2022.01.05

Nvidia's Bull Run May Continue, But Micron Is A Better Pick | Seeking Alpha

Nvidia의 상승은 계속될 수 있지만 Micron이 더 나은 선택입니다.

Summary

- Nvidia and Micron are two semiconductor giants, but Nvidia has been a better performer and a more popular stock lately.

Nvidia와 Micron은 두 개의 반도체 거물이지만 최근에는 Nvidia가 더 나은 실적을 내고 더 인기 있는 주식이 되었습니다.

- Although Nvidia's semiconductors are irreplaceable, their past growth rate appears unsustainable.

- Nvidia의 반도체는 대체할 수 없지만 과거와 같은 성장률은 지속 불가능해 보입니다.

- On the other hand, Micron's bull run could just be getting started, and its growth is becoming less cyclical.

- 반면에 마이크론의 강세는 이제 막 시작되었을 수 있으며, 그 성장은 덜 변동적이 되었습니다.

Thesis

Both NVIDIA (NASDAQ:NVDA) and Micron (NASDAQ:MU) are semiconductor giants benefiting from strong growth trends in data centers, self-driving cars, and other high tech fields.

From a purely business perspective, Nvidia's capital-light operations and market leadership make it preferable. However, at a 6x cheaper valuation, Micron is the better buy now.

NVIDIA와 Micron은 모두 데이터 센터, 자율 주행 자동차 및 기타 첨단 기술 분야의

강력한 성장 추세로부터 혜택을 받고 있는 반도체 대기업입니다.

순수한 비즈니스 관점에서 Nvidia의 자본이 적은 운영과 시장 리더십은 Nvidia를 선호하게 만듭니다.

그러나 6배 더 저렴한 밸류에이션으로 봤을 때, 마이크론이 지금 더 나은 선택입니다.

Introduction

Nvidia's bull run over the past couple years made it by far the most valuable semiconductor company.

In fact, it's now the 8th most valuable company in the world. Among semiconductor companies, only TSMC (NYSE:TSM) joins it in the top 25.

This status has given Nvidia a reputation as the premier "picks and shovels" play of futuristic tech.

Nvidia는 지난 몇 년 동안 강세를 보이면서 지금까지 가장 가치 있는 반도체 회사가 되었습니다.

실제로, 지금은 세계에서 8번째로 가치 있는 회사입니다.

반도체 회사 중 TSMC(NYSE:TSM)만이 상위 25위 안에 들 수 있습니다.

이러한 지위 덕분에 Nvidia는 미래 기술의 최고의 공급회사라는 명성을 얻게 되었습니다.

It's certainly true that Nvidia is a picks and shovels play. Nvidia's GPUs - which specialize in highly parallelized computing like graphics - are increasingly important in areas like data centers, cryptocurrency mining, and self-driving cars.

Companies like Meta (NASDAQ:FB) are ramping up spending in these fields, which in Meta's case reportedly includes an all-in bet on Nvidia's GPUs. Widespread demand created a shortage of Nvidia products and drove the bull run that 6xed the stock from its March 2020 lows.

Nvidia가 도구 공급회사라는 것은 확실히 사실입니다. 그래픽과 같은 고도로 병렬화된 컴퓨팅을 전문으로 하는 Nvidia의 GPU는 데이터 센터, 암호화폐 채굴 및 자율 주행 자동차와 같은 영역에서 점점 더 중요해지고 있습니다. Meta(NASDAQ:FB)와 같은 회사는 이 분야에 대한 지출을 늘리고 있으며 Meta의 경우 Nvidia GPU에 대한 올인 베팅이 포함된 것으로 알려졌습니다. 광범위한 수요는 Nvidia 제품의 부족을 야기했고 주가가 2020년 3월 저점에서 6배 상승한 강세장을 주도했습니다.

However, over half of that performance was driven by multiple expansion. Nvidia bottomed at 35 P/E in 2020, and now stands at nearly 100. This lofty multiple makes Nvidia look much further ahead of its semiconductor peers than it actually is.

그러나 그 성과의 절반 이상이 다중 확장에 의해 주도되었습니다. Nvidia는 2020년에 PER 35배 로 바닥을 쳤고

현재 거의 100에 가깝습니다. 이 높은 배수는 Nvidia가 실제보다 훨씬 앞서게 보이게 합니다.

To illustrate, Micron - which at a $104B market cap and P/E of 14 has flown comparatively under the radar - actually has more revenue than Nvidia. In the last 12 months, they brought in $27.7B compared to $24.3B from Nvidia. If Nvidia's P/E was applied to Micron, it would have a $713B market cap... just 5.6% smaller than Nvidia's.

예를 들어, 시가 총액이 1040억 달러이고 P/E가 14배로 비교적 잘 알려지지 않은 Micron은 실제로 Nvidia보다 더 많은 매출을 올리고 있습니다. 지난 12개월 동안 Nvidia의 243억 달러에 비해 277억 달러의 매출을 올렸습니다.

Nvidia의 P/E가 Micron에 적용된다면 시가총액은 7,130억 달러가 될 것입니다. Nvidia보다 5.6% 작습니다.

(분석: 이런 식의 비교는 옳지 않다고 봅니다. 왜냐하면 엔비디아는 팹리스 회사고, 마이크론은 매년

매출의 1/3정도를 설비투자해야 하는 회사이므로 같은 멀티플을 줄수는 없다.)

From a business perspective, there's not much similarity between these two companies besides the fact that they both design semiconductors.

비즈니스 관점에서 이 두 회사는 둘 다 반도체를 설계한다는 사실 외에는 그다지 유사점이 없습니다.

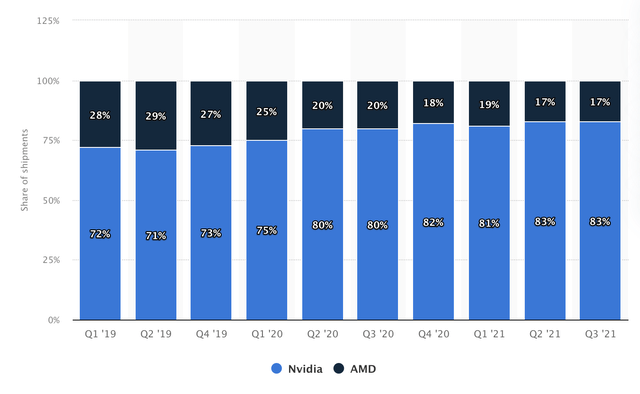

Source: Statista

Nvidia focuses on GPUs, a product that it invented. It has 83% market share, excluding integrated GPUs where Intel leads. This market share is partially protected by intellectual property.

Nvidia는 자신이 발명한 제품인 GPU에 중점을 둡니다. 인텔이 주도하는 통합 GPU를 제외하면 83%의 시장 점유율을

기록하고 있다. 이 시장 점유율은 지적 재산권에 의해 부분적으로 보호됩니다.

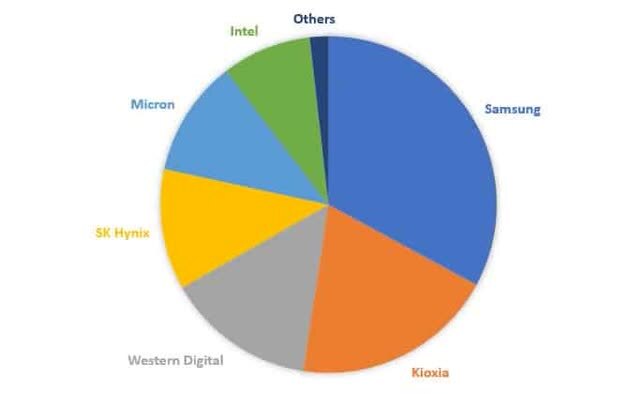

Source: TECHDesign

On the other hand, Micron is a distant third in DRAM market share and only fifth in the crowded NAND space. Unlike Nvidia, Micron manufactures chips in addition to designing them and doesn't seem to have a noteworthy advantage when it comes to intellectual property.

DRAM and NAND are two types of memory chips. While GPUs specialize in performing a lot of operations very quickly, memory chips focus on storing a lot of information.

Memory chips are used alongside GPUs, and don't compete directly with them. Micron is partnered with Nvidia on a variety of offerings, helping both companies benefit from the same growth trends. In particular, both companies have highlighted AI, 5G, IoT, gaming, industrial, blockchain, the metaverse, and auto as areas that will drive future growth.

In the rest of this article, I'll explain why Nvidia's growth rate over the past year may not be sustainable, while Micron's future growth may be even better than it was in the past.

Nvidia's Growth Trajectory

Source: Seeking Alpha

According to Seeking Alpha, analysts project a 16-18% revenue and earnings CAGR for Nvidia over the next two years. For comparison, Nvidia is wrapping up a year where it will have grown earnings by about 73%.

What's causing the deceleration? One place to look is prior to 2021. Between 2005 and 2020, Nvidia's revenue grew at a CAGR of 12%. Adding 2021's historic growth brings it to 14% CAGR. So analysts are projecting slightly elevated growth relative to historic levels, which I think is reasonable. This level of growth is very impressive, and it was enough for Nvidia to generate strong returns even prior to this year.

This growth is also above the industry average. Since 2008, the only large cap semiconductor company with a revenue CAGR above 15% is Broadcom (NASDAQ:AVGO), which only broke this threshold due to acquisitions. Keep in mind that this is during the biggest tech bull run ever.

Famous investor Peter Lynch was skeptical of any company growing faster than 20% because of the difficulty of sustaining that growth, and the lack of exceptions to this rule in the semiconductor industry seems to prove him right. (There are plenty of exceptions in software though.)

At nearly 100 P/E and growing off of its largest revenue base ever, 2021 will be a difficult act for Nvidia to follow. Nvidia will have to grow significantly faster than 18% per year to justify its valuation relative to peers, since 18% growth would still put its PEG ratio above 5. If Nvidia delivers on its projected growth and trades flat for the next two years, it will have a forward P/E of 49.

It's also worth noting that semiconductor revenue is cyclical, so this isn't the first time that Nvidia has experienced strong growth. In both 2008 and 2018, Nvidia had growth of 34% of higher, but those years were followed by growth of -16% and 21% in the next year.

Just to highlight one area where growth doesn't look sustainable, Nvidia benefited from the increasing popularity of cryptocurrency in 2021. Nvidia has stated that it doesn't have visibility into exactly how much demand from crypto impacts revenue, but its products are used to mine cryptocurrency like Bitcoin (BTC-USD).

I'm certainly not so bold as to call a top in Bitcoin, but historically it has been the case that the year after a halving has marked the start of a Bitcoin bear market. Additionally, altcoins that use proof of stake (including Ethereum, which will switch to proof of stake in 2022) have been gaining market share on Bitcoin. Proof of stake doesn't need Nvidia's GPUs because it doesn't do as much computation.

Micron benefits from cryptocurrency as well, since miners need a lot of power and a lot of memory. But the market's perception seems to be that Nvidia benefits more based on the well publicized GPU shortages related to mining, which could negatively impact Nvidia's stock if Bitcoin crashes. Additionally, Micron would not be as impacted by a switch to proof of stake.

Focusing only on cryptocurrency is a disservice to Nvidia's strong growth across the board. Revenue is growing rapidly in every segment:

| Segment | YoY Growth |

| Gaming | 42% |

| Data Center | 55% |

| Visualization | 144% |

| Automotive | 8% |

Source: The Author

These segments all have enormous potential, and that could let Nvidia continue to grow quickly for years. I'm not ruling out the possibility that Nvidia beats estimates and has positive returns in 2022 or the following years. Over the long term, I have no doubt that they will continue to grow revenue and do very well. I just see better places to deploy capital now, which brings us to Micron.

Micron's Growth Trajectory

Micron is no slouch either when it comes to growth. Between 2005 and 2020, their revenue had a 10% CAGR (compared to 12% for Nvidia). According to Micron, memory has been the fastest growing sub-field in semiconductors over the last two decades.

| Segment | YoY Growth |

| Compute/Networking | 34% |

| Mobile | 27% |

| Storage | 26% |

| Embedded | 51% |

Source: Earnings Presentation

Micron breaks down its segments a bit differently than Nvidia, but its segments are all growing quickly as well. They highlight many of the same growth drivers as Nvidia. In particular, they saw 80% growth in industrial/IoT this year, and they expect 40-50% CAGR in the auto market over the next three years.

Source: Seeking Alpha

Micron's fiscal year ends at a different time than Nvidia, so it's difficult to make head-to-head comparisons based on the estimates in the image above. But one easy point to make is that Micron's projected EPS growth in the one year ending August 2022 is 10% higher than Nvidia's projected EPS growth in the two years from January 2022 to January 2024.

These are just projections and they're often wrong. But Micron's projected EPS growth is based on just 16% revenue growth, which seems like an attainable target that's only slightly higher than its historic growth rate.

Ideally, an investment would be fairly valued based on earnings estimates so that a company doesn't have to wildly exceed expectations to deliver strong returns. I believe that's the case with Micron, since even using its historic 10% CAGR without factoring in this year's projected 46% growth, it has a PEG of just 1.4.

Another reason why I believe Micron's growth estimates are attainable is because of where they are in the supply/demand cycle. While Nvidia's revenue is breaking records every quarter, Micron still has less revenue now than it did in 2018. This is an industry-wide issue; revenue for Micron competitor SK Hynix also peaked in 2018.

It's not a foregone conclusion that revenue in the memory industry will reach another all-time high. But considering the strong growth trends that underpin the industry and the progress those trends have made since 2018, I think it's reasonable to assume that this will happen at some point.

There are a variety of other reasons why Micron's future growth could be steadier and more sustainable than it was in the past:

- 75% of their revenue now comes from long term agreements based on close collaboration with customers. This is up from 10% five years ago.

- The memory industry has consolidated (anyone remember Sandisk, Inotera, or Elpida?), which should lead to more favorable pricing and less risk of oversupply.

- The adoption of capital intensive EUV manufacturing technology will make it more difficult for new entrants, especially in China where the tech is unavailable.

- Micron could get support from the federal government as part of the CHIPS act, which appears to be more focused on manufacturing than design (and thus not as likely to benefit Nvidia).

- Micron recently started paying a dividend, which indicates management's confidence that their cash flows are sustainable.

Risks

To be clear, my thesis is that Micron will outperform Nvidia over the next few years, not that Nvidia's stock will decline. Great companies like Nvidia can trade at elevated multiples for a long time and I have no desire to short Nvidia. Even so, there are a couple reasons why this narrow thesis could fail and Micron could end up underperforming Nvidia.

The first is that Micron's moat sources are not as strong as Nvidia's. Micron's market position has improved as a result of the factors mentioned in the previous section. Even so, it's still a relatively small player compared to Samsung despite its market leadership in some verticals like low power DRAM. This could stop Micron from driving innovations through R&D or exercising pricing power. On the other hand, Nvidia invented the GPU, owns substantial intellectual property related to it, and is the largest GPU player with the largest R&D budget.

Micron has also benefitted from multiple expansion; a couple years ago it had a forward P/E of just 3. In that respect, Nvidia and Micron have both experienced a similar level of multiple expansion (about 5x). The difference is that Micron's current P/E of 14 is a reasonable multiple for a fast growing cyclical company with high teens revenue growth. Nvidia's current P/E of 93 is a reasonable multiple for a high quality company positioned to grow at 30%+ for years to come, which I doubt Nvidia (or any large cap semiconductor company) can do. Even so, both companies could be vulnerable to multiple contraction in the future. While I believe it's unlikely, Micron could benefit less from changes to its multiple than Nvidia.

'반도체-삼성전자-하이닉스-마이크론' 카테고리의 다른 글

| Global chip shortage: Samsung expects its profits to jump by 52% (0) | 2022.01.10 |

|---|---|

| 삼성전자의 실적이 메모리 반등에 희망을 주다(2022.01.07) (0) | 2022.01.08 |

| ASML 공장 화재로 EUV 광학 부품 공급에 영향(2022.01.05) (0) | 2022.01.06 |

| 대만 지진(2022.01.04) (0) | 2022.01.05 |

| ASML 독일 반도체 공장에서 불‥노광장비 생산 차질 우려 (0) | 2022.01.05 |