2022.04.19

Who dominates the global semiconductor market? (digitimes.com)

The semiconductor industry with a sophisticated division of labor has seen a rapid evolution over more than 60 years, during which the global capital market also has played a key role. The industry's development is a very complicated one, from either a political or economic point of view.

정교한 노동 분야인 반도체 산업은 글로벌 자본 시장이 중요 역할을 하는 동안, 60년 넘게 급격한 혁신을

보았다. 산업 발전은 정치적으로나 경제적으로나 매우 복잡한 것이다.

To give a holistic view of the future semiconductor industry, DIGITIMES just released a 2022 semiconductor industry report to further explore the impact of geopolitics on the semiconductor supply chain and the possibility of co-opetition among the major countries and companies in the race. The following is the abstract of the whole report.

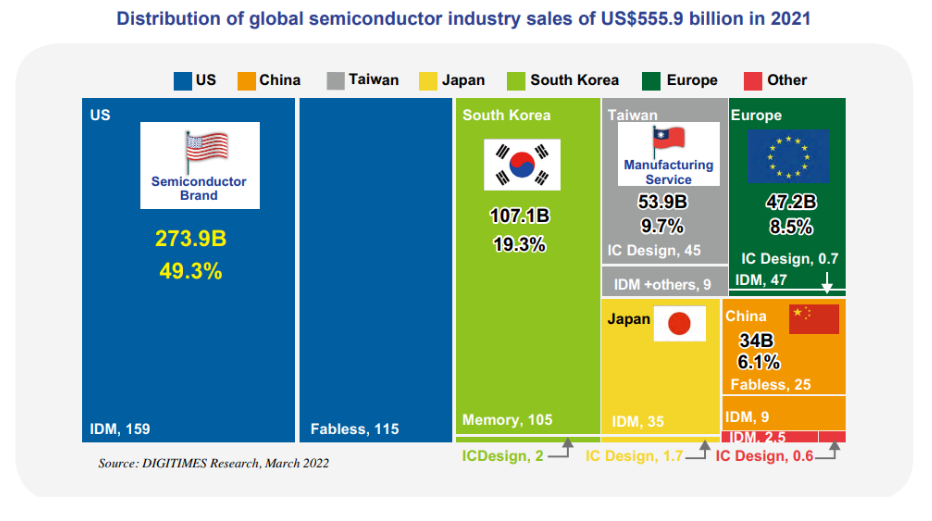

We have observed and analyzed the global semiconductor market of US$555.9 billion through different dimensions beyond the industrial output value.

US brand vendors including Intel, TI, Nvidia, AMD, and Qualcomm contributed US$273.9 billion of revenues, accounting for 49.3% of the global market and allowing US companies to remain the most influential in the global market. Apart from Micron, almost all of them focus on logic chips and they are the global market leaders.

2021년 글로벌 반도체 매출 5559억달러를 달성한 반도체 시장을 관찰하고 분석했다.

인텔, TI, Nvidia, AMD와 Qualcomm등 미국 반도체 회사들의 매출은 2739억달러로

글로벌 반도체 매출의 49.3%에 달했다.

마이크론과 달리 그들은 로직칩에 집중했고 글로벌 시장의 리더이다.

The semiconductor market can be divided into two sectors: memory and non-memory.

Memory products usually contribute 35-40% of the global semiconductor market, with non-memory semiconductor products including logic chips and control chips representing the rest.

반도체 시장은 메모리 반도쳉와 비메모리 반도체 시장으로 나뉘인다.

메모리 시장은 전체 반도체 시장의 35-40%를 차지한다.

나머지는 로직칩과 컨트롤 칩등이 차지한다.

US-based Micron and Japan's Kioxia are major players in the memory market but Korean companies dominate the memory sector, which enables South Korea to have 19.3% of the overall semiconductor market.

미국의 마이크론과 일본의 키옥시아가 메모리 시장의 주요 업체지만, 한국업체들은 메모리 시장을 지배하고 있고,

한국업체들은 전체 반도체 시장의 19.3%를 차지하고 있다.

Although the memory market also has its own business cycle, buyers can adjust the memory capacity they need according to pricing. This is different from logic and control chips with diverse characteristics.

Though dominating the memory industry, South Korea is striving to shore up its presence in IC design and wafer fab sectors, with a focus on logic ICs and contract chipmaking services.

It hopes to seek a balance for its industry that is tilting towards memory.

Taiwan has established a strong foothold in the global semiconductor sector. Besides its unrivaled manufacturing capabilities, Taiwan also has remarkable success in the IC design sector. Leveraging rising demand for alternatives to imports, Taiwan's IC design houses started by developing chipsets for PC, power management ICs, and driver ICs in the 1990s. MediaTek was founded in 1998 with an even stronger ambition. Taiwan-based IC design houses and IDMs such as Winbond, Macronix and Nanya contributed sales amounting to US$53.9 billion, accounting for 9.7% of the global total, with Taiwan sitting in third place in the global IC design rankings.

Led by STMicroelectronics, NXP, and Infineon, European manufacturers represent 8.5% of the global market share. Automotive chips will be the strategic products for all automotive players to cash in on future business opportunities. European manufacturers have undertaken relatively less capacity expansion in the past few years. Will they adhere to Europe's own way or invite TSMC to construct fabs in Europe? The decentralization of semiconductor ecosystems could become more pronounced. The manufacturing structure with Asia as its hub over the past decades will break up into a localized and diversified landscape.

Japanese manufacturers had their golden period during the 1980s and 1990s. Renesas, Kioxia, Rohm and IC design house Socionext reported total revenue of US$36.7 billion, accounting for a moderate 6.6% of the global market. Can Japan make a comeback? The partnership with TSMC to build a fab in Japan is the initial step, and Japan's souring relationship with South Korea seems to be pulling Japan closer to Taiwan.

The emerging market forces that deserve more attention are undoubtedly coming from China.

Demand from China accounts for 60% of the world market since more than half of the electronic products are produced there.

Though China's semiconductor industry started quite late, there has been remarkable growth propped up by government support, such as the "Big Fund." It has a lengthy list of IC design houses, but most of them have little influence in the market.

It is estimated that revenues from Chinese IC design houses that are outsourcing chip production with meaningful sales volumes were US$25 billion. Adding another US$9 billion from the IDM sector made China the sixth-largest semiconductor supplier next to Japan in 2021, with a global market share of 6.1% – a figure close to what SMIC president Zhao Haijun had described as China's chip self-sufficiency status.

The following statistics more or less reflect intertwined relations of the IT industry under the impact of industrial co-opetition and geopolitics.

'반도체-삼성전자-하이닉스-마이크론' 카테고리의 다른 글

| SK하이닉스 (000660)-키움증권(2022.04.25) (0) | 2022.04.25 |

|---|---|

| 반도체 장비, 주문후 인수까지 18개월 걸림(2022.04.21) (0) | 2022.04.21 |

| 삼성전자 하이닉스 (2) | 2022.04.19 |

| 중국에서 진행 중인 봉쇄는 전자부품에 대한 글로벌 공급망을 위협 (0) | 2022.04.18 |

| 2021년 전세계 반도체 매출, 전년 대비 26% 증가” 가트너 (0) | 2022.04.18 |