2021.12.13

DRAM ASP Expected to Decline by 8-13% QoQ in 1Q22 Owing to Seasonal Demand Downturn, Says TrendForce

2022년1분기 디램 계약 가격은 계절적 수요 감소로 8-13% 하락 예상

Regarding the shipment of various end products in 4Q21, the quarterly shipment of notebook computers is expected to remain about the same as 3Q21 figures, as prior component gaps were partially resolved during the quarter, according to TrendForce’s latest investigations.

2021년4분기 노트북 출하량은 노트북 부품 부족이 부분적으로 해소면서 3분기와 비슷할 것이다.

As such, since PC OEMs’ DRAM inventory has lowered by several weeks, TrendForce has also further reduced its forecast of DRAM price drops for 1Q22.

PC OEM 제조사들의 디램 재고도 몇주에 걸쳐 감소하면서, 트렌드포스는 2022년1분기 디램 가격 하락폭이

축소될 것으로 예상했다.

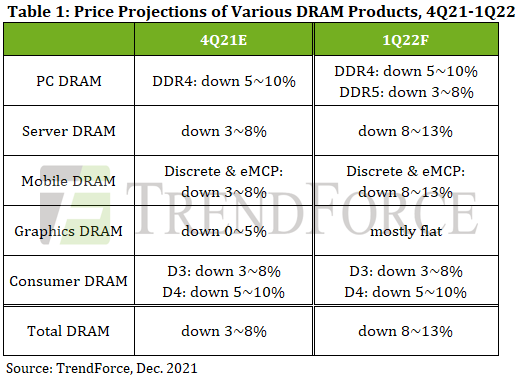

Even so, the overall demand for DRAM will still enter a cyclical downturn in 1Q22, during which DRAM ASP will also maintain a downward trajectory with an 8-13% QoQ decline. Whether this price drop will subside going forward will depend on how well suppliers manage their inventory pressure and how DRAM purchasers anticipate further price changes.

그럼에도 불구하고 DRAM에 대한 전반적인 수요는 2022년 1분기에도 여전히 주기적인 하락세에 진입할 것이며,

이 기간 동안 DRAM 평균판매 가격도 전분기 대비 8~13% 하락하는 하락세를 유지할 것입니다.

이러한 가격 하락이 앞으로 진정될지는 공급업체가 재고 압박을 얼마나 잘 관리하고 DRAM 구매자가 추가 가격 변동을 예상하는지에 달려 있습니다.

Decline in PC DRAM prices will narrow somewhat as PC OEMs reduce inventory

PC OEM 재고 축소로 PC DRAM 가격 하락폭 소폭 축소될 것이다.

Whereas demand for Chromebooks has noticeably slowed down, demand for consumer and commercial notebooks remains strong. Furthermore, certain components which were previously in shortage are starting to experience improved lead times.

크롬북에 대한 수요가 눈에 띄게 둔화된 반면, 소비자 및 상업용 노트북에 대한 수요는 여전히 강력합니다.

또한 이전에 부족했던 특정 구성 요소의 리드 타임이 개선되기 시작했습니다.

(리드타임: 주문후 인수까지 걸리는 시간)

Hence, quarterly shipment of notebook computers for 4Q21 will likely surpass earlier projections.

Looking ahead to 1Q22, not only will the demand side undergo a cyclical downturn, but the sufficiency ratio of PC DRAM will also surpass 3.0% following 4Q21’s high base period for comparison.

따라서 4Q21 노트북의 분기별 출하량은 당초 예상을 상회할 것으로 예상된다.

1Q22를 내다보면 수요측면이 주기적인 침체를 겪을 뿐만 아니라 PC DRAM의 충당율도 4Q21의 고 충당률에 이어

3.0%를 넘어설 것이다.(충당률: 공급 나누기 수요)

These factors will result in DRAM prices undergoing a noticeable decline, although PC OEMs will carry a lower inventory of DRAM in 1Q22 compared with 11-13 weeks of inventory in the previous quarter, thereby helping to curb the price drop of PC DRAM products.

이러한 요인들로 인해 DRAM 가격이 눈에 띄게 하락할 것이지만, PC OEM이 1분기에 DRAM 재고를 전 분기의

11-13주 재고에 비해 더 적게 보유하게 되어 PC DRAM 제품의 가격 하락을 억제하는 데 도움이 될 것입니다.

On the other hand, as mobile DRAM prices begin to drop, certain DRAM suppliers have begun reallocating some of their production capacities from mobile DRAM to PC DRAM. As a result, PC DRAM bit supply will likely undergo a corresponding increase in the short run.

한편, 모바일 DRAM 가격이 하락하기 시작하면서 일부 DRAM 공급업체들은 일부 생산 능력을 모바일 DRAM에서 PC DRAM으로 재배치하기 시작했습니다. 결과적으로, PC DRAM 비트 공급은 단기적으로 상응하는 증가를 겪을 것입니다.

In sum, although the above factors are able to provide some upside momentum that narrows the price drop of PC DRAM products, they are not enough to result in an upturn. In particular, DDR4 and DDR5 PC DRAM will experience QoQ declines of 5-10% and 3-8%, respectively, for 1Q22, although the latter product will not noticeably impact the overall PC DRAM ASP, as its penetration rate is still relatively low.

요컨대 위의 요인들이 PC DRAM 제품의 가격 하락폭을 좁힐 수 있는 상승 모멘텀을 제공할 수 있지만, 상승으로 이어지기에는 역부족이다. 특히 DDR4와 DDR5 PC DRAM은 2022년 1분기에 각각 5~10%, 3~8% 하락할 것으로 예상되지만, 후자의 제품은 보급률이 여전히 상대적으로 낮아 전체 PC DRAM ASP에 큰 영향을 미치지는 않을 것입니다.

Server DRAM prices will decrease by about 8-13% QoQ due to slowdown in procurement activities

Server DRAM 가격은 조달 활동 둔화로 전분기 대비 약 8~13% 하락할 것.

At the moment, CSPs and enterprise clients are carrying about 6-9 weeks and 8-10 weeks of server DRAM inventory, respectively. Although these levels represent a slight decline compared to the end of 3Q21, this decline will not substantially contribute to an increase in demand.

현재 클라우드 업체와 기업 고객들은 각각 약 6~9주 및 8~10주의 서버 DRAM 재고를 보유하고 있습니다.

이러한 수준은 3Q21 말과 비교하여 약간의 감소를 나타내지만 이러한 감소가 수요 증가에 크게 기여하지는

않을 것입니다.

Hence, server DRAM buyers will remain relatively conservative with regards to procurement activities before server DRAM prices reach a level that these buyers consider to be rock bottom. DRAM suppliers’ inventory of server DRAM, on the other hand, has been gradually rising in 1H21 owing to decreased demand.

따라서 서버 DRAM 가격이 구매자가 생각하는 바닥 수준에 도달하기 전에 서버 DRAM 구매자는 조달 활동에 대해

비교적 보수적인 태도를 유지할 것입니다.

반면 DRAM 공급업체의 서버 DRAM 재고는 수요 감소로 2021년 상반기에 점차 증가하여 왔다.

Furthermore, certain suppliers have ramped up their wafer input for server DRAM products, leading to an increased production. In addition, while both buyers and sellers have reached a consensus on the falling prices of server DRAM, supply chain-related component gap issues have become gradually resolved, meaning Tier 1 clients will lessen their server DRAM procurement in the upcoming off-season. As a result, suppliers will then be able to fulfill orders that were placed by Tier 2 clients but previously deferred because suppliers prioritized orders from Tier 1 clients. These Tier 2 client orders will provide some upside demand for server DRAM, which is a component that is in relative surplus compared to other components. TrendForce therefore expects server DRAM prices to decrease by 8-13% QoQ in 1Q22, during which server DRAM prices will experience the most severe declines compared to the other quarters in 2022.

Mobile DRAM prices will decline by about 8-13% QoQ in light of intensifying oversupply

Thanks to mobile DRAM suppliers’ aggressive sell-offs in 4Q21, smartphone brands still carry a high level of mobile DRAM inventory as of the end of 2021. Looking ahead to 1Q22, not only will the market welcome the arrival of the traditional off-season, but other issues with the supply of processor chip bundles and the impact of the COVID-19 pandemic will also result in a 10% QoQ drop in smartphone production for the quarter. Smartphone brands will become even more careful with respect to their procurement activities so as to avoid continually accumulating inventory. As smartphone brands revise down their production targets, market demand for mobile DRAM has therefore become weaker now than it was in 1H21, in turn exacerbating the oversupply situation, which is reflected in the persistently rising mobile DRAM inventory of DRAM suppliers. On the whole, the aforementioned issues of high inventory levels and oversupply situation will lead smartphone brands to further conservatize their production and procurement plans in 1Q22. Given that suppliers have suggested a sales strategy of negotiating for 4Q21 and 1Q22 prices collectively, and both buying and selling sides are confronted with inventory pressure, TrendForce thus forecasts an 8-13% QoQ decline in mobile DRAM prices for 1Q22.

Graphics DRAM prices will hold flat while demand improves and spot prices rises ahead of time

The application demand for graphics DRAM has been recovering noticeably in the recent period. Even so, it is worth pointing out that the graphics DRAM market is subject to a very high degree of fluctuations, and this situation is exacerbated by the introduction of the application demand from cryptocurrency mining in recent years. Because the values of cryptocurrencies can swing dramatically, GPU manufacturers such as NVIDIA and AMD have to constantly adjust their sales strategies and switch between bundling and de-bundling. In so doing, they are contributing to the rapid rise and fall of graphics DRAM demand. The graphics DRAM products that the three dominant suppliers are now producing belong to the GDDR6 series. The latest distribution of graphics DRAM output by chip type shows that suppliers are also gradually shifting their focus from 8Gb to 16Gb. Micron, in particular, is the most proactive in this transition. On the other hand, the mainstream graphics cards are still using 8Gb chips at this moment, so the demand for 8Gb graphics DRAM chips has actually increased. In addition, spot prices of both GDDR5 8Gb and GDDR6 8Gb chips have experienced huge price hikes. Due to this uptrend in spot prices, the difference between spot and contract prices is now negligible for graphics DRAM. Some spot transactions even reveal prices that are higher than contract prices. This latest development reflects the situation where buyers are more proactive in price negotiations. Prices of graphics DRAM products on the whole will be fairly constrained from declining further due to the rise in spot prices, the aforementioned demand turnaround, and Micron’s decision to scale back production for 8Gb chips. Taking these factors into account, TrendForce expects that the overall price trend will stay mostly flat.

DDR3 Consumer DRAM prices will drop by about 3-8% QoQ despite reduced supply

The demand for consumer (specialty) DRAM is expected to be relatively weak in 1Q22 due to the effect of the traditional off-season for consumer electronics. Also, demand will stay fairly depressed for TVs, which represent the leading source of in-home entertainment spending. This is because countries around the world will continue in their attempts to lift their pandemic-related restrictions. In addition to these factors, component gaps in the supply chain will still be a serious challenge for device manufacturers. As DRAM components are in excess supply relative to non-memory components, device manufacturers will be less willing to stock up on the former. Suppliers have been slow to scale back production for DDR3 products this year because prices of DDR3 products surged during the first half of the year. However, the downward pressure on prices has now become much more significant, so the two leading South Korean suppliers have taken the initiative to revise their product mix strategies. Hence, they will again transfer more of their mature wafer processing capacity from DDR3 products to CMOS image sensors or logic ICs. Turning to price trend, TrendForce points to the strong correlation between DDR4 consumer DRAM products and PC DRAM products. The latter were the first to experience a weakening of demand, and their prices have already made a downward turn in 4Q21. Looking ahead to 1Q22, contract prices of PC DRAM products will keep falling because of their significant difference with spot prices. This means that DDR4 consumer DRAM products will also suffer sliding prices for 1Q22 with QoQ declines reaching 5-10%. Looking at DDR3 consumer DRAM products, their prices will also drop even as their supply is shrinking. Contract prices of DDR3 2Gb chips are projected fall by 3-8% QoQ on average for 1Q22, whereas DDR3 4Gb chips are projected to register larger declines.

'메모리 관련 데이터' 카테고리의 다른 글

| 2021년 12월 메모리 고정가 (0) | 2022.01.01 |

|---|---|

| 낸드 메모리 공급 과잉 없다/디램 캐펙스(2021.12.17) (0) | 2021.12.17 |

| 2021년 11월 메모리 고정가 (0) | 2021.11.30 |

| 2021년 10월말 메모리 고정가 (0) | 2021.11.01 |

| 디램 가격은 2022년 수요 부족으로 하락 (0) | 2021.10.12 |