative terms, in the event the market rating adjusts downwards.

- Micron의 등급(EV/EBITDA 비율)은 특히 미래 수익 프로필과 관련하여 비정상적으로 낮습니다. 그 결과 시장 등급이 하향 조정될 경우 마이크론 투자자에게 절대적 측면과 상대적 측면 모두에서 뛰어난 위험 보상 제안이 제공됩니다.

The Data-Centric Revolution Is Here

When the oil conglomerate Shell (SHEL) stated that 'Data is the new Oil', one should take note.

석유 대기업 쉘(SHEL)이 '데이터가 새로운 석유다'라고 말할 때 주목해야 한다.

Data-centric computing is an emerging concept that has relevance in information architecture and data center design. It describes an information system where data is stored independently of the applications. This is a radical shift in information systems that will be needed to address organizational needs for storing, retrieving, moving and processing exponentially growing data sets.

데이터 중심 컴퓨팅은 정보 아키텍처 및 데이터 센터 설계와 관련된 새로운 개념입니다.

데이터가 응용 프로그램과 독립적으로 저장되는 정보 시스템을 설명합니다.

이는 기하급수적으로 증가하는 데이터를 저장, 검색, 이동 및 처리해야 하는 조직의 요구 사항을 해결하는데

필요한 정보 시스템의 급격한 변화입니다.

Consumer Applications

4G TO 5G (Mobile Business Unit Update: Winning in the 5G Era)

CEO Mehrotra summarised the overall demand picture thus at a Technology Conference in December '21:

마이크론 CEO Mehrotra는 '21년 12월 기술 컨퍼런스에서 전반적인 수요 상황을 요약하여 다음과 같이 말했습니다.

Micron Technology's (MU) CEO Sanjay Mehrotra Presents at Credit Suisse 25th Annual Technology Conference (Transcript)

Micron Technology, Inc. (NASDAQ:NASDAQ:MU) Credit Suisse 25th Annual Technology Conference Call December 1, 2021 11:20 AM ET Company Participants Sanjay Mehrotra – Chief Executive Officer...

seekingalpha.com

In mobile 5G, the trend's from 500 million units this year going to 700 million-plus in calendar year 2022.

The secular trends for memory and storage across the data center to the smartphones continue to be one of increasing content and strong demand drivers.

On the automotive side, we have talked in the past that supply chain has been hand-to-mouth.

And so overall, the supply chain shortages are improving, leading to improvements in the industry,

but these will continue to gradually improve throughout calendar year 2022.

모바일 5G스마트폰은 지난해 5억 대 판매에서 2022년에는 7억 대 이상으로 증가하는 추세입니다.

데이터 센터 전반에서 스마트폰에 이르는 메모리 및 스토리지에 대한 지속적 추세는

계속해서 증가하는 장착량과 강력한 수요 동인 중 하나입니다.

자동차 측면에서 우리는 과거에 공급망이 입에서 입으로 입으로 옮겨왔다고 이야기했습니다.

따라서 전반적으로 공급망 부족이 개선되어 업계가 개선되지만 2022년 내내 점진적으로 개선될 것입니다.

Mehrotra's tone appeared cautious regarding automotive demand (probably due to well-publicised shortages in microchips then), but it's likely to develop into Micron's largest growth vector.

Given Above, Why Hasn't Pricing Of Digital Memory Improved?

The obvious negation of the rosy outlook depicted above is that ASPs (Average Selling Prices) of both DRAM and NAND have been weak since March '21. Why should these secular tailwinds take effect in the future, if they didn't impact the recent past?

이런 장미빛 전망에도 불구하고 디램과 낸드 가격이 못오른 이유.

위에 묘사된 장밋빛 전망에 대한 명백한 부정은 '21년 3월 이후 DRAM과 NAND의 ASP(Average Selling Price)가

약세를 보였다는 것입니다. 최근의 과거에 영향을 미치지 않았다면 이러한 세속적인 순풍이

미래에 영향을 미쳐야 하는 이유는 무엇입니까?

The answer to that very valid question is a long convoluted one, but can summarised thus:

매우 타당한 질문에 대한 답변은 길고 복잡하지만 다음과 같이 요약할 수 있습니다.

- COVID-19 spikes in China and the draconian lockdowns, in addition to the ongoing Russian invasion of Ukraine created (and continues to create) enough economic uncertainty to taint global demand.

- 진행 중인 러시아의 우크라이나 침공에 더해 중국의 COVID-19 급증과 가혹한 봉쇄는 글로벌 수요를 오염시키기에 충분한 경제적 불확실성을 야기했습니다.

- As a case in point, worldwide smartphone shipments fell 11% YOY for the first quarter of 2022.

- 2022년1분기 중국의 코로나 발생과 우크라이나 전쟁으로 글로벌 스마트폰 출하량이 전년동기대비 11% 감소.

- COVID-19 imposed lockdowns created shortages for a myriad of sub-components essential for a range of consumer products. It was a chronic microcontroller shortage that induced both General Motors and Ford to suspend entire assembly lines due to the absence of a few chips.

- 코로나 사태로 지역 봉쇄가 이루어져 제품 생산에 필수적인 다양한 부품 공급이 부족해졌다.

- Note the shortages of older node microchips are still very much with us. It was only last Friday the NXP Semiconductor's CEO (NXPI) said that his company can sell every microcontroller to the automotive industry it can make; output will be constrained by supplier inputs (in this case substrates from Shanghai) until 2024 at least.

- 구식 공정의 마이크로칩들이 아직도 많이 부족하다는 것을 주목하라.

- 지난 금요일 자동차용 반도체 생산업체인 NXP는 상하이 봉쇄로 반도체 기판이 부족한 것과 같이,

- 반도체 생산에 제약이 있다고하면서 이런 상태가 적어도 2024년까지 계속될 것으로 보았다.

Yet, it's precisely this coiled spring of demand that will be released once the spate of lockdowns in China

and geopolitical tensions in Ukraine subside.

이렇게 스프링이 감기듯 억제된 수요는 일단 중국의 코로나 봉쇄와 우크라이나의 지정학적 문제가 해결되면

풀릴 것이다.

The Emergence Of An Oligopoly

Two decades (1997-2017) depict an industry rife with innovation and a vicious struggle for survival by numerous suppliers, each vying to secure a place in the future.

Quantum leaps in all aspects of memory design and manufacturing permitted massive cost improvements every year…the rate of technological progress was so rapid that if a supplier couldn't get its inventory out the door in a given quarter, it was virtually worthless in the next, because some other supplier that had kept pace with the digital beat offered a superior product at a lower price.

Natural selection was vicious, few survived. The consolidation in DRAM has been extreme, where three players have emerged to supply 97% of the global DRAM ($60bn pa), displacing a motley crew who represented about 25% of the market in 2008.

But another law began to emerge in the digital jungle: the law of diminishing productivity. In the early stages of a product lifecycle, the cost improvements were massive, but later, constraints in manufacturing, design and even the natural laws of material physics led to smaller and less frequent improvements.

The three global DRAM suppliers estimate the current rate of improvement in cost/gigabyte is 5% pa, whereas 40% quantum leaps (both in cost and storage density) were the norm a decade ago. Furthermore, the capital investment necessary for that marginal improvement has soared, as the complexity of squeezing yet another kilobyte of data into a nano-metre of wafer that's already three-stories high has deepened.

Well, that tale brings us to today, arguably the Golden of Memory, where a handful of players in both DRAM and NAND are finally in a position to capitalise on the enormous legacy investment.

A critical issue is the longer life of inventory as we enter the age of slower rate of marginal improvement. An important issue, still unacknowledged by investors, is that the corollary of a slower rate of cost improvements is a longer inventory shelf-life.

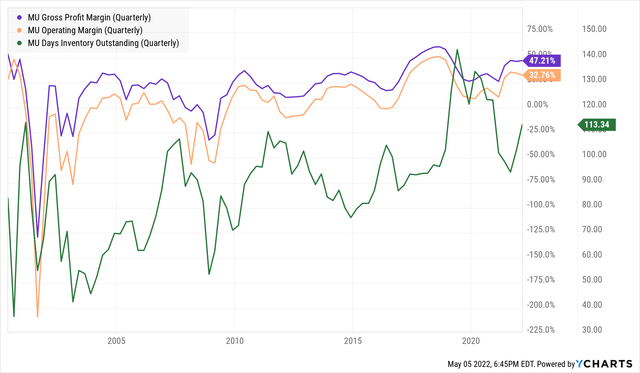

Micron inventory and margins (ycharts.com)

Note that anytime inventory exceeded 80 days (2001, 2007, 2012), Micron would incur a dramatic fall in operating margins, as it dumped the obsolete inventory.

This has changed dramatically in the last five years; the graph shows inventory days rose as high as 130-145 days in 2019/20, and yet Micron remained profitable.

The above graph offers vital support to my thesis: the lower pace of technology improvements will enable suppliers to be far more rational in pricing - there is no longer a need to slash prices of DRAM/NAND, for that inventory has a longer and more predictable shelf life. In addition, the remaining suppliers, now a mere handful, can plan expansions in supply to match demand, not to exceed it.

Inflation's Impact On Micron - Selling Price And Input Costs

Micron is far less dependent on rising input costs than most companies, thereby reducing operational risks beyond their control; this should not be underestimated by the investor, given the geopolitical uncertainties that run rampant today. Gross margins are much more a function of operational yield in a capital-intensive manufacturing process, as stated in the 2021 Annual Report. (page 23)

Our gross margins are dependent, in part, upon continuing decreases in per gigabit manufacturing costs achieved through improvements in our manufacturing processes.

Valuation

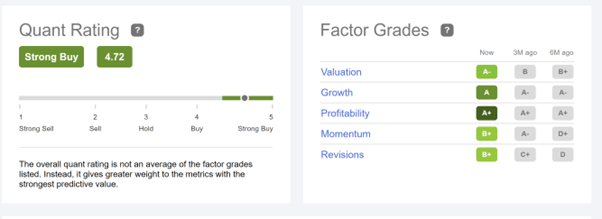

This year has been an unusually hazardous environment for investors, having to deal with company earnings hampered by supply chain disruptions as well as a stock market coming to grips with higher rates. Through the treacherous landscape, Micron posted a pedigree quarter in its February '22 results, demonstrating its resilience despite supply chain challenges emanating from COVID-19 lockdowns and shortages of noble gases (essential for lithographic etching in semiconductor manufacturing) sourced from Ukraine. Yet the share price was marked down severely, sliding 25% this year versus a market decline of 13%.

SA Quant Rating System gives Micron the highest recommendation (since 1 April '22) based on a comprehensive range of metrics.

SA QUANT OVERALL RATING (seekingalpha.com)

Price Target

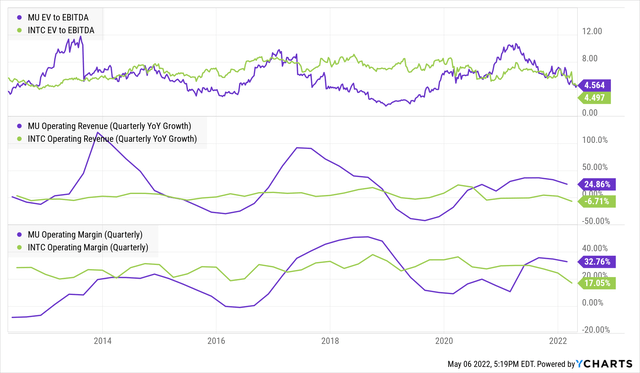

Outlined below is a comparison of Micron with two semiconductor manufacturers, Intel (INTC) and Taiwan Semiconductor Manufacturing Company (TSM). They face similar operating characteristics: being capital-intensive manufacturers striving for better yield; a significant R&D budget to remain technologically relevant; a need to grow revenue by innovation.

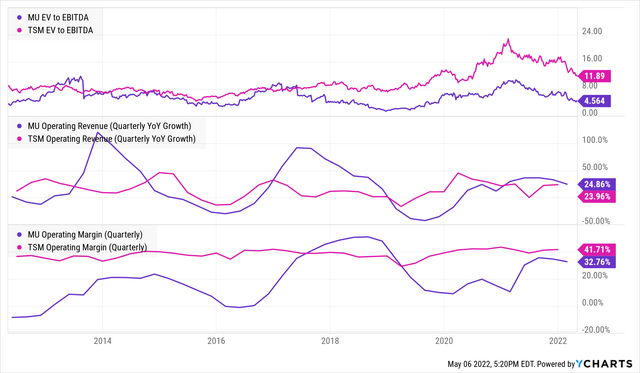

Micron is currently trading on an EV/EBITDA (TTM) ratio of 4.49X. Bewilderingly, this is even lower than Intel (INTC), whereas Micron boasts a far better record on margins and revenue growth over the last decade, as below.

MU VS INTC VALUATION RATIOS (ycharts)

Micron's track record bears more resemblance to Taiwan Semiconductor Manufacturing Company. Granted, TSM has demonstrated an unmatched operational excellence. The graph below shows investors have marked the Taiwanese company down this year, to reflect escalating tensions between China and Taiwan.

MU VS TSM VALUATION (ycharts.com)

As seen above, Micron's valuation (EV/EBITDA) stands at less than half that of TSM,

while the Taiwanese company faces material political risk that Micron doesn't share.

Once investors begin to digest Micron's transformation, the valuation rating is bound to rise. A primary target EV/EBITDA would be 10. I expect the ratio of Micron to rise further in due course to about 15.

But this will need to be verified; it will unfold in due course via a sustained rising trajectory in earnings.

Using consensus earnings of $12.73 (Aug 2023) as a proxy for EBITDA, this delivers a current price target $127.

Over the course of time, say the next 3 years, the market will begin to acknowledge Micron's pedigree, evidenced by a steady ascent in revenue, sustained margins and an upward trajectory in earnings.

In light of this scenario, I expect to hold Micron as a core holding in my portfolio.

The share price will likely rise in tandem with earnings.

In these uncertain inflation-prone times, Micron provides excellent upside potential with minimal risks

due to a highly depressed valuation.

It's critical to repeat Micron retains a rare privilege: the opportunity of pricing power.

Supply/demand dynamics have tilted in favour of the supplier;

Micron has far more control over its cost structure than a typical company.

This provides the investor a tangible measure of safety in a turbulent inflationary world.

'반도체-삼성전자-하이닉스-마이크론' 카테고리의 다른 글

| 디램의 타입, 디램의 사용처와 디램의 종류 (0) | 2022.05.10 |

|---|---|

| 퀄컴 사장은 메타버스가 큰 사업 기회라고 언급(2022.05.06) (0) | 2022.05.08 |

| 다시 찾아온 메모리 전성시대…성장세 비메모리의 2배(2022.05.06) (0) | 2022.05.08 |

| 중요-반도체와 클라우드의 강세가 마이크론에 의미하는 것(2022.05.06) (0) | 2022.05.06 |

| 마이크론은 20%이상 저평가 상태(2022.04.29) (0) | 2022.04.30 |