2023.12.24

'세일즈포스'는 고객에게 클라우드 컴퓨팅 서비스를 제공하는 업체이다.

Return On Equity (ROE)-->자기자본 수익률

자기자본이익률 = 순이익 ÷ 자기자본

Salesforce, Inc.'s (NYSE:CRM) Stock Is Rallying But Financials Look Ambiguous: Will The Momentum Continue?

Salesforce, Inc. (NYSE:CRM) 주식은 상승세를 보이지만 재무상황은 모호해 보입니다: 이러한 흐름이 계속될까요?

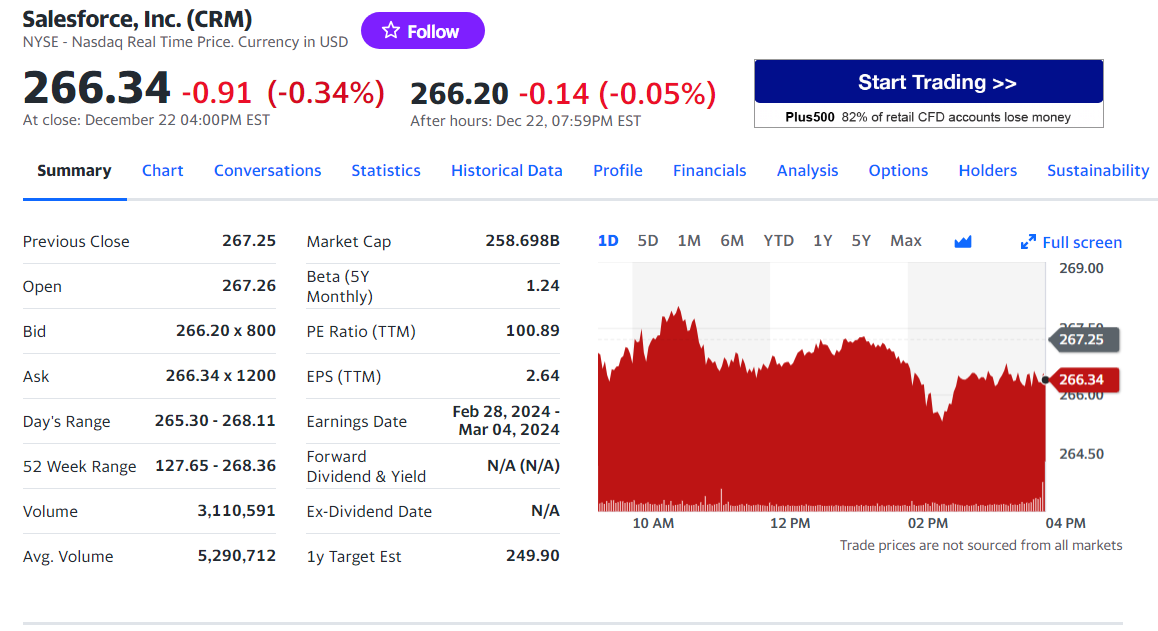

Salesforce's (NYSE:CRM) stock is up by a considerable 29% over the past three months. However, we wonder if the company's inconsistent financials would have any adverse impact on the current share price momentum. In this article, we decided to focus on Salesforce's ROE.

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. In short, ROE shows the profit each dollar generates with respect to its shareholder investments.

Check out our latest analysis for Salesforce

Salesforce의 주식은 지난 3개월 동안 상당한 29% 상승했습니다. 그러나 회사의 일관성 없는 재무 상황이 현재 주가 모멘텀에 부정적인 영향을 미칠 수 있는지 궁금해합니다. 이 기사에서는 Salesforce의 ROE에 초점을 맞추기로 결정했습니다.

ROE 또는 자기자본이익률은 회사가 주주로부터 받은 투자로부터 얼마나 효과적으로 수익을 창출할 수 있는지를 평가하는 유용한 도구입니다. 간단히 말해, ROE는 주주 투자에 대한 각 달러가 얼마나 많은 이익을 창출하는지를 보여줍니다.

Salesforce의 최신 분석 내용을 확인해보세요.

How To Calculate Return On Equity?

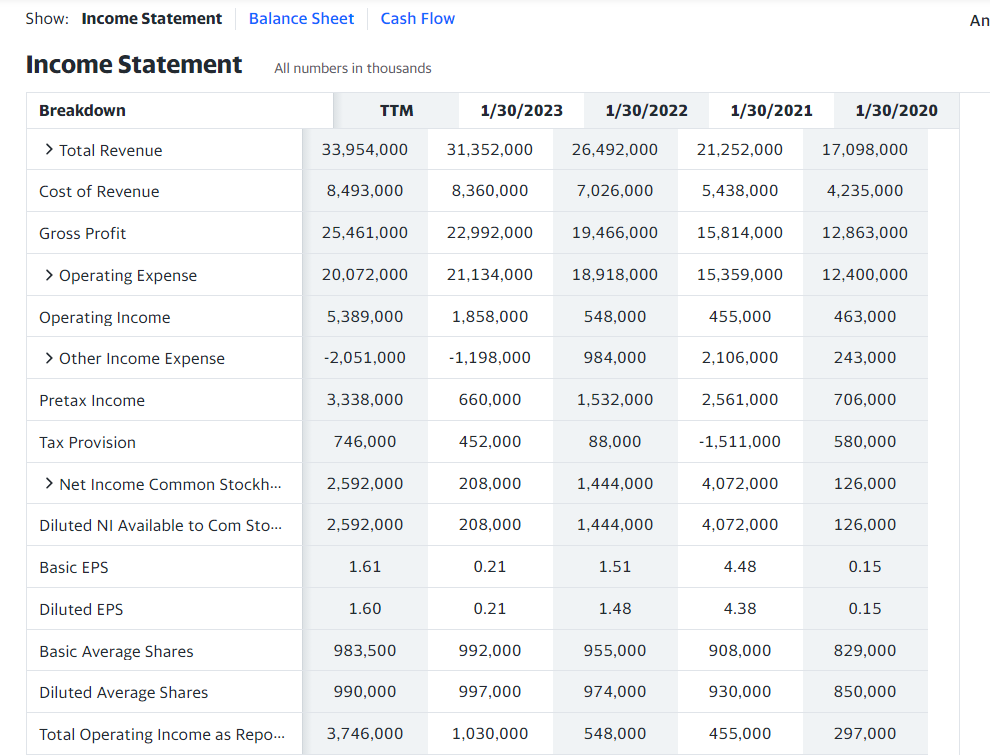

ROE can be calculated by using the formula: Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Salesforce is: 4.5% = US$2.6b ÷ US$58b (Based on the trailing twelve months to October 2023).

The 'return' is the income the business earned over the last year.

That means that for every $1 worth of shareholders' equity, the company generated $0.04 in profit.

Return On Equity (ROE)는 다음의 공식을 사용하여 계산될 수 있습니다:

자기자본이익률 = 순이익(연속적인 운영으로부터) ÷ 자기자본

따라서 위의 공식을 기반으로 계산한 Salesforce의 ROE는 다음과 같습니다:

4.5% = 26억 달러 ÷ 580억 달러 (2023년 10월까지의 지난 12개월 기준).

'수익'은 회사가 지난 1년 동안 벌어들인 순이익입니다.

이는 매 달러당 회사가 주주자본을 기준으로 0.04달러의 이익을 창출했음을 의미합니다.

What Has ROE Got To Do With Earnings Growth?

We have already established that ROE serves as an efficient

profit-generating gauge for a company's future earnings. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don’t share these attributes.

ROE가 어떻게 이익 성장과 관련이 있는지에 대해 이미 확인했습니다.

ROE는 회사의 미래 수익에 대한 효과적인 수익 생성 지표로 작용합니다.

이제 회사가 얼마나 많은 이익을 재투자하거나 "유지"하여 미래 성장을 위해 사용하는지를 평가해야 합니다.

이는 회사의 성장 잠재력에 대한 감을 얻게 해줍니다.

일반적으로 다른 조건이 동일할 때, 자기자본이익률(ROE)이 높고 이익 유지율이 높은 기업은 이러한 특성을 갖추지

않은 기업보다 더 높은 성장률을 가집니다.

Salesforce's Earnings Growth And 4.5% ROE

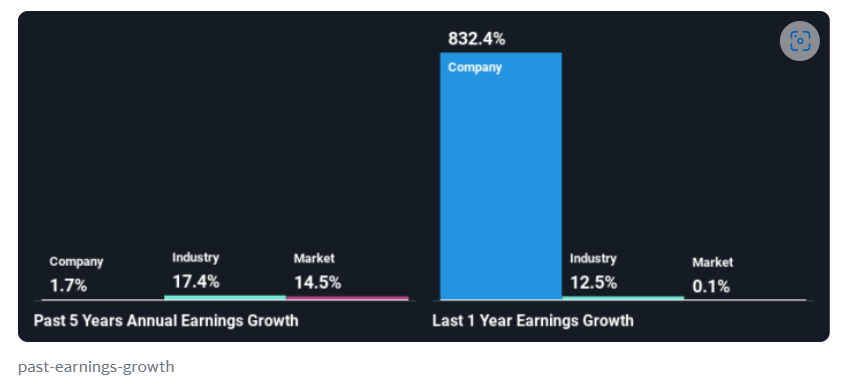

When you first look at it, Salesforce's ROE doesn't look that attractive. A quick further study shows that the company's ROE doesn't compare favorably to the industry average of 9.7% either.

Hence, the flat earnings seen by Salesforce over the past five years could probably be the result of it having a lower ROE. As a next step, we compared Salesforce's net income growth with the industry and were disappointed to see

that the company's growth is lower than the industry average growth of 17% in the same period.

Salesforce의 이익 성장과 4.5% ROE

첫눈에 보기에 Salesforce의 ROE는 그다지 매력적으로 보이지 않습니다. 간단한 추가 연구를 통해 회사의 ROE가 9.7%인 산업 평균과도 유리하게 비교되지 않음을 알 수 있습니다. 따라서 지난 5년간 Salesforce가 보인 수익의 부진은 아마도 더 낮은 ROE 때문일 수 있습니다.

다음 단계로, Salesforce의 순이익 성장을 산업과 비교해 보았는데, 회사의 성장이 동일 기간에 산업 평균 성장률인

17%보다 낮다는 점에 실망했습니다.

아래 도표는 왼쪽 3개는 지난 5년간 세일즈포스,산업과 전체 시장의 ROE를 비교한 것이고,

오른쪽 3개는 지난 1년간의 ROE를 비교한 것이다.

Earnings growth is a huge factor in stock valuation.

The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. Doing so will help them establish if the stock's future looks promising or ominous. What is CRM worth today? The intrinsic value infographic in our free research report helps visualize whether CRM is currently mispriced by the market.

이익 성장은 주식 가치 평가에서 매우 중요한 요소입니다.

투자자는 예상되는 이익의 성장 또는 감소가 시장에 반영되었는지를 확인해야 합니다.

이를 통해 주식의 미래가 유망하거나 불길한지를 판단할 수 있습니다. 현재 CRM(세일즈포스)의 가치는 얼마일까요?

저희의 무료 연구 보고서에 포함된 내재 가치 인포그래픽을 통해 CRM이 현재 시장에서 오가격 되었는지 시각적으로

확인할 수 있습니다.

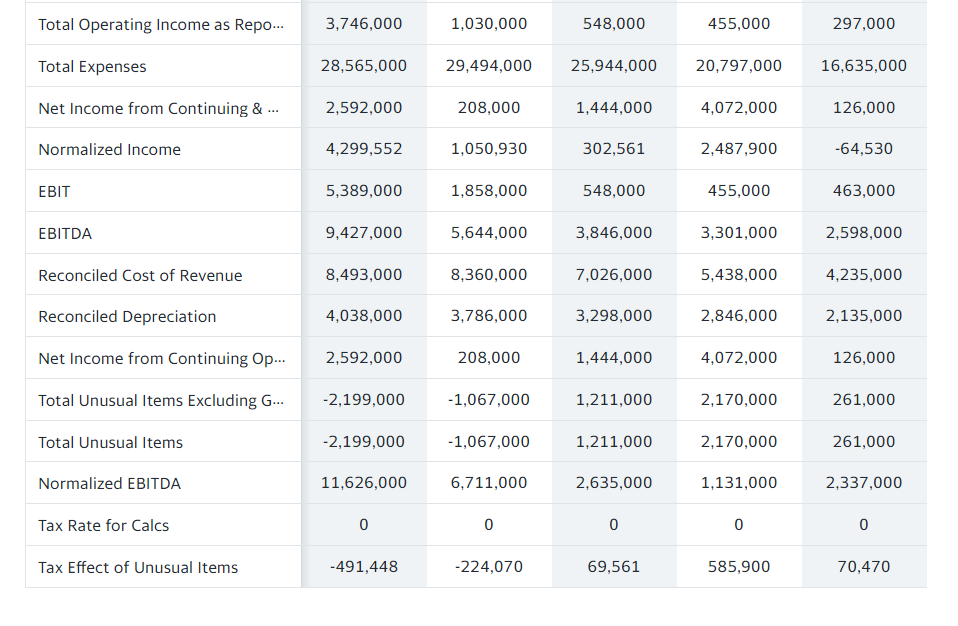

Is Salesforce Efficiently Re-investing Its Profits?

Salesforce doesn't pay any dividend, which means that it is retaining all of its earnings. This makes us question why the company is retaining so much of its profits and still generating almost no growth? It looks like there might be some other reasons to explain the lack in that respect. For example, the business could be in decline.

Salesforce는 어떤 배당금도 지급하지 않으므로 모든 이익을 재투자하고 있다는 것을 의미합니다. 이는 회사가 수익의 대부분을 유지하면서도 거의 성장을 창출하지 못하는 이유에 대해 의문을 제기합니다. 이러한 부족한 성장을 설명하기 위해 다른 이유가 있을 수 있습니다. 예를 들어, 비즈니스가 하락세에 있을 수도 있습니다.

Conclusion

On the whole, we feel that the performance shown by Salesforce can be open to many interpretations.

Even though it appears to be retaining most of its profits, given the low ROE, investors may not be benefitting from all that reinvestment after all. The low earnings growth suggests our theory correct. With that said, the latest industry analyst forecasts reveal that the company's earnings are expected to accelerate. To know more about the latest analysts predictions for the company, check out this visualization of analyst forecasts for the company.

결론

총평으로 보았을 때, Salesforce가 보여준 성과는 여러 해석이 가능할 것으로 보입니다.

수익 대부분을 유지하고 있는 것으로 보이지만 낮은 ROE로 인해 투자자들은 모든 재투자에서 혜택을 받지 못할 수

있습니다. 낮은 이익 성장은 우리의 이론을 지지합니다.

그렇지만 최신 산업 분석가의 예측에 따르면, 회사의 이익이 가속화될 것으로 예상됩니다.

회사에 대한 최신 산업 분석가의 예측을 더 알고 싶다면, 회사에 대한 분석가 예측의 시각화를 확인해보세요.

------------------------------------------

'반도체-삼성전자-하이닉스-마이크론' 카테고리의 다른 글

| AI폰 '5억 대' 새시장 개화에 모바일 D램 훈풍···작년 말부턴 '패닉바잉'도 [biz-플러스](2024.01.05) (1) | 2024.01.05 |

|---|---|

| 지진으로 일시적으로 중단된 일본의 실리콘 웨이퍼, MLCC, 및 반도체 시설은 관리 가능할 것으로 예상됨(2024.01.04) (2) | 2024.01.04 |

| 메모리, 온디바이스 AI 최대 수혜-KB증권(2023.12.12) (2) | 2023.12.22 |

| 마이크론 8.6% 상승(2023.12.20) (0) | 2023.12.22 |

| 산업 기업들이 인공지능으로부터 막대한 이익을 얻을 수 있을 것(2023.12.09) (0) | 2023.12.21 |