2024.09.13

Micron double downgraded to Underperform by BNP Paribas (yahoo.com)

BNP Paribas issued a double downgrade on Micron Technology (MU), now rating the stock at Underperform and slashing its price target to $67 from $140 per share.

프랑스 증권 회사인 BNP 파리바가 마이크론 테크놀로지(MU)에 대해 이중 강등 조치를 취하며, 주식을 이제 "언더퍼폼"(Underperform, 시장수익률 하회) 등급으로 평가하고 주가 목표를 주당 140달러에서 67달러로 대폭 하향 조정했습니다.

---------------------------------------

2024.09.15

(긴급)모건스탠리, SK하이닉스 투자의견 더블 하향! & 주목해야 할 기관 전략 변화! (youtube.com)

2분20초경--->모건스탠리는 2016년 HBM의 공급과잉과 낸드의 영업이익 3.6조 적자를 예상.

모건스탠리 하이닉스 2단계 하향. 시장 컨센서스(블룸버그)는 2026년 영업이익률이 39.2%이나

모건스탠리의 예상치는 3.0%로 나타났다.

The text from the image is:

"Hynix looks cheap on valuation with sustained competitiveness in HBM. However, we have concerns: DRAM pricing power is fading, NAND excesses are building, and our channel checks have led us to turn more cautious than the market on all commodity DRAM segments for 4Q. Underweight and Top Pick.

"하이닉스는 HBM에서 지속적인 경쟁력을 바탕으로 평가가 저렴해 보입니다. 그러나 우리는 우려를 가지고 있습니다: DRAM 가격 결정력이 약화되고 있고, NAND 잉여가 쌓이고 있으며, 우리의 채널 검토 결과 모든 상품 DRAM 세그먼트에 대해 4분기 시장보다 더 신중한 입장을 취하게 되었습니다. 비중 축소(하이닉스) 및 최우선(삼성전자) 추천.

Key Takeaways 주요 요약

1 We believe 4Q marks the peak of the cycle in terms of YoY rate of change.

1. 우리는 4분기가 연간 변동률의 정점을 표시한다고 믿습니다.

- Memory conditions are beginning to deteriorate. It will get tougher for revenue growth and margins from here as we move past late-cycle conditions.

- 메모리 상태가 악화되기 시작했습니다. 늦은 사이클 상태를 지나면서 여기서부터 수익 성장과 마진이 더 어려워질 것입니다.

- HBM - the biggest concern is that 'good' supply may be catching up with overstated demand in 2025 owing to fragmentation and peak rate of spending from AI.

- HBM - 가장 큰 우려는 '좋은' 공급이 2025년 AI의 분열과 지출 정점으로 인해 과대평가된 수요를 따라잡을 수 있다는 것입니다.

-With our Hynix downgrade, we are making a relative call within Technology. We prefer moving up to quality in Samsung and value-oriented end markets."

- 하이닉스의 하향 조정과 함께, 우리는 기술 내에서 상대적인 판단을 내리고 있습니다. 우리는 삼성과 가치 지향적인 최종 시장에서의 품질 향상을 선호합니다."

-----------------------------

2024.09.17

Is Micron Technology, Inc. (MU) a Good Big Tech Stock to Buy Now? (yahoo.com)

We recently compiled a list of the 13 Best Big Tech Stocks To Buy Now. In this article, we are going to take a look at where Micron Technology, Inc. (NASDAQ:MU) stands against the other big tech stocks.

우리는 최근에 지금 구매할 수 있는 최고의 13대 대형 기술 주식 목록을 작성했습니다. 이 기사에서는 Micron Technology, Inc. (NASDAQ:MU)가 다른 대형 기술 주식에 비해 어떤 위치에 있는지 살펴보겠습니다.

The State of Big Tech Right Now

Big tech has long been an immensely popular area to invest in when it comes to US stocks, and for good reason. Tech stocks, particularly those investing in AI and offering AI products, have been generating immense returns in 2024, with the second week of September bearing witness to their immense potential. This week, the S&P 500 and the Nasdaq Composite posted their best returns for the entire year, and many tech stocks were part of the faction that made this possible. As a result, there's a huge rise in the popularity of AI and tech stocks. This is in stark contrast to market opinions on AI stocks, particularly during the first week of September, when many were very concerned that we are in an AI hypecycle that is bound to wind down soon.

현재 대형 기술의 상태

대형 기술은 미국 주식에 투자할 때 오랫동안 매우 인기 있는 분야였으며 그럴만한 이유가 있습니다. 특히 AI에 투자하고 AI 제품을 제공하는 기술 주식은 2024년에 엄청난 수익을 창출하고 있으며, 9월 둘째 주는 그들의 엄청난 잠재력을 목격한 시간이었습니다. 이번 주에 S&P 500과 나스닥 종합지수는 올해 최고 수익률을 기록했으며, 많은 기술 주식들이 이를 가능하게 한 집단의 일부였습니다. 결과적으로 AI와 기술 주식의 인기가 크게 상승했습니다. 이는 9월 첫째 주에 AI 주식에 대한 시장 의견과 극명하게 대조되는데, 많은 사람들이 우리가 곧 수그러들 것으로 예상되는 AI 하이프 사이클에 있다고 매우 우려하고 있었습니다.

(주: hype cycle-->과대 선전 제품이나 기술이 깊은 실망으로 이어지는 일의 주기적 경험)

Altimeter Capital's CEO, Brad Gerstner, recently joined CNBC's "Closing Bell" to discuss trends shaping big tech right now. He noted that the pace of AI at present is faster than any other tech development seen before. He also added that many investors are starting to lean back into big tech ahead of the election. This development may be coming about because of the historical trend that suggests that stocks perform better in the months directly following a US election - in which case, it makes sense for investors to be piling into big tech and AI right now since that's a sure shot way to profit in the next few months.

알티미터 캐피탈의 CEO인 브래드 거스트너가 최근 CNBC의 "클로징 벨"에 출연하여 현재 대형 기술을 형성하고 있는 추세에 대해 논의했습니다. 그는 현재 AI의 발전 속도가 이전에 본 적 없는 기술 발전보다 빠르다고 지적했습니다. 또한 많은 투자자들이 선거를 앞두고 다시 대형 기술로 기울기 시작했다고 덧붙였습니다. 이러한 발전은 역사적 추세에 따라 미국 선거 직후 몇 달 동안 주식이 더 잘 수행된다는 것을 제안하기 때문에 발생할 수 있는데, 이 경우 투자자들이 다음 몇 달 동안 수익을 창출하는 확실한 방법으로 대형 기술과 AI에 몰리는 것이 합리적입니다.

How Is Big Tech Impacting Other Sectors?

A recent notable trend that people have begun to see because of the rise of big tech companies and the growing use of AI is a greater demand for power. Many major tech companies are beginning to require more energy, with the AWS-owner going as far as buying a nuclear-powered data center for $650 million recently.

대형 기술이 다른 분야에 미치는 영향은 어떻습니까?

최근 대형 기술 회사의 부상과 AI 사용의 증가로 인해 사람들이 눈치채기 시작한 주목할만한 추세는 전력 수요의 증가입니다. 많은 주요 기술 회사들이 더 많은 에너지를 필요로 하기 시작했으며, AWS 소유주는 최근 6억 5천만 달러에 핵동력 데이터 센터를 구입하기까지 했습니다.

The primary driving force for this rising demand is the need to develop AI. Many energy-conscious investors may see this new trend as a red flag for big tech. However, Jensen Huang has noted that while AI takes a ton of energy to train, once developed and trained, it will also help save energy. He particularly noted that AI is going to become so advanced through this development that it will eventually end up offering solutions that can change the way we use energy, making our operations endlessly more energy efficient.

이러한 수요 증가의 주요 원동력은 AI 개발의 필요성입니다. 에너지를 의식하는 많은 투자자들은 이 새로운 추세를 대형 기술에 대한 경고 신호로 볼 수 있습니다. 그러나 젠슨 황은 AI 훈련에 엄청난 에너지가 소모되지만, 개발되고 훈련된 후에는 에너지 절약에도 도움이 될 것이라고 지적했습니다. 그는 특히 AI가 이러한 개발을 통해 매우 발전하여 결국 에너지 사용 방식을 바꾸는 솔루션을 제공하게 될 것이며, 우리의 운영을 끝없이 더 에너지 효율적으로 만들 것이라고 강조했습니다.

With this in mind, big tech seems to be quite an interesting space to follow right now, especially in the days leading up to the US Presidential Elections. As such, we've compiled a list of the best big tech stocks to buy right now.

이를 염두에 두고 현재 대형 기술은 특히 미국 대통령 선거를 앞두고 매우 흥미로운 분야로 보입니다. 이에 따라 우리는 지금 구매할 수 있는 최고의 대형 기술 주식 목록을 작성했습니다.

Our Methodology

For our list below, we selected big-tech stocks with the highest numbers of hedge funds holding stakes in them during the second quarter and then ranked them based on this metric in ascending order.

Why are we interested in the stocks that hedge funds pile into? The reason is simple: our research has shown that we can outperform the market by imitating the top stock picks of the best hedge funds. Our quarterly newsletter’s strategy selects 14 small-cap and large-cap stocks every quarter and has returned 275% since May 2014, beating its benchmark by 150 percentage points. (see more details here).

우리의 방법론

아래 목록을 위해 우리는 2분기 동안 헤지펀드들이 지분을 보유하고 있는 대형 기술 주식 중에서 가장 많은 수의 헤지펀드가 보유한 주식을 선정하고, 이 지표에 따라 오름차순으로 순위를 매겼습니다.

왜 우리는 헤지펀드가 몰리는 주식에 관심을 가지나요? 그 이유는 간단합니다: 우리의 연구에 따르면 최고의 헤지펀드들의 최상위 주식 선택을 모방함으로써 시장을 능가할 수 있다는 것을 보여줍니다. 우리의 분기별 뉴스레터 전략은 매 분기마다 14개의 소형주와 대형주 주식을 선택하고, 2014년 5월 이후로 275%의 수익을 내어 벤치마크를 150 퍼센트포인트 뛰어넘었습니다. (자세한 내용은 여기에서 확인하세요).

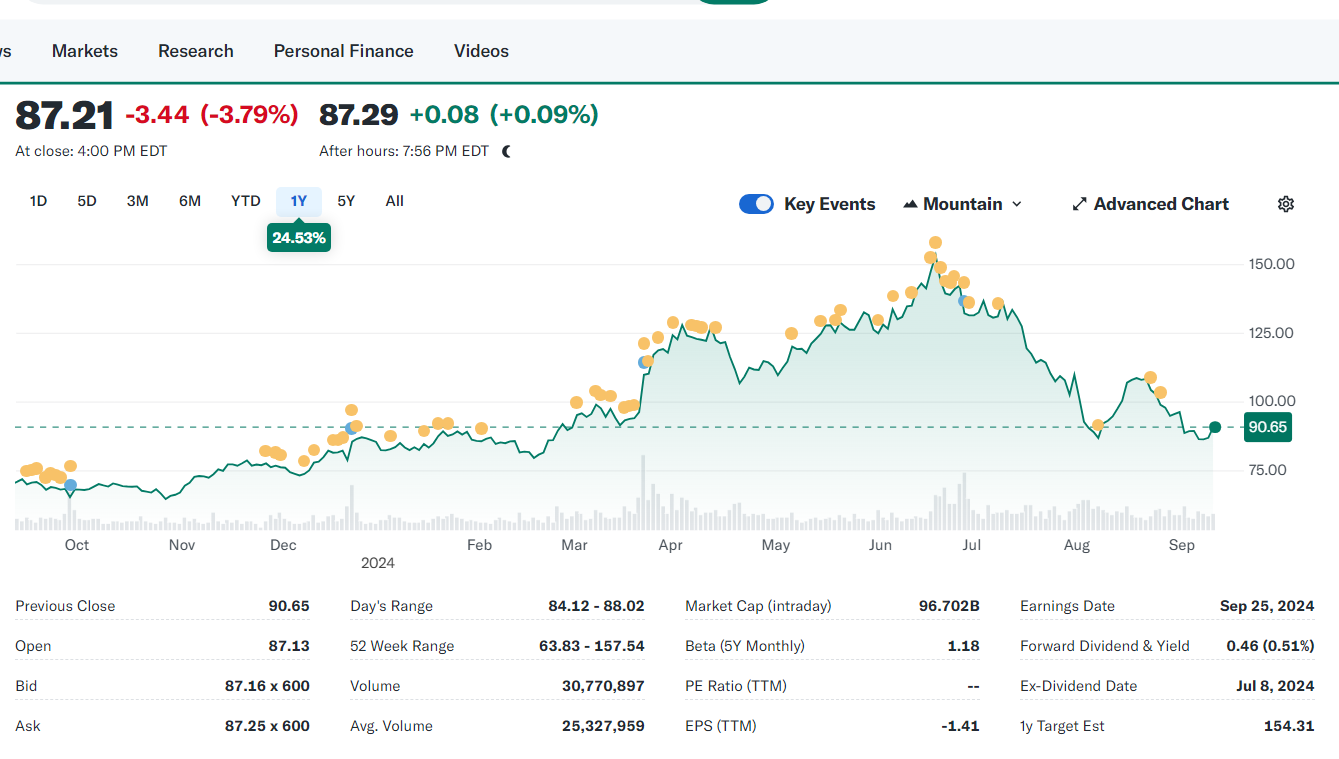

Micron Technology, Inc. (NASDAQ:MU)

Number of Hedge Fund Holders: 120

Micron Technology, Inc. (NASDAQ:MU) is another semiconductor company on our list. It offers memory and storage tech, such as DRAM semiconductor devices, among others.

Micron Technology, Inc. (NASDAQ:MU):헤지펀드 보유자 수: 120

Micron Technology, Inc. (NASDAQ:MU)는 우리 목록에 있는 또 다른 반도체 회사입니다. DRAM 반도체 장치 등 메모리 및 저장 기술을 제공합니다.

While Micron Technology, Inc. (NASDAQ:MU) has performed well in the fiscal third quarter of 2024 by generating revenue of $6.8 billion and operating cash flow of $2.5 billion, the stock is facing some challenges. Recently, it was hit by two price-target cuts from Raymond James and Exane BNP Paribas, both of which resulted in the stock decline during the second week of September.

Micron Technology, Inc. (NASDAQ:MU)는 2024년 회계 3분기에 68억 달러의 매출과 25억 달러의 운영 현금 흐름을 생성하며 잘 수행되었지만, 주식은 일부 도전에 직면하고 있습니다. 최근에 레이몬드 제임스와 엑산 뱅크 파리바의 두 차례 가격 목표 인하로 인해 9월 둘째 주 동안 주가가 하락했습니다.

Despite this, Micron Technology, Inc. (NASDAQ:MU) is still expected to benefit from industry tailwinds in smartphone, PC, and data center growth. The company has huge potential for growth, particularly because of robust AI demand that has propelled its sequential revenue growth to 17% and has allowed Micron Technology, Inc. (NASDAQ:MU) to gain market share in high-margin products such as High Bandwidth Memory.

Micron Technology, Inc. (NASDAQ:MU) was spotted in the 13F holdings of 120 hedge funds in the second quarter, with a total stake value of $5.2 billion.

그럼에도 불구하고 Micron Technology, Inc. (NASDAQ:MU)는 여전히 스마트폰, PC, 데이터 센터 성장과 같은 업계의 호재로부터 혜택을 받을 것으로 예상됩니다. 회사는 특히 강력한 AI 수요 덕분에 연속 매출 성장률이 17%에 이르렀고, 이는 Micron Technology, Inc. (NASDAQ:MU)가 고마진 제품인 High Bandwidth Memory 시장에서의 점유율을 높이는 데 도움을 주었습니다.

Micron Technology, Inc. (NASDAQ:MU)는 2분기에 120개 헤지펀드의 13F 보유 목록에서 발견되었으며, 총 지분 가치는 52억 달러에 달했습니다.

Overall MU ranks 9th on our list of the best big tech stocks to buy. While we acknowledge the potential of MU as an investment, we believe that AI stocks hold promise for delivering high returns and doing so within a shorter timeframe. If you are looking for an AI stock that is more promising than MU but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

전반적으로 MU는 구매할 최고의 대형 기술 주식 목록에서 9위를 차지하고 있습니다. MU가 투자로서의 잠재력을 인정하면서도, 우리는 AI 주식이 높은 수익을 제공하고 그것을 더 짧은 시간 내에 할 수 있는 가능성을 가지고 있다고 믿습니다. MU보다 유망하지만 수익의 5배 미만으로 거래되는 AI 주식을 찾고 계시다면, 가장 저렴한 AI 주식에 관한 우리의 보고서를 확인해 보세요.

'반도체-삼성전자-하이닉스-마이크론' 카테고리의 다른 글

| “SK하이닉스·삼성, HBM 영업이익률 53% 전망… 가격 반토막 나도 이익 구간”(2024.09.20) (0) | 2024.09.20 |

|---|---|

| "최고의 HBM4 출시"…삼성, TSMC와 맞손(2024.09.17) (1) | 2024.09.17 |

| SK하이닉스 (000660) ,D램 수요 양극화 심화 목표가 240,000원-KB증권(2024.09.13) (1) | 2024.09.13 |

| 반도체 주식들은 힘든 한 주를 보낸 가운데 엔비디아 주식 4% 하락(2024.09.07) (6) | 2024.09.07 |

| SK하이닉스 "HBM3E 품질테스트서 단 한번도 문제없이 통과"(2024.09.04) (1) | 2024.09.04 |