2022.07.29

요약:아마존웹서비스는 아마존의 한 섹터로 클라우드 컴퓨팅 즉 데이테센터를 운영하는 부문이다.

아마존의 2분기 영업이익은 33억달러였다.

아마존웹서비스에서 57억달러의 영업이익을 달성했으나 다른 부문에서 24억달러의 영업손실이 있었다.

순이익은 투자한회사 리비안의 손실 39억달러등을 포함하여 20억달러의 순손실을 입었다.

현재 아마존의 영업이익이 플러스인 것은 아마존웹서비스의 실적 덕분이다.

2022년 아마존웹서비스의 연간 영업이익은 224억달러로 예상.

아마존은 하반기에 아마존웹서비스의 투자액을 2배로 늘린다고 함.

Amazon Q2 Results: AWS Shines Once Again (NASDAQ:AMZN) | Seeking Alpha

Summary

- Amazon just reported its Q2 results, beating analyst expectations on revenue & exceeding the top end of management's guidance.

- 아마존의 2분기 매출은 시장 예상치를 상회.

- It also saw operating income at the high end of its guidance, entirely thanks to AWS.

- 아마존의 클라우드 플랫폼인 아마존웹서비스 덕분에 가이던스 상단의 영업이익을 달성.

- Amazon Web Services, or AWS, is Amazon’s cloud computing platform.

- It is the fastest growing segment of Amazon, boasting operating margins above 30% whilst achieving 33% YoY growth.

- 아마존웹서비스는 아마존의 부문중 가장 빠르게 성장하는 부문으로 연율 33%로 성장하면서

- 30%이상의 영업이익률을 자랑했다.

- AWS' revenue of $72 billion over the past 12 months has greatly improved Amazon's profitability,

- but it still has a huge opportunity ahead.

- 아마존웹서비스의 매출은 지난 12개월간 720억달러로 아마존 이익을 향상시켰지만,

- 아직도 미래에 거대한 기회를 가지고 있다.

Investment Thesis

I previously wrote about Amazon (NASDAQ:NASDAQ:AMZN) in an article entitled Amazon: AWS Is Brilliant, Everything Else Is Pretty Good, Too. I highlighted my belief that AWS should be the cornerstone of any investment thesis in Amazon, given that it's the clear industry leader, boasts impressive margins, is the fastest growing segment of Amazon, and CEO Andy Jassy actually founded the AWS division back in 2006.

2006년 아마존웹서비스 설립이래 아마존에서 가장 빠르게 성장하는 부문이다.

Amazon just reported Q2’22 results, and it's clear that the market was extremely pleased.

With that said, let’s take a look at how the company did, and if the investment thesis remains on track.

Earnings Overview

Starting with revenue, Amazon delivered an impressive beat against analysts' estimates whilst also coming in slightly above the top end of management’s guidance. Revenue for the quarter totaled $121.2B, with analysts expecting $119.2B & management guiding for between $116B and $121B. Given the difficult macroeconomic environment, this significant beat is a sure sign of Amazon's strength.

아마존은 시장예상치인 매출 1192억달러와 회사 전망치인1160-1210억달러를 상회하는 1212억달러의 매출을 달성했다.

어려운 거시경제 상황에서 시장예상치를 상회하는 아마존의 매출은 아마존의 강력함을 보여주었다.

아래 그래프의 노란선은 시장예상치를 나타낸다.

Investing.com / Amazon / Excel

Outlook for Q3 was also in line with analysts' estimates. The midpoint of management’s $125-$130B guidance was just above analysts' estimates of $127B, so another sign of strength despite a much more cautious consumer.

3분기 매출 예상치도 시장 예상치에 부합한다.

아마존의 3분기 매출 전망치 1250억-1300억달러의 중간값은 애널리스트 예상치 1270억달러보다 높다.

이는 더욱 조심스러워진 소비 심리에도 불구하고 아마존의 강력함의 증거이다.

Amazon also came in towards the top end of its operating income guidance of ($1.0B)-$4.0B, achieving ~$3.3B, and no prizes for guesses what the main contributor to this was. AWS delivered operating income of ~$5.7B, with Amazon's North America segment posting an operating loss of ~($0.6B) and the International segment posting a further loss of ~($1.8B). Once again, it’s AWS driving profitability.

아마존은 영업이익 전망치 상단인 33억달러의 영업이익을 달성했다.

아마존은 북미에서 6억달러정도, 국제 부문에서 18억달러의 손실을 입었으나

아마존웹서비스 57억달러의 영업이익을 달성하여 아마존 영업이익을 이끌었다.

1분기 영업이익은 37억달러, 2분기 영업이익은 33억달러이다.

Amazon / Excel

Amazon doesn’t give guidance on EPS, but it reported EPS of ($0.20) per share vs analysts' estimates of $0.13 per share. Amazon actually reported an overall net loss of ~($2B) in the quarter, but this does include a loss of ($3.9B) related to Amazon’s investment in Rivian Automotive (RIVN); basically, EPS is not a very useful metric since it is heavily skewed by the impact of Rivian's share price fluctuations.

아마존의 2분기 주당순이익은 0.20달러 순손실로 시장예상치 주당순이익 0.13달러를 하회했다.

2분기 순손실은 20억달러로 이는 투자한 전기차회사 리비안의 손실 39억달러가 포함된 것이다.

All in all, Amazon provided investors with a lot to smile about, and the market reacted appropriately. At the time of writing, shares in Amazon are up around 12%, and rightly so! This was a great quarter, and once again AWS stole the show.

대체로 아마존의 실적은 투자자들을 미소짓게했고 시장은 적절하게 반응하였다.

Diving Into AWS

As mentioned, AWS had another quarter where it was the main driver of profitability for Amazon.

In fact, over the past 12 months, AWS has been keeping Amazon’s operating profits in the green – with a staggering EBIT of $22.4B on revenues of $72.1B, boasting operating profit margins of ~31% over the past 12 months.

언급한대로 아마존웹서비스는 아마존 이익의 주요 부문이다.

실제로 지난 12개월간 아마존웹서비스는 아마존의 영업이익이 플러스를 유지하게 하였다.

지난 12개월간 매출 721억원, 영업이익률 31%, EBIT 224억달러를 달성했다.

EBIT(Earnings before interest and tax)는 이자와 법인세 차감전 이익으로 영업이익이다.

아래 그래프에서 회색 부분은 아마존웹서비가 아닌 부문의 영업이익이고

노란 부분은 아마존웹서비스 영업이익이다.

Amazon / Excel

Most impressive is the consistent growth of AWS. Q2 revenue was up 33% YoY (compared to the overall business which saw revenue growth of 7% YoY, or 3% Ex-AWS), and this is predominantly high-margin recurring revenue that Amazon can rely on for the foreseeable future - it is certainly not likely to be as volatile as the consumer-facing business.

가장 인상적인 것은 아마존웹서비스의 지속적인 성장이다.

2분기 매출은 전년 동기대비 33% 증가하였고(아마존 전체 매출은 동기간 7% 증가, 아마존웹서비스를 제외하면

3% 증가하였다)

아마존웹서비스 매출은 148억달러에서 197억달러로 33% 증가.

영업이익은 42억달러에서 57억달러로 36% 증가했다.

Amazon Q2'22 Webcast Slides

Given that AWS is Amazon’s crown jewel, investors should be looking for this segment to continue growing & becoming a more meaningful contributor to overall revenue.

Thankfully, this is already happening. As per the below graph, AWS is continuing to take up a greater share of Amazon’s revenue. It’s exciting to see the lower-margin consumer-facing side of Amazon start to be replaced by this high-margin, recurring revenue segment.

아래 그래프를 보면 아마존의 저네 매출에서 소비자 대면 매출 비중은 감소하고, 이를 아마존웹서비스 매출 비중이

대체하고 있다는 것을 볼수있다.

아마존웹서비스가 아마존 전체 매출에서 차지하는 비중이 2016년 9.9%에서

2022년에는 17.4%를 차지할 것으로 예상.

Amazon / Excel

If I haven’t got you excited enough about AWS, then I’ll turn to CFO Brian Olsavsky’s comments on the earnings call:

내가 아마존웹서비스에 대하여 당신을 흥분시키지 못했다면, 재무담당 사장이 말한 것을 소개하겠다.

AWS continues to grow at a fast pace, and we believe we are still in the early stages of enterprise and public sector adoption of the cloud. We see great opportunity to continue to make investments on behalf of AWS customers.

아마존웹서비스는 계속해서 매우 빠른 속도로 성장하고 있다.

우리는 아직 기업과 공공부문이 클라우드 채택의 초기 단계에 있다고 생각한다.

우리는 아마존웹서비스 고객들을 위하여 지속적으로 투자하는 커다란 기회를 보고 있다.

A $72B annual run rate, EBIT margins in excess of 30%, and still in the early stages of adoption? Wow.

Plus, cloud services is an industry where scale is everything & AWS held a 33% market share in Q1’22 according to Canalys, compared with 21% for Microsoft Azure (MSFT) and 8% for Google Cloud (GOOGL) (GOOG), the two closest competitors.

연간 720억 매출에 영업이익이 30%가 넘는데 아직 비지니스의 초기 단계에 있다면?

2022년1분기 글로벌 클라우드 서비스 점유율은 아마존웹서비스가 33%, 마이크로소프트 애저가 21%,

구글클라우드가 8%를 차지한다.

The ‘still in the early stages’ quote is backed up by insights from Facts and Factors, who expect the Cloud Computing Market to grow at a 15.8% CAGR from 2022 through to 2028.

클라우드컴퓨팅 시장은 2022년부터 2028년까지 연율 15.8%로 성장할 것이다.

I almost don’t care about the rest of Amazon – but, since it looks like it’ll be sticking around, let’s take a quick look at the non-AWS side.

Lack of Profitability Elsewhere

Perhaps the least surprising part of this earning’s report were the losses elsewhere in Amazon. Inflation is hitting everything, and even Amazon can’t escape the pressures put on fuel, energy, and transportation costs across its enormous delivery network.

On the plus side, management are dealing with these issues & making decisions that should leave Amazon in an even stronger position when inflation eases up & the macroeconomic environment starts to return to normal. CFO Olsavsky said:

Last quarter, I discussed several cost pressures facing our worldwide stores business; inflationary costs, fulfillment network productivity, and fixed cost deleverage. Recall that these amounted to approximately $6 billion of incremental costs in Q1 when compared to Q1 2021. We've made solid progress in reducing these costs.

For the second quarter, incremental costs were in line with our expectations at approximately $4 billion when compared to Q2 2021. Inflationary pressures remained at elevated levels in Q2, similar to what we saw in Q1. These include pressures from higher fuel, trucking, air and ocean shipping rates, which we expect will continue into Q3.

We made strides to improve fulfillment network productivity in Q2. Staffing levels were more in line with rising Q2 demand, and we saw better optimization of our fulfillment network. On the transportation side, we've continued to improve delivery route density and improve package deliveries per hour. We are encouraged by the progress during the quarter and see opportunity to further improve in the second half of the year.

Amazon Q2'22 Webcast Slides

The company continues to expand into wider consumer offerings, across an incredibly broad range of verticals. A few examples of recent moves include the expansion of its checkout-free Amazon Fresh stores, the introduction of a Small Business Badge to help customers identify small businesses selling on Amazon, and the launch of Virtual Try-On for Shoes where customers can virtually try on thousands of different items of footwear.

Honestly, there’s too many new products, services, and solutions being pushed out to cover in one article – so I'll leave you with this; Amazon is a company that truly has innovation in its blood. It created AWS whilst being an ecommerce business, who knows what world-changing product or service it is capable of creating next. Clearly, this latest quarter demonstrates that innovative ideas are continuing to be rolled out, so who knows when Amazon might hit the jackpot again.

Amazon Is Getting Stronger

I always invest in companies with the intention of holding them for years, if not decades. But businesses are constantly changing and evolving, so it’s important to look at the results every quarter to ensure that the company is continuing to perform.

Given that my thesis for Amazon revolves around AWS, I will focus on that side of the business – and I think it’s clear that AWS is just getting stronger and stronger. It is achieving revenue growth in excess of 30% during a tough macroeconomic environment, despite already having trailing 12-month revenues of $72B. With every new customer that is added, AWS grows stronger through its switching costs & the ability to land and expand, and it shows no signs of letting up on this growth.

Amazon is also very well diversified, with the B2B offering of AWS making up for weaker profitability and slowing growth in the consumer-facing division. Amazon is still going all in when it comes to innovation & expansion on the consumer side, but once they decide to flip the switch for profitability & the recession passes, Amazon will have two behemoth businesses operating under one impressive umbrella.

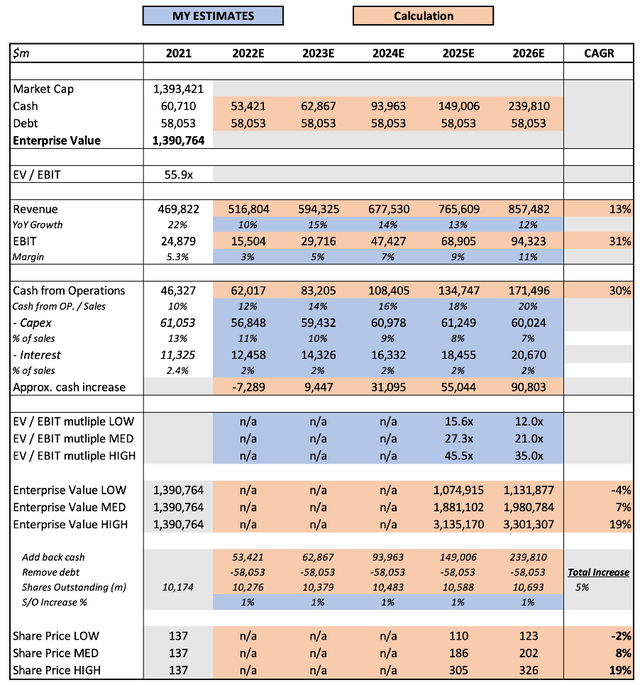

Valuation

As with all high growth, innovative companies, valuation is tough. I believe that my approach will give me an idea about whether Amazon is insanely overvalued or undervalued, but valuation is the final thing I look at - the quality of the business itself is far more important in the long run.

Amazon / Excel

The full breakdown behind my revenue model assumptions can be found in my previous article. I usually update different aspects based on the latest quarterly earnings, but actually I think my assumptions used before these results still apply – I think 10% YoY growth on 3% EBIT margins remains an appropriately conservative assumption. Given this, my only updates will be to the enterprise value inputs.

Put all that together, and I can see Amazon shares achieving an 8% CAGR through to 2026 in my mid-range scenario. On reflection, I believe that Amazon will merit an EV/EBIT multiple closer to the 35x in my high-case scenario, resulting in a 19% CAGR, if AWS continues on its current trajectory.

Investment Thesis: Strengthening

For me, this quarter was yet another sign that the Amazon story is turning more into the AWS story – and I like that, a lot. AWS remained robust in an environment where many businesses have struggled, and the fact that management believes cloud adoption to still be in its early innings is music to my ears.

Amazon Q2 Earnings: Key Segments Are Producing (NASDAQ:AMZN) | Seeking Alpha

Summary

- AWS sales are up 33% year-over-year.

- Amazon is taking legal action against the admins of more than 10,000 Facebook groups to crack down on fraudulent reviews.

- Amazon advertising is very measurable as it is at the point where customers have their credit cards out to make purchases.

Introduction

My thesis is that the June 2022 quarter was excellent for Amazon's (NASDAQ:AMZN) key segments. Per the 2Q22 release, the 3 most important segments, AWS, third-party ("3P") and advertising saw Y/Y sales increases of 33%, 13% excluding F/X and 21% excluding F/X. Their Q/Q sales went up 7%, 8% and 11%, respectively. Y/Y sales for the first-party ("1P") segment were down 4% but this lower margin segment is less meaningful to the bottom line.

As CFO Brian Olsavsky said in the 2Q22 call, the AWS segment can be resilient by showing the value it provides as we hit a potential rough patch in the economy. On a relative basis, the numbers are showing that Apple's (AAPL) privacy changes hurt Shopify (SHOP) merchants who advertise on Meta (META) much more than Amazon 3P merchants who use Amazon advertising.

Amazon Q2 Sales By Segment

The quarterly sales increases for AWS, 3P and advertising stand out below:

segment sales (2Q22 release)

AWS

Unlike the commerce segments, we see little in the way of November and December seasonality with AWS. However, CFO Olsavsky reminds us in the 2Q22 call that the AWS segment sees a seasonal Q2 step-up in stock-based compensation such that the operating income margin is suppressed:

AWS operating income was $5.7 billion in Q2. As a reminder, this includes a portion of our seasonal Q2 step-up in stock-based compensation expense. AWS results included a greater mix of these costs, reflecting wage inflation in high-demand areas, including engineers and other tech workers as well as increasing technology infrastructure investment to support long-term growth.

Seeing as operating income for AWS went down from $6,518 million on sales of $18,441 million in 1Q22 to $5,715 million on sales of $19,739 million in 2Q22, Doug Anmuth of JPMorgan Chase asked about the AWS operating margin declining from 35% in 1Q22 down to 29% in 2Q22. CFO Olsavsky didn't seem concerned about the quarterly differences. He noted that the AWS margins dropped sequentially and he said the margin rate in that business is going to fluctuate. He cited factors like the sales force, new regions and infrastructure capacity which can be offset by infrastructure efficiency gains. His comments about the progress with the customer base and the increasingly long commitments are encouraging. His comments about resiliency can partially mollify investors if we find ourselves enduring an extended recession:

And you said that the revenue pattern can be - and the margin on that revenue can fluctuate quite a bit quarter-to-quarter. But [we] see a lot of strength in the business right now. We're very happy with the growth rate. We're happy with the adoption of the cloud. As you hit a potential rough patch in the economy, I think the last time we saw this was back in 2008-ish, and we started to draw lessons from that, but we did notice that it did help our cloud business at the time because, again, when you're trying to launch a new product or service and you have to face with building your own data center and getting capital for a data center and building it yourself or moving to the cloud and essentially buying incremental infrastructure capacity, cloud computing really shows its value.

Again, the crucial AWS segment saw sales go up from $18,441 million in 1Q22 to $19,739 million in 2Q22. This segment's quarterly operating income more than offset negative quarterly operating income from North American and International:

$5,715 million AWS segment

$(627) million North America segment

$(1,771) million International segment

-----------

$3,317 million total quarterly operating income

Looking at operating income by segment from a trailing-twelve-month ("TTM") perspective, we again see that AWS is key:

$22,409 million AWS segment

$(1,521) million North America segment

$(5,590) million International segment

-----------------------

$15,298 million total TTM operating income

Last quarter I used a multiple on the annualized operating income for a valuation range. The AWS segment is not worth less just because this quarter's operating income is lower than last quarter's due to a larger amount of investments in the income statement lines. This shows one of the fallacies when we oversimplify things with basic yardstick shortcuts. The annual sales run rate based on the 2Q22 figure of $19,739 million is $78,956 million. Using the more steady-state operating margin of 35% that we saw in 1Q22 as opposed to the more growth oriented margin of 29% from 2Q22, we get a steady-state annualized operating income figure of nearly $28 billion. Given the fact that the cloud business is resilient even in times of inflation, I think the lower end of this range has an elevated floor. Applying a multiple of 23 to 25x gives us a valuation range of $644 billion to $700 billion.

3P

It's nice to read in the 2Q22 release that Amazon is taking substantial steps to protect merchants and customers from fraudulent reviews. Filing legal action against the admins of more than 10,000 Facebook groups is a serious and necessary endeavor. Combining this legal action along with Amazon's improving AI should help improve the integrity of their 3P review system:

Amazon filed legal action against the administrators of more than 10,000 Facebook groups that attempt to orchestrate fake reviews on Amazon in exchange for money or free products. These groups are set up to recruit individuals willing to post incentivized and misleading reviews on Amazon's stores in the U.S., the UK, Germany, France, Italy, Spain, and Japan. Amazon will use information discovered from this legal action to identify bad actors and remove fake reviews commissioned by these fraudsters that haven't already been detected by Amazon's advanced technology, expert investigators, and continuous monitoring.

Given the way the 3P and ad segments are putting up solid sales numbers in these difficult times, I believe the multiplier numbers in my last Amazon article were a bit pessimistic and I'm now using more optimistic ranges of 16 to 18x for 3P and 17 to 20x for ads [3P was 14 to 15x and ads were 14 to 16x]. TTM sales for the 3P segment are $107.3 billion and the operating income is $21.5 billion if we use a steady-state margin of 20%. Using a multiple of 16 to 18x gives us a valuation range of roughly $345 to $387 billion.

Advertising

Amazon is advantaged in the advertising funnel as they are at the point where customers are ready to make a purchase. This makes things much clearer from a measurement perspective, especially in today's environment where Apple has made privacy changes that make measurement harder for other forms of advertisements that are higher up in the funnel. CFO Olsavsky explains this in the 2Q22 call:

I'll just add a little more on advertising because you're probably wondering again about softness - potential for softness in that or macroeconomic factors. Right now, we still see strong advertising growth. Again, it's got to be a positive both for the customer and for the brand. I think our advantage is that we have highly efficient advertising. People are advertising at the point where customers have their credit cards out and are ready to make a purchase. It's also very measurable.

Another problem with Apple's privacy changes is that it now takes advertisers longer to receive campaign metrics such that timely adjustments are more difficult. The 2Q22 release explains how Amazon's ad ecosystem is advantaged as it delivers hourly campaign metrics:

Amazon Ads launched Amazon Marketing Stream (Beta), a product that automatically delivers hourly Sponsored Products campaign metrics to advertisers or agencies through the Amazon Ads API. The Stream provides near real time performance insights to enable more effective campaign optimization, more agility in responding to campaign changes, and increased operational efficiency to help drive business growth for advertisers.

Advertising TTM sales through June were $33,962 million. This implies an operating income of $15.3 billion if we use a steady-state margin of 45%. Using a multiplier of 17 to 20x gives us a valuation range of about $260 billion to $306 billion.

Additional Commerce Components

Despite the fact that the 3P segment has about double the GMV of the 1P segment, the 3P sales are only the take part of the GMV whereas the 1P sales capture everything. As such, the reported sales figure for the 1P segment is higher than the figure for the 3P segment.

I like to Amazon's 1P and 3P GMV along with the GMV of other companies to put things in perspective:

GMV (author's spreadsheet)

Q/Q sales for 1P were down but this segment is much less meaningful than 3P despite the higher reported sales figures. Amazon 1P TTM sales through June 2022 were $218,001 million and the implied steady-state operating income is $15.3 billion if we use a 7% margin. I think this segment is worth 10x the steady-state operating income which is about $150 to $155 billion.

I think the physical stores segment is worth about $10 billion and I assign a valuation of $0 to the subscription and "other" segments.

Other Considerations

Amazon continues to expand into other areas like healthcare and delivery. The One Medical telehealth acquisition announcement is a positive sign on the healthcare side.

AMZN Stock: Valuation Summary

Like other tech companies, Amazon over-hired during the covid pandemic but they're making corrections and their employee headcount has gone down nearly 100,000 from 1,622,000 in 1Q22 to 1,523,000 in 2Q22.

Consolidated 2Q22 sales were $121.2 billion and the 3Q22 guidance says consolidated sales should be between $125 and $130 billion which is growth of 13% to 17% over 3Q21. This guidance anticipates an F/X hit of 390 basis points. Rather than focusing on the consolidated sales, it is becoming increasingly important for investors to look at these disparate segments separately. For example, I'd rather see consolidated 3Q22 sales of $125 billion than $126 billion if the $125 billion total is solely from increases in 3P and AWS whereas the $126 billion is solely from an increase in 1P.

Here is my valuation summary:

$644 to $700 billion AWS

$345 to $387 billion 3P

$260 to $306 billion Advertising

$160 to $165 billion Additional Commerce

$0 to $25 billion Other Considerations

--------------

$1,409 to $1,583 billion

The 2Q22 10-Q shows 10,187,554,818 shares outstanding as of July 20th. Multiplying this by the July 29th share price of $134.95 gives us a market cap of $1,375 billion. The enterprise value is about $64 billion more than the market cap, seeing as we have $58.1 billion in long-term debt and $66.5 billion in long-term lease liabilities which are only partially offset by $37.5 billion in cash and $23.2 billion in marketable securities.

'마이크로소프트 -엔비디아-AMD-인텔' 카테고리의 다른 글

| 엔비디아, RTX 40 시리즈 그래픽카드 공개(2022.09.22) (0) | 2022.09.22 |

|---|---|

| 인텔, 플래시 사업 매각 이어 옵테인 메모리 철수 결정(2022.07.29) (0) | 2022.07.31 |

| 인텔-AMD, DDR5 지원 CPU 대전 펼친다(2022.07.24) (0) | 2022.07.29 |

| 마이크로소프트 실적 발표(2022.07.27) (0) | 2022.07.27 |

| 하락장에서 사야할 반도체 성장주는 AMD(2022.07.02) (0) | 2022.07.03 |