2021.05.26

Micron Stock: Investors Have Short Memories On Memory Capex (NASDAQ:MU) | Seeking Alpha

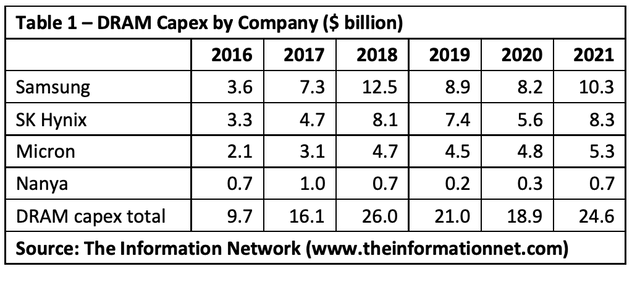

Table 1 shows DRAM capex by company on a yearly basis over the same period. DRAM capex tracks ASPs, coinciding with the ASP peak with the maximum of $26.8 in 2018.

아래 표 '테이블1'은 반도체 회사별 디램 설비에 투자한 금액이다. 단위는 10억달러이다.

즉 2020년 삼성과 SK하이닉스가 디램에 투자한 금액은 각각 82억달러와 56억달러에 달했다.

The reason is simple, as detailed in The Information Network’s report entitled “Hot ICs: A Market Analysis of Artificial Intelligence (“AI”), 5G, CMOS Image Sensors, and Memory Chips.” Memory companies increased spending, which increased capacity, and which caused overcapacity, an inventory overhang, and a drop in ASPs.

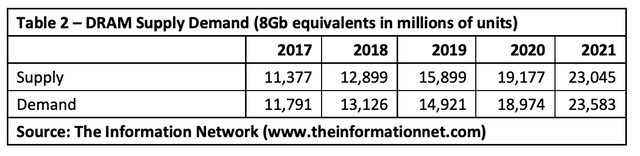

As shown in Table 2, in 2017 and 2018, the DRAM industry was in a period of undersupply, and hence the increase in capex spend. Unfortunately, the large capex increases in 2018-2019 created a period of oversupply in 2019 and 2020.

아래 표 '테이블2'는 글로벌 디램 업체들의 공급과 수요를 8Gb(1GB) 단위 수량으로 나타낸 것이다.

2017년과 2018년은 디램 공급 부족으로 2018년과 2019년에는 설비 투자를 필요 이상으로 많이하여

2019년과 2020년 공급 과잉을 야기했다. 공급 증가율은 23.3%와 20.6%인데 2019년 디램 수요 증가율은 13.7%로

공급 과잉 상태.

2020년 글로벌 디램 공급은 191.77억 GB이고, 디램 수요는 189.74억 GB로 공급과잉 상태였다.

Supply increased 23.3% in 2019 and 20.6% in 2020. However, demand increased just 13.7% in 2019, which was the start of oversupply. Work/study/stay-at-home orders because of Covid-19 resulted in increased demand for DRAMs with strong growth in PCs, gaming stations, and cloud servers. As a result, demand increased 27.2% in 2020.

We are now in a period of undersupply in 2021. It warrants an increase in capex, but as MU’s CEO continues to point out, the company is viewing capex judiciously.

전년대비 디램 공급 증가율은 2019년 23.3%, 2020년 20.6%였다.

반면에 2019년 수요 증가율은 13.7%로 공급 과잉이 시작되었다. 코로나 사태로 시작된 재택 근무와 재택 교육은

PC, 게이밍기기와 클라우드 서버 수요를 증가시켜서, 결과적으로 2020년에는 디램 수요가 전년대비 27.2% 증가하였다.

이제 2021년 우리는 디램 공급 부족 상태에 놓여있다. 이것은 설비 투자를 증가시키는 것을 정당화하지만,

마이크론 사장이 지속적으로 지적하듯이 회사는 절제된 투자를 진행할 것이다.

I had my forecasts in my database, but only included data through 2021 in the article.

Here is Chart 2 with 2022 and 2023. I hope it isn't too distorted. So yes, I see continued based on new excursions, that the undersupply in 2021 will be gone and in oversupply for 2022 and 2023.

2021년은 디램 공급 부족, 2022년과 2023년은 공급 과잉.

Table 2 – DRAM Supply Demand (8Gb equivalents in millions of units)

2017 2018 2019 2020 2021 2022 2023

Supply 11,377 12,899 15,899 19,177 23,052 25,653 31,317

Demand 11,791 13,126 14,921 18,974 23,603 25,368 31,177

Source: The Information Network (www.theinformationnet.com)

-----------------------------------

Evercore ISI said that the stock price decline of Micron Technology (MU.US) is an "excellent" buying opportunity and reiterated the stock's "Outperform" rating with a target price of $135, and Micron Technology is still the bank's first choice.The bank’s analyst CJ Muse said that compared with Micron’s CFO’s attitude last week, the company’s CEO Sanjay Mehrotra is more cautious on NAND, weak DRAM bit production guidance in the fourth quarter, and third-quarter profit margins. And the lack of updates to earnings per share estimates seem to worry investors. However, Muse believes that the decline in Micron Technology's stock price is an "excellent" buying opportunity. In view of the strong pricing and demand trends of DRAM and NAND, Micron is still expected to announce better-than-expected Q3 revenue and earnings per share guidance.

---------------------------------

2021.04.17

현재 메모리 업체들의 투자 전략은 미세 공정으로 전환하는 과정에서 웨이퍼 손실이 발생하는데,

이를 보완하는 수준의 설비만 투자하는 것이다.

적극적인 메모리 공급 확대는 염두에 두고 있지않다.

또 현재 반도체 장비 시장은 파운드리업체들의 적극적인 투자로 장비 주문후 인도 기간이

길어지고 있다. 실제로 현재 반도체 생산 장비를 주문후 내년1분기안으로 인도받기는

쉽지않은 상태라고 한다.

글로벌 파운드리 1위 업체인 대만의 TSMC는 작년 172억달러 투자에 이어 올해는 300억달러를

투자할 것이라고 지난 1분기 실적 설명회에서 밝혔다.

반도체 장비 시장에서 비메모리 업체와 메모리업체의 장비 쟁탈전이 벌어진 상태다.

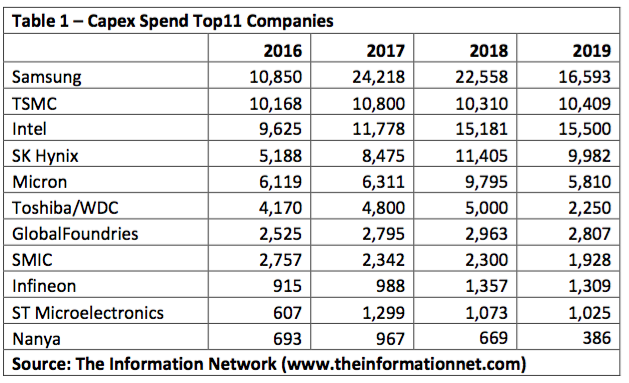

1.지난 2019년까지 반도체 투자 실적은 다음과 같다.

단위는 백만 달러이다.

2. 다음은 지난 3년간 비메모리와 낸드를 제외한 디램에 투자한 금액이다.

2018년 서버 디램 호황으로 대규모 투자이후 2년간 디램 관련 투자 금액이 급격히 감소했음을 볼수있다.

삼성의 디램 투자 금액: 81.3억달러(2018)-->62억달러(2019)-->49억달러(2020년)

하이닉스의 디램 투자 금액: 76억달러(2018)-->65억달러(2019)-->40억달러(2020년)

마이크론의 디램 투자 금액: 44.63억달러(2018)-->42억달러(2019)-->36억달러(2020년)

3. 2021년 메모리 투자는 약간 증가.

하이닉스와 마이크론의 메모리 투자(디램+낸드)는 전년비 10억달러 정도 증가할 것으로 예상된다.

이 정도의 투자로 2022년 메모리 수요에 맞는 공급이 이루어지기는 힘들 것이다.

즉 2022년에도 메모리 공급 부족은 이어질 것이다.

-----------------------------------------------------------------------

2021.05.17

Micron: Pricing Dynamics Will Lead To Stock Price Upside (NASDAQ:MU) | Seeking Alpha

Disciplined Capex Geared Towards Node Transitions

The overall memory market is exhibiting robust growth and is expected to remain strong in the long term from rising applications. However, Micron and the top memory industry players are being conservative with capex and supply growth. Based on management guidance, Micron's capex is expected to grow by 18.6% to $9 bln in 2021 which is a higher rate than Samsung and SK Hynix but lower than Western Digital and Kioxia.

| Company Capex ($ mln) | 2020 | 2021F | Growth % |

| Micron | 7,589 | 9,000 | 18.6% |

| Samsung | 29,433 | 28,100 | -4.5% |

| SK Hynix | 10,589 | 10,500 | -0.8% |

| Western Digital | 1,645 | 3,000 | 82.4% |

| Kioxia | 4,000 | 6,000 | 50.0% |

Source: Micron, Samsung, SK Hynix, Western Digital, SemiEngineering

Semiconductor CapEx To Grow 13.0% In 2021

Total market to reach $127B this year; Samsung, TSMC are top spenders.

semiengineering.com

난야는 7년간 3단계에 걸쳐 12조원 투자하기로 결정.

-------------------------------------------------

2021.06.03

Micron: Not All CapEx Is Bearish (NASDAQ:MU) | Seeking Alpha

How can this be?

It's because new nodes require the most equipment, the most cleanroom space, and the most R&D than ever before - AND - for the lowest gain in bit supply increases.

새로운 미세 공정으로 전환하는데에는 많은 장비가 필요하지만, 생산량 증가는 적게 이루어진다.

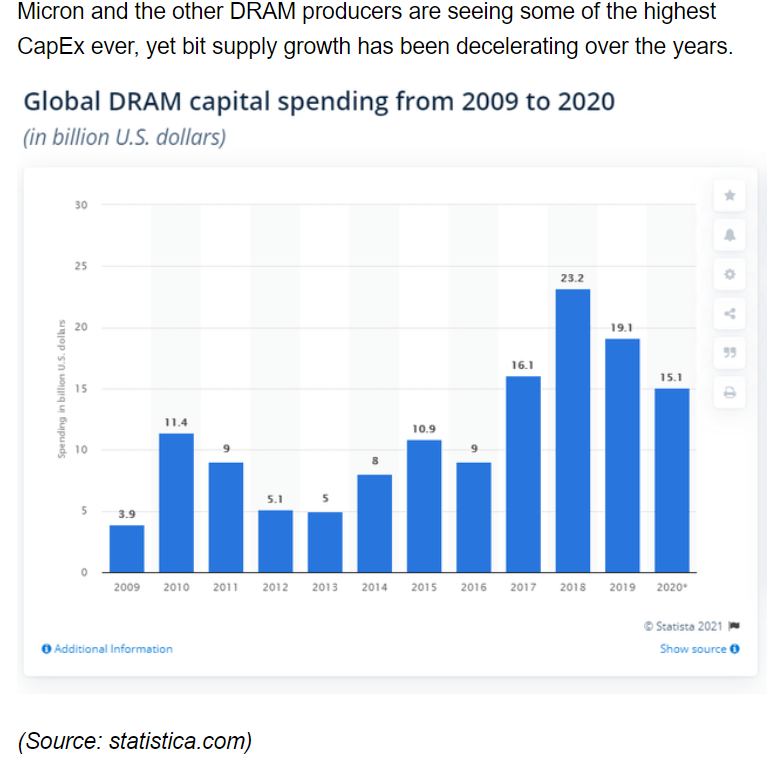

This then brings us to the point of CapEx and equating higher CapEx with higher supply. In the past, node transitions produced remarkable bit growth in the mid-to-high double digits. Today, bit growth in high teens is the norm, yet CapEx spend is near all-time highs.

과거에는 새로운 미세 공정으로 전환하면 2자리수 중후반(50%~90%)의 생산량 증가가 일어났지만 , 오늘날에는

10% 후반대가 정상이 되었다. 하지만 설비투자액은 사상 최고치에 달했다.

But there's even more to the story.

Producers aren't adding wafer capacity in their plans; they are simply keeping wafer starts the same (net zero) and transitioning lines to the latest node. Some may call out the "additional wafer starts" by a new fab, but in reality, that's not taking the whole situation into account. Wafer starts in other fabs or other parts of the cleanroom may have dropped because of the technology transitions.

생산업체들은 생산량 증가보다는 최신 공정으로 전환하는데 발생하는 웨이퍼 손실을 줄이려고 노력할 뿐이다.

Micron has very clearly signaled what its CapEx plans for 2021 were when CEO Sanjay Mehrotra outlined it when fiscal 2021 started in September:

We are targeting fiscal 2021 CapEx to be approximately $9 billion to support our long-term goal of maintaining stable share of industry bit supply, which will be achieved through node transitions alone and without a net increase to wafer starts.

This has been reaffirmed just as recently as few weeks ago when CFO David Zinsner outlined what CapEx plans have been and still are:

...the other thing I would say is, on the CapEx front is...there's a fair amount of CapEx for us...that also doesn't go to...necessarily the bit growth, right? I mean, we are spending a lot in the back end to bring that in-house. We are, I think more proactively just having kind of wide space available for cleanroom expansion as we bring out new process technologies, which are more complex, which require more real estate.

If you are equating $1 of CapEx today as the same $1 of CapEx from 15 years ago, you are completely lost - or lazy - in your analysis. The investments Micron is bringing about in 2021 are majorly on node transitions and keeping wafer starts at net zero growth. The rest is going toward vertical integration of packaging and testing on the back-end to control the entire process and be flexible with customization for its customers.

This means the industry is fueling bit supply growth to feed bit demand by merely transitioning to the next technology node, which has now sunk to the high-teen percentage area. Wafer start increases are minimal, and the term "expansion" has taken on a new definition. No longer does it mean increased supply through wafer starts but rather a process to maintain what is already in place.

Simply concluding an increase in CapEx as an increase in industry bit supply is an erroneous exercise and results in a completely wrong conclusion. Instead of being bullish as one should be when they see disciplined supply growth, the opposite happens and causes an investor to be extremely bearish. As I noted in my last Micron article, the only thing that will derail this supply and demand balance the market is currently experiencing is demand completely falling off before the end of calendar 2021, not because the producers ramped up and oversupplied.

The market is seeing CapEx spend as an adversary to the bullish memory market dynamics, and it's reflected in Micron's recently consolidating share price. The CapEx spent today is not equal to the results of the CapEx spent from cycles past. Trying to draw a straight line between the two will result in the opposite investment decision, resulting in significant missed opportunity risk. As the year continues and supply stays on the same expected path of not meeting demand, Micron's stock will go from consolidation to the next leg up toward $120.

'메모리 관련 데이터' 카테고리의 다른 글

| 2021년 5월말 메모리 계약 가격 (1) | 2021.05.31 |

|---|---|

| 2021년4월말 메모리 계약 가격 (0) | 2021.05.24 |

| 2021년3월말 메모리 고정가(2021.03.31) (0) | 2021.03.31 |

| 2021년2월말 메모리 고정 가격 (0) | 2021.02.28 |

| 2021년1월 메모리 고정가 (1) | 2021.01.29 |