2022.07.29

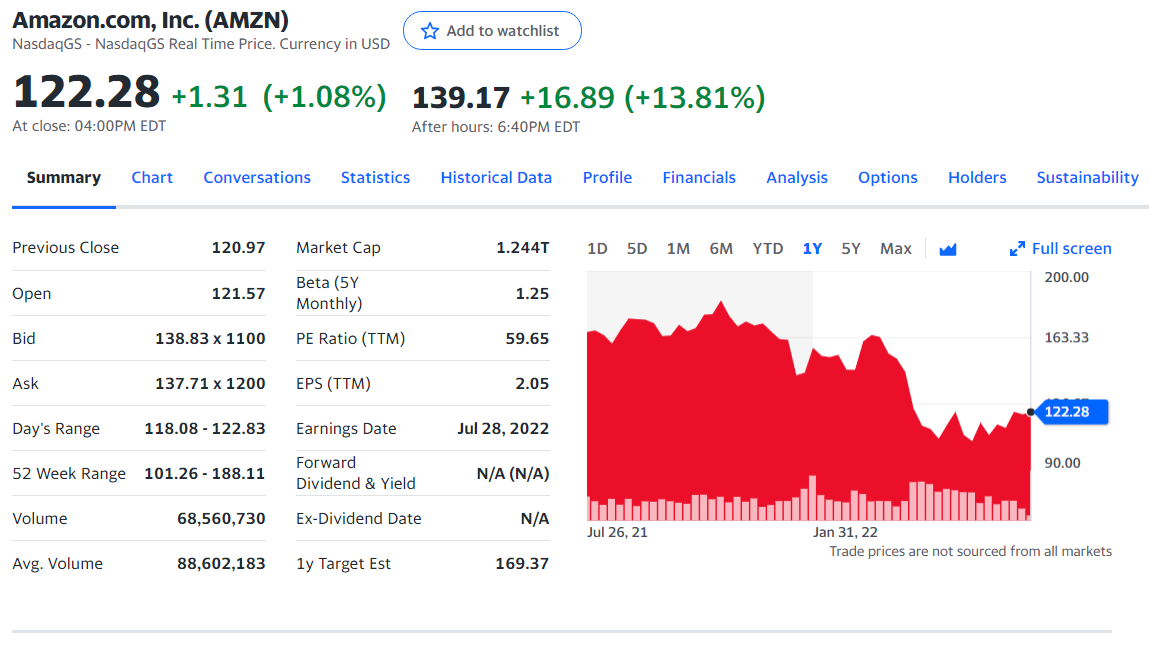

애플과 아마존은 시장 예상치를 상회하는 실적 발표로 시간외 거래에서

2.94%와 13.81% 상승.

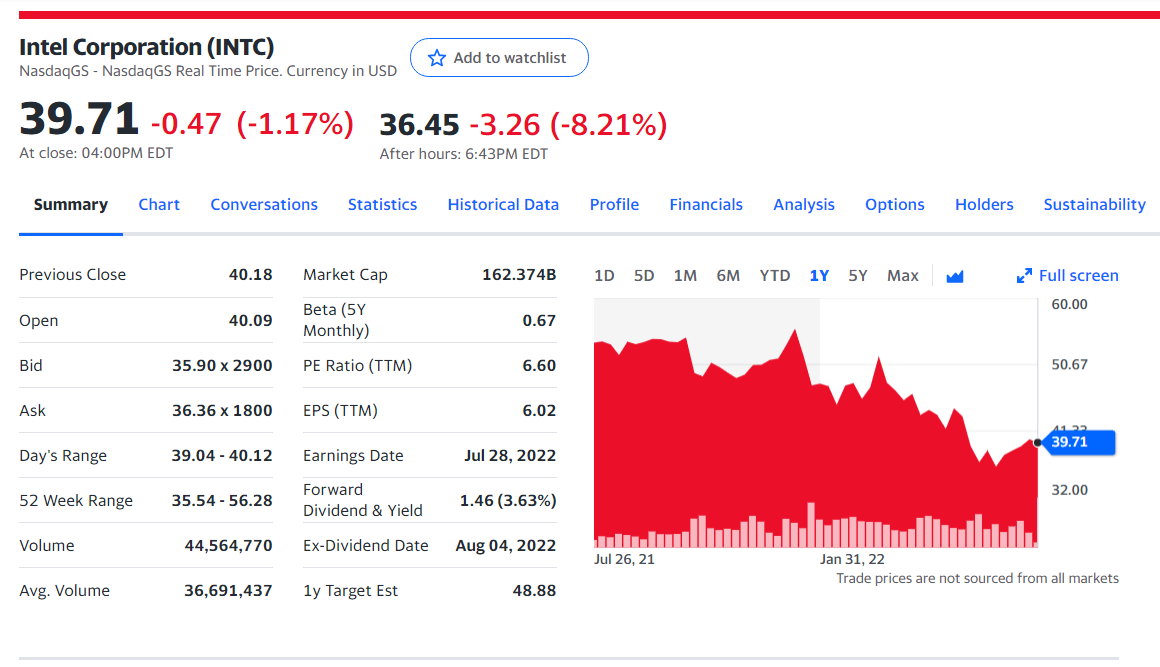

하지만 인텔은 작년 동기대비 매출이 22% 감소하는등 시장 예상치를 하회하는 실적과

연간 실적 하향 발표로 시간외 거래에서 8.21% 하락중.

------------------------------------------

애플 어닝 서프라이즈아마존 두 분기 연속 순손실 | 한국경제TV (wowtv.co.kr)

애플 어닝 서프라이즈아마존 두 분기 연속 순손실

애플이 올해 2분기에 월가의 기대를 뛰어넘는 성적을 냈다. 반면 세계 최대 전자상거래 업체 아마존은 두 분기 연속으로 순손실을 기록했다. 애플은 28일(현지시간) 2분기(애플 자체 기준으로는 3

www.wowtv.co.kr

---------------------------------------

1. 애플

Apple expects revenue to 'accelerate' following strong quarterly results | Seeking Alpha

Apple Stock Rises On June-Quarter Beat | Investor's Business Daily (investors.com)

The Cupertino, Calif.-based company earned $1.20 a share on sales of $83 billion in the quarter ended June 25. Analysts polled by FactSet expected Apple to earn $1.16 a share on sales of $82.8 billion. On a year-over-year basis, Apple earnings fell 8% while sales inched 2% higher.

애플은 6월25일 마감하는 3분기 실적 발표.

매출 830억달러, 주당순이익 1.20달러로 시장 예상치 828억달러와 1.16달러를 상회했다.

전년 동기대비 매출은 2% 증가했고, 주당순이익은 8% 감소했다.

Apple reports record revenue of $83B amid high inflation (yahoo.com)

Apple (AAPL) released its Q3 earnings on Thursday, beating analysts' expectations with record revenue of $83 billion despite fears of rising inflation.

Here are the most important numbers from the report, and how they compare to Wall Street's expectations, as compiled by Bloomberg.

- Revenue: $83 billion versus $82.7 billion expected

- Earnings per share: $1.20 versus $1.16 expected

- iPhone revenue: $40.7 billion versus $38.9 billion expected

- iPad revenue: $7.22 billion billion versus $6.9 billion expected

- Mac revenue: $7.4 billion billion versus $8.4 billion expected

- Wearables revenue: $8.1 billion versus $8.8 billion expected

- Services revenue: $19.6 billion billion versus $19.7 billion expected

Apple's stock was up more than 3% after the report.

Despite the record revenue, Apple reported net income fell 10.5% year-over-year.

But according to Morgan Stanley, this is all short-term trouble for the iPhone maker. In a note, Erik W. Woodring indicates that Apple’s services business could help push the tech titan’s market cap over the $3 trillion market again.

모건스탠리에 따르면 애플의 서비스부문이 애플 시총을 3조달러 이상으로 증가시킬 것으로 예상했다.

Services revenue was especially strong in Q3, jumping from $17.5 billion last year to $19.6 billion.

3분기 애플의 서비스부문 매출은 작년 175억달러에서 196억달러로 증가했다.

Apple is widely expected to launch its iPhone 14 line along with its Apple Watch Series 8 later this fall.

And while that won’t have much impact on the company’s Q4 earnings since the products are announced just a few weeks before the quarter ends, it should boost its Q1 2023 performance.

이번 가을에 발표되는 아이폰14와 애플워치8 시리즈는 분기가 끝나기 몇주전에 출시되기 때문에

4분기(7월-9월) 실적에는 별 영향을 못미치고 회계년도 2023년1분기(10ㅇ월-12월말) 실적을 증가시킬 것.

Apple is also said to be preparing to enter the AR/VR space with its own headset that will likely launch sometime in 2023. That could serve as the next major product for the company and open up broader opportunities for services and content sales.

애플은 2023년에 자신의 AR/VR 기기를 가지고 이 분야에 뛰어들 것인데,

이는 애플 차세대 주력 제품이 될 것이다.

2.아마존

아마존은 투자한 전기차회사 리비안의 손실로 전체 이익은 손실로 발표.

하지만 클라우드 부문인 아마존웹서비스는 견실한 매출과 이익을 발표.

실적 선방한 아마존, 믿을 건 역시 클라우드…"AWS는 여전히 빠르게 성장 중" < 인프라 < 뉴스 < 기사본문 - 테크M (techm.kr)

실적 선방한 아마존, 믿을 건 역시 클라우드…"AWS는 여전히 빠르게 성장 중" - 테크M

아마존이 올 2분기 클라우드 사업부문 성장에 힘입어 시장 예상치를 웃도는 분기 실적을 기록했다. 여기에 향후 실적에 대한 낙관적 전망을 내놓으며 시간외 거래에서 주가가 13% 급등했다.28일(

www.techm.kr

Amazon.com Inc. (Nasdaq: AMZN) has operated with a net loss throughout 2022, as the Seattle-based e-commerce behemoth on Thursday reported high sales but no profit for the second straight quarter.

높은 매출과 이익 손실을 발표.

Amazon beat analysts' estimates for revenue, reporting $121.2 billion against the predicted $119 billion, but its investment in electric vehicle maker Rivian Automotive Inc. sunk a profit squeezed by inflationary pressures. The company reported its 18% share of Rivian contributed to a loss of $3.9 billion for the quarter. The same valuation loss affected Amazon last quarter.

아마존은 시장 예상치 1190억달러를 상회하는 1212억달러의 매출을 달성.

하지만 지분 18%를 투자한 전기차업체의 손실 39억달러가 반영되어 이익은 손실로 발표.

Hours before Amazon reported, Rivian announced it was laying off 6% of its workforce in reaction to inflation and rising interest rates.

아마존이 투자한 리비안은 인플레이션우려로 직원 6% 감축할 것을 발표.

Amazon said it is optimistic that ballooning logistics spending was getting under control and forecast that revenue would grow even faster in the latter half of the year. The company held its Prime Day sales event earlier this month and has a similar event planned for October, according to a report from Business Insider. The company also has the holiday season in Q4 to look forward to.

Amazon's future guidance offered more optimism, despite a possible recession looming, as it said it expected to post between $125 billion and $130 billion in revenue for Q3. Even in rougher quarters, Amazon has been accurate in its projections.

아마존은 다음 분기 매출에 매우 낙관적으로 3분기 예상치를 1250억달러에서 1300억달러 사이로 발표.

"Despite continued inflationary pressures in fuel, energy, and transportation costs, we’re making progress on the more controllable costs we referenced last quarter, particularly improving the productivity of our fulfillment network," CEO Andy Jassy said in a news release.

Logistics costs are still growing for Amazon. The company reported shipping costs had risen 9% year over year to $19.3 billion, but it is cooling down from the rapidly growing costs it experienced in 2021.

운송 비용은 계속 증가하고 있다.

운송 비용은 전년 동기대비 9% 증가한 193억달러에 달했지만 2021년 증가하는 속도보다는

낮아지고 있다.

On the other side of the company, Amazon Web Services had another successful quarter helping boost overall profits. The cloud division brought in $19.7 billion in sales, with $5.7 billion in operating income.

아마존의 한 부분인 아마존웹서비스는 아마존의 대부분 이익을 책임지면서

매출 197억달러와 영업이익 57억달러를 발표.

3.인텔

Intel Posts 22% Quarterly Sales Decline, Slashes Forecast (yahoo.com)

인텔 분기 매출 22% 감소.

Revenue in the second quarter fell 22% to $15.3 billion, significantly below the average analyst estimate of $18 billion. Per-share profit excluding some items was 29 cents, Intel said Thursday in a statement, while analysts had predicted 69 cents. Sales in the current period will be as low as $15 billion, compared with projections of $18.7 billion.

2분기 매출은 전년동기대비 22% 감소한 153억달러로 시장예상치 180억달러를 심각하게 하회.

주당 순이익은 29센트로 ㅅ시장예상치 69센트를 하회했ㄷ다.

이번 분기 예상 매출도 150억달러로 시장 전망치인 187억달러에 못미쳤다.

'애플' 카테고리의 다른 글

| 애플과 브로드컴, 미국산 칩 개발을 위한 장기간 거래 계약 체결 (digitimes.com) (0) | 2023.05.25 |

|---|---|

| 애플(AAPL),기대를 뛰어넘는 아이폰 판매로 인해 좋은 실적을 발표(2023.05.05) (0) | 2023.05.05 |

| 구글(알파벳) /마이크로소프트 실적 발표 (0) | 2022.04.27 |

| 중요-클라우드 컴퓨팅이 AMD 주가를 최고가로 만들 것 (0) | 2022.03.09 |

| 애플의 헤드셋은 게임체인저가 될수있다(2022.02.05) (0) | 2022.02.05 |