2022.03.21

D램 세대교체 시작…삼성·SK '반도체의 겨울' 끝날까 (edaily.co.kr)

----------------------------------------

2022.03.21

대만 서버 케이스 생산업체는 2022년 서버 수요에 낙관적이다.

Chenbro upbeat about 2022 (digitimes.com)

----------------------------------------

2022.03.16

3월16일 미국장에서 번스타인의 투자 의견 상향으로 마이크론은 전일대비 8.97% 상승한 79.67달러로 마감.

번스타인은 향후 1,2분기내에 디램 가격 상승을 예상하며 삼성전자와 SK하이닉스의 투자 의견도 상향시켰다.

번스타인은 디램 가격이 곧 바닥을 칠것을 전망하며 마이크론 목표가를 상향함에 따라 주가가 폭등했다.

Micron Technology (NASDAQ:MU) shares jumped in early trading on Wednesday after investment firm Bernstein upgraded the semiconductor maker, noting that while macro issues have caused a sell-off in tech stocks, the dynamic random access memory market is expected to "bottom" in the next couple of quarters.

번스타인은 디램 시장이 다음 2분기내에 바닥을 칠것으로 전망했다.

Analyst Mark Li raised his rating to outperform from underperform and boosted his target price to $94, up from $58, noting that the Russian invasion of Ukraine is not expected to cause a "notable" disruption in supply or hurt demand and even with the current oversupply in the DRAM market, it's likely to balance out in the next quarter or two and prices will rebound.

번스타인의 애널리스트 마크리는 마이크론에 대해서 언더퍼폼에서 아웃퍼폼으로,

목표가를 58달러에서 94달러로 상향하였다.

그는 러시아의 우크라이나 침공은 주목할만한 공급망 붕괴나 수요를 저해하지 못할 것이고,

현재 공급과잉인 디램 시장이 다음분기나 다다음 분기내에는 균형이 맞출것이고,

디램 가격도 상승할 것이으로 전망했다.

Li also noted that China has yet to break the DRAM oligopoly, which includes Micron (MU), Samsung (OTC:SSNLF) and SK hynix, which should help the market.

"Our latest checks indicated continued struggle in 17 [nanometer] with poor yield and further schedule delay," Li wrote.

또 중국이 마이크론 삼성 하이닉스가 점유하고 있는 디램 과점 시장을 아직 깨지 못하고 있다고 분석했다.

마크리는 "중국은 여전히 17나노 공정에서 낮은 수율로 헤매고 있으며 계획이 더 늦어지고 있다고 분석했다.

Micron (MU) shares rose more than 8% to $79 in early trading on Wednesday.

Li also upgraded shares of Samsung and SK hynix on Wednesday.

마이크론은 79달러까지 상승했다.

마크리는 삼성과 하이닉스에 대한 투자 의견도 상향하였다.

In addition, Li noted that Micron (MU) is likely to see prices for DRAM rise later this year, going into 2023 before declining in 2024. "Supply discipline will keep the decline mild so that shipment increase still brings revenue and earnings growth then," Li added.

게다가 디램 가격은 올해 후반기에 상승할 것이고, 이 상승은 하락이 예상되는 2024년 이전인

2023년까지 지속될 것으로 분석했다.

공급 억제로 가격 하락이 완만할 것이고, 출하량 증가로 매출과 이익이 증가할 것으로 마크리는 분석했다.

Last month, Citigroup reiterated its buy rating on Micron (MU), noting that dynamic random access memory pricing could be higher in the second half of the year.

지난 달에는 씨티 그룹이 디램 가격이 하반기에 상승할 것이라며 마이크론의 투자 의견을

매수로 재언급하였다.

----------------------------------------------

2022.03.17

Micron Technology: Analyzing 2 Analysts (NASDAQ:MU) | Seeking Alpha

Summary

- 205 pages of research on Micron Technology landed in my inbox with a thud.

- First was one of Bernstein's Black Books on Global Memory, tipping the scales at 195 pages.

- Second was one of the often feared "Channel Checks" from Goldman Sachs, at a svelte 10 pages.

- Both were very positive for Micron, even if Bernstein is negative on the overall sector.

- UPDATE: As shown below, Bernstein has now issued a 20-page update to the 205-page Black Book on Global Memory. Amazing changes in a very short period!

Seems my hedge fund buddy flew to Europe and got to stay in his expensive hotel with Covid. He's fine and I'm better with his attention on sending me Micron Technology (NASDAQ:MU) research. Now he's impatient to hear what nuggets were contained in this 205-page pile.

Summary Comparison

So what's the essence of what these two research powerhouses are saying? Here's my cheat sheet:

번스타인(3월8일)과 골드만삭스(3월10일)의 보고서의 요약:

번스타인의 지난번 목표가는 58달러였으나 이번 업데이트 보고서에서 94달러로 상향.

골드만 삭스의 마이크론 목표가는 110달러.

| Bernstein | Goldman Sachs | |

| 2022 Revenue | 31.3 billion | 38 billion |

| 2023 Revenue | 38.3 billion | 42 billion |

| 2022 EPS | 8.4 | 11.45 |

| 2023 EPS | 11.6 | 13.69 |

| Price Target | $58 | $110 |

Let's ignore the fact that these basic numbers in Bernstein's report disagree in Exhibit 1 (lower) from the detailed income statement in Exhibit 333. (Atrocious proofreading, or total lack or explanation on differences, duly noted.) Used non-GAAP EPS from both reports. Bernstein's report carries a date of March 2022 and is watermarked March 8. Goldman's report is March 10, 2022.

Bernstein

Readers here know that I liked Mark Newman, who used to do semi-research for Bernstein. Newman has moved on to Nyobolt Battery as Chief Commercial Officer. Why do we care? Because Bernstein usually employs some great analysts. Newman was formerly a director of strategic planning at Samsung. So he wasn't what Warren Buffet was afraid of in this quip:

Wall Street is the only place that people ride to in a Rolls Royce to get advice from those who take the subway.

Newman was often wrong on stock timing calls, but was usually great on analysis. Plus, his graphics were often better than the current crew. I'm still dialing in on the current crew who has a highfalutin professorial tone in some of their writing. May they prove as accurate as Newman was, since they are very positive about Micron in this 195-page report, even while exhibiting neuroses about the industry.

As I posted previously, Micron was the only company to get a solo call out in the Portfolio Manager's Summary:

We're particularly impressed with Micron for its consistent and continued improvement, and its technology leadership currently.

The other players were lumped into this group jumbo:

With better consolidation, DRAM profitability is superior to NAND, but NAND's faster growth and the synergy between the two can't be ignored. Hence, we believe Samsung, SK hynix, and Micron are better positioned because they have both NAND and DRAM business, but other major suppliers only have NAND business.

But one need only turn the page to find that this schizophrenic new Bernstein semi team, who praises Micron for tech leadership then rates the entire industry underperforms, giving Micron a price target of $58. I think their praise on tech leadership is amply deserved and their negative call on the stock is just wrong.

The Bernstein report is rife with wonky statistical discussion, huge typos, a general lack of close analysis of the macro scene, and not enough appreciation of Micron's huge technological lead in some areas which might allow them to shine even in the flat to down industry Bernstein seems to expect.

Here's a classic example of one of their typos:

The biggest upside risk to our target price for Samsung Electronics Co Ltd, SK hynix Inc, and Micron Technology Inc is an earlier end of oversupply, which can be a result of better demand or lower supply.

Well Virginia, the "...end of oversupply...." would be a huge positive, not an "upside risk" as they write.

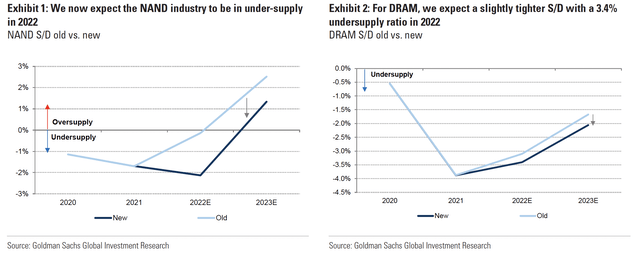

And while we're on the subject of oversupply, compare this Bernstein exhibit to the one from Goldman below.

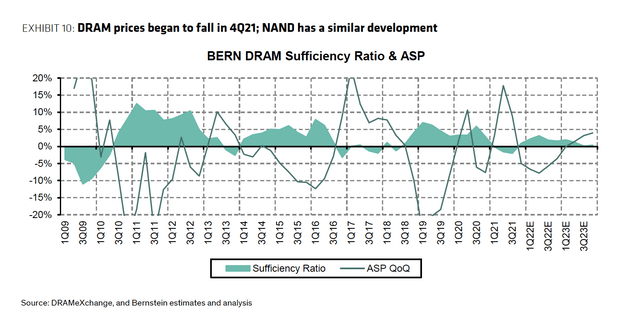

Exhibit 10 on DRAM sufficiency (Bernstein)

Note that the Goldman graph, below, shows DRAM in undersupply for the same periods. Both graphs cannot be correct. From news reports and other research reports, I'm siding with Goldman on this one.

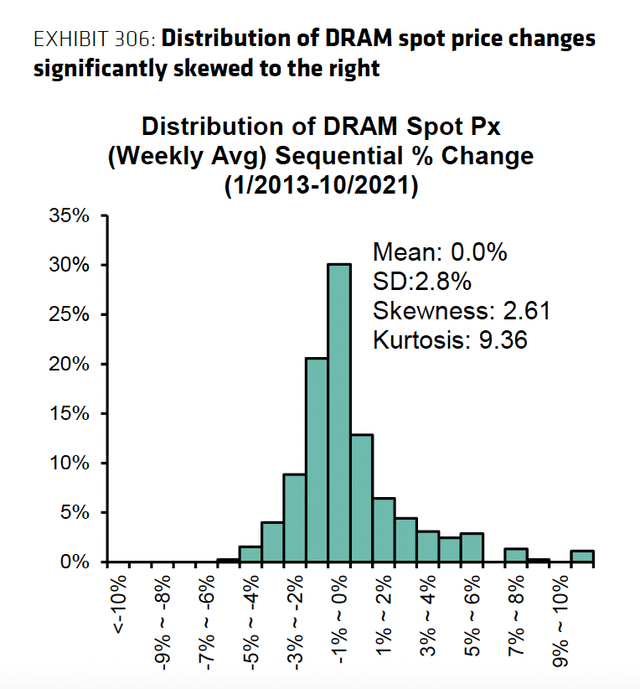

What about wonkiness? How is this for a chart?

Bernstein

I promise you none of the hedge fund principals I've spoken with are basing their buy/sell decisions on the kurtosis or skewness of DRAM spot price. (Isn't there a mouthwash for kurtosis?) Portfolio analysts spouting this mumbo jumbo to the portfolio managers would be short-lived. More relevant, but still wonky, are pages of analysis on regression of stock prices and memory spot prices. But I will spare you.

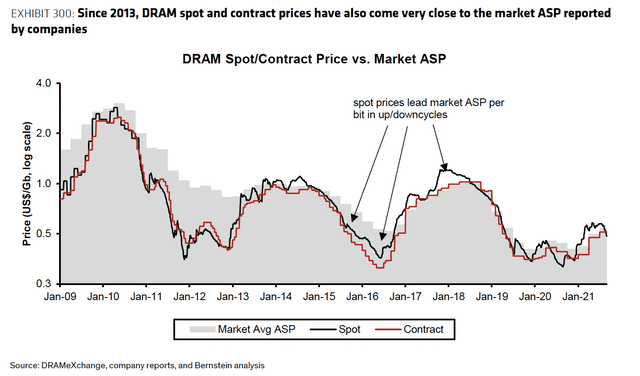

So what do I like from the Bernstein report? There's plenty to like from detailed sections on memory 101 to tech pricing slides like this one:

Bernstein

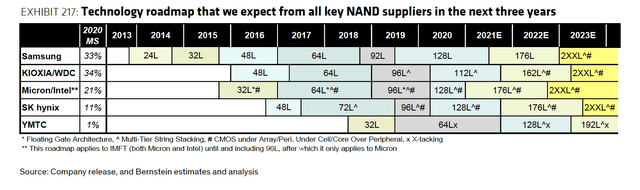

And relative positioning roadmaps and timetables like this one on NAND:

Bernstein

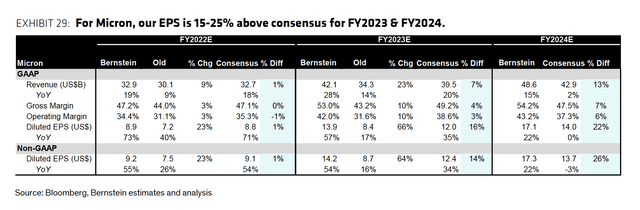

HOLD THE PRESSES! BERNSTEIN UPDATE. I originally submitted this article to Seeking Alpha on March 15. I pulled it back to add this section after I received Bernstein's update of March 16. Here's their slide showing the Black Book estimates, shown above, along with their current numbers:

Bernstein

Bernstein now thinks a $94 price target is more appropriate than the $58 number they'd featured in the Black Book less than two weeks ago. Their telescope has lengthened and sharpened, and they now offer up a 2024 revenue estimate of 48.6 billion, and fully diluted non-GAAP EPS of $17.3 per the Exhibit above.

The Black Book didn't have 2024 numbers even though it was produced just two weeks ago.

번스타인은 2주도 채안된 전에 발간된 블랙북에서 목표가 58달러였는데 지금은 94달러로 수정하였다.

2024년 매출은 486억달러로, 주당순이익은 17.3달러로 추정하였다.

지난번에 발간된 블랙북에는 2024년 추정치는 없었다.

Why the change of heart? I suspect the sloppy Black Book produced howls from institutional investors who took this new analyst team to task. Whatever the cause for the change, Bernstein now has some positive macro and industry factors which they must just have noticed, but which I believe were extant when they inked the Black Book. They now feel:

China hasn't made sufficient progress to break the DRAM oligopoly

And this on DRAM:

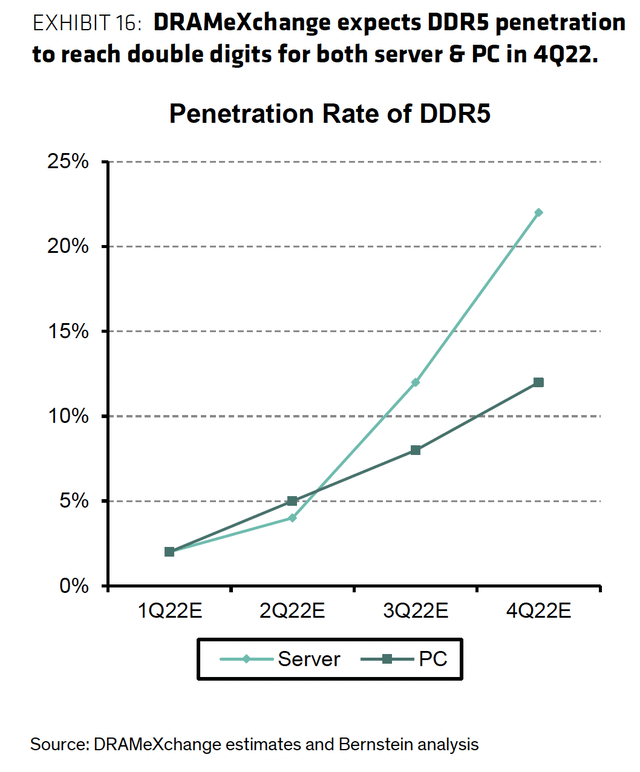

Our base case accounts for DDR5 & EUV and projects bit addition slower than expected. DDR5 intrinsically consumes more wafer capacity, and the lower yield during the ramp will make bit addition even more limited. EUV helps keep capex elevated, but that doesn't result in bit capacity immediately.

And here is a graphic, illustrating the aforementioned DDR5 growth:

DDR5 디램의 2022년4분기 침투율은 서버용은 20%대 초반,

PC용은 10%대 초반을 예상한다.

(분석: 인텔의 신규 서버 CPU인 사파이어 래피즈는 2분기에 출시 예정.

사파이어 래피즈는 DDR5를 지원한다. DDR5는 DDR4에 비해 속도는 2배,

전력은 30% 덜 사용한다)

Bernstein

My hat is off to Bernstein for putting out an update and thus repudiating much of what they wrote in the massive Black Book two weeks ago.

Goldman

They are writing this report after channel checks, where they found positives:

골드만삭스가 메모리 회사에 긍정적인 이유 3가지

- Robust Cloud Demand 견조한 클라우드 수요

- Positive bias to near-term NAND pricing. [Citing WD/Kioxia contamination.]

- 웨스턴디지털과 키옥시아의 생산 물질 오염으로 인한 낸ㄷ드 가격 상승

- Supply Challenges. [Where they believe additional production equipment will be tough for the next 12 months.]

- 향후 1년간 추가적인 장비 주문이 어렵다는 공급 측면의 문제.

- (장비를 만드는데 필요한 반도체가 부족해서, 장비 주문하면 인수할 때까지 1년이상 걸림)

They also shared concerns:

- Continued Weakness in Chinese Smartphones

- Inventory Build at Apple (AAPL)

- Potential delays (albeit minor) in Intel Sapphire Rapids (INTC)

- YMTC apparently gaining customer traction

Goldman's bullishness on the industry is driven by a tighter undersupply situation as shown in these two exhibits:

아래 그림1번은 낸드가 2022년에는 공급이 부족할 것이라는 그래프.

그림2번은 디램이 2022년에는 공급이 3.4%정도 부족할 것이라는 그래프.

Goldman Sachs

And here is Goldman's investment thesis:

While the demand side of the equation warrants scrutiny given potential negative implications from geopolitical instability, inflation, and rising rates, we believe 1) disciplined capital spending by the industry, particularly in NAND, 2) tightness in Wafer Fab Equipment (which, in our view, caps any potential upside to supply growth over the next 12-18 months), and 3) the recent incident at WD/Kioxia, will collectively keep DRAM and NAND supply growth in check for the foreseeable future. [Emphasis by Goldman]

Conclusions

Both Goldman and Bernstein are research powerhouses. In the horse race of these two reports and sets of estimates, I strongly favor Goldman. Both reports were written before the current China Covid lockdowns, but we know from past such events there is short term pain followed by medium- and longer-term memory price firming.

I miss Mark Newman writing these tomes for Bernstein.

I'm long a bundle of January 2023 call options on which I have been writing weekly OTM calls.

Let's finish the Ukraine war, God Bless them, and get China off lockdown. Then watch all of the memory stocks, but especially Micron, soar to new levels. Good luck!

'반도체-삼성전자-하이닉스-마이크론' 카테고리의 다른 글

| SK하이닉스-키움증권(2022.03.17) (0) | 2022.03.18 |

|---|---|

| 5G 스마트폰의 성장이 마이크론의 성장 동력(2022.03.17) (0) | 2022.03.18 |

| 삼성 파운드리, 성숙공정 투자 확대(2022.03.14) (0) | 2022.03.14 |

| 3분기, D램 가격 오른다(2022.03.14) (0) | 2022.03.14 |

| 글로벌 스마트폰 AP 점유율 (0) | 2022.03.13 |