2022.03.17

Micron Stock: Technology Leader Poised For Huge 5G Growth | Seeking Alpha

Summary

- Micron Technology is the 4th largest semiconductor company in the world and a leader in DRAM and NAND storage.

- 마이크론은 글로벌 4위의 반도체 기업이다.

- Micron is expected to benefit from 5G cell phone adoption as these phones have 50% higher DRAM and double the NAND versus comparable 4G cellphones.

- 마이크론은 5G 스마트폰의 채택으로 수혜를 받을 것이다.

- 5G 스마트폰은 4G스마트폰에 비해 디램은 50%, 낸드는 배 더 장착한다.

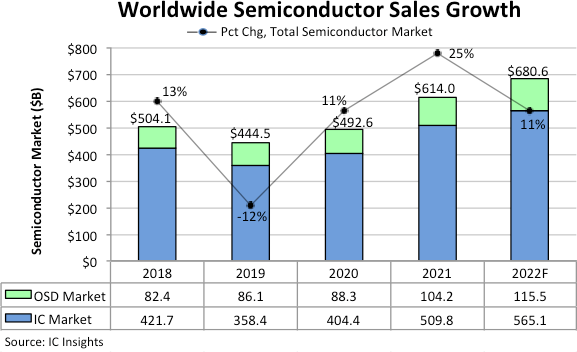

- Global semiconductor revenue in 2022 is forecast to grow 11% and reach a record-high $680.6 billion, according to IC Insights.

- 2022년 글로벌 반도체 매출은 전년대비 11% 성장한 6806억달러에 달할것이다.

- MU stock is undervalued and has strong growth prospects ahead; let's dive into the reasons why.

- 마이크론 주식은 저평가 되어있고, 앞으로 크게 상승할 것이다.

The Semiconductor industry has recently made headlines, thanks to supply chain constraints and global shortages. During 2021, over 11 million vehicles had to be removed from production due to Semiconductor shortages, according to Statista.

반도체 산업은 공급망 붕괴와 글로벌 공급 부족때문에 최근 뉴스의 헤드라인을 장식하고 있다.

2021년 1년간 11백만대 이상의 자동차가 반도체 부족으로 감산되었다.

This has further cemented into people's minds the importance of semiconductors in our life, from consumer electronics to our cell phones and even the heated seats in your car, they all require semiconductors.

이것은 사람들의 머리속에 우리 삶에서 반도체의 중요성을 굳건히 인식시켰고,

소비자 가전부터 스마트폰, 심지어 자동차 난방 의자까지 모두 반도체를ㄹ 필요로 한다.

Strong demand for semiconductors caused global revenue to soar by over 25% in 2021 and is forecasted to grow by a further 11% in 2022, according to IC Insights.

반도체의 강한 수요로 글로벌 반도체 매출은 2021년에 전년대비 25% 증가해고, 2022년에는 11% 성장할 것이라고

IC인사이트는 예상했다.

Our thirst for Semiconductors is set to continue, driven by new 5G cell phones, portable technology (Apple watches etc.), data center growth and even an increasing number of IoT (Internet of things) devices.

신규 5G 스마트폰, 애플워치같은 포터블 기기, 데이터센터의 성장과 사물인터넷 기기의 증가등에 힘입어

반도체에 대한 갈증은 계속될 것이다.

Global Semiconductor sales (IC Insights)

Micron Technology (NASDAQ:MU) is poised to benefit from these trends as the 4th largest semiconductor company in the world. The firm is one of only a handful of semiconductor manufacturers with the capability to produce DRAM Chips, you may have seen these brands Micron & Crucial if you've ever upgraded your laptop RAM (Random Access Memory).

5G cell phones are an especially interesting tailwind for the company, as they have 50% higher DRAM (Dynamic Random Access Memory) and double the NAND content versus 4G phones.

5G smartphone revenue is expected to reach $337bn for the industry by 2025, up from $108bn in 2021,

according to Juniper Research.

5G 스마트폰은 4G스마트폰에 비해 디램은 50%, 낸드는 배 더 장착한다.

5G스마트폰 매출은 2021년 1080억달러에서 2025년에는 3370억달러가 될것이다.

Micron makes 71% of its revenue from DRAM and 26% from NAND which is used in Solid State (Hard) Drives (SSD).

마이크론의 매출은 디램이 71%, 낸드가 26%이다.

These have many applications including, computers, mobile, automotive and even cloud data center storage.

Data centers are a large & growing market for memory and storage, driven by investment by Enterprise IT.

Micron has benefited from these tailwinds with Data center revenue growing by 70% year over year.

마이크론의 데이터센터향 매출은 전년대비 70% 증가하였다.

The share price is down 23% from its highs of $96 per share in February 2022 and seems to have found support, at the $70 range bouncing back by 5%. In this post, I'm going to dive into the firms business model, technical prowess, financials and valuation.

마이크론의 주가는 2022년2월 고점 96달러에서 23% 하락하였다.

70달러선에서 지지를 받고 5%정도 상승한 상태이다.

Micron's Strong Business Model

Micron has 13 Manufacturing sites, 14 customer labs and 40,000 team members. They have multiple sites internationally: HQ in Idaho, USA, UK/EUROPE, India, Malaysia, Taiwan, Singapore, Japan, China. This global presence adds diversification to the company's operations and they are not just mainly in Taiwan like some Semiconductor companies.

Micron designs & manufactures semiconductors and then executes strategic acquisitions to increase manufacturing scale & product diversity.

The firm is very self aware and states, "Our Success is Largely dependent on":

- High Returns on R&D Spend

- Efficient Manufacturing

- Development of advanced product/processes

- Market acceptance of products

- Return driven capital spending.

As a technology company, the firm must continually innovate to stay ahead, thus they are investing heavily into R&D (10%) of revenues, approximately $2 billion per year. So far their investments are paying off and the firm has a high 14.6% return on capital.

Micron's goals include continually reducing manufacturing costs & increasing density per wafer, so far they are doing this exceptionally.

Micron - A Technology Leader

Micron has over 44,000 patents and advanced manufacturing technology, which is vital for Semiconductor manufacturers.

The company has recently pioneered the "World's most advanced DRAM process technology" , called the 1-alpha. This allows a massive 40% improvement in memory density and a 15% drop in power usage. The semiconductor game is all about fitting as many transistors as possible into a smaller area, reducing power consumption and increasing performance. Micron is winning on wall fronts. The 1-alpha DRAM process offers a 40% improvement in memory density along with a 15% drop in power consumption.

They are also ahead of their competitors in many technological areas. For example, their 176-layer NAND went into production in Q4 2020, 6 months in front of SK Hynix and 8 months ahead of Samsung (OTC:SSNLF). Recently Micron's 1-alpha DRAM went into production in Q1 2021, a full year ahead of SK Hynix & Samsung Electronics. In terms of cell size, Micron comes out on top with a 66.26 mm2 cell smaller than Samsung's 73.58 mm2 and SK Hynix's 75.21 mm2.

Fierce Financials

Micron has produced strong results in the prior year with revenue jumping 29% from $21 billion to $27 billion. For Q1, revenue by unit was down 10% over the quarter, which is most likely why the stock sold off. This looks to be an overreaction by Wall Street given revenue is up 34% year over year.

Micron Revenue (Financials)

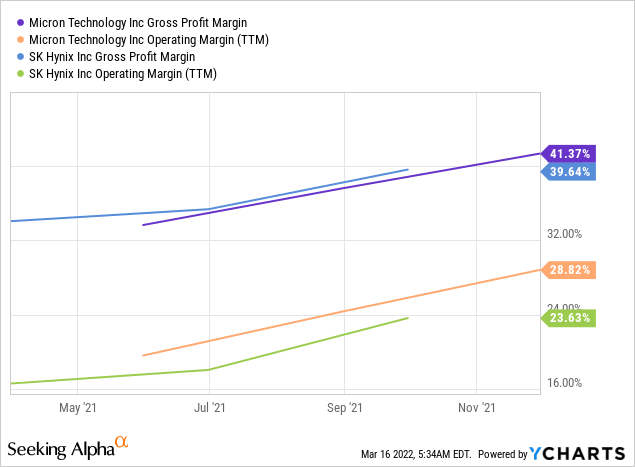

The firm has high Gross margins, which have increased to 41.4% of the revenue, slightly above their closest competitor SK Hynix.

Micron Margins (Created by author Ben Y chart)

Net Income increased by an amazing 118% from $2.7 billion, to $5.9 billion. The firms cash position also increased substantially to $8.6 billion. The company also announced to be buying back ~$7 billion worth of stock and eliminating the dilution from convertible debt. This is a great sign to see and shows management is bullish on the company's prospects.

Is MU Stock Undervalued?

I have plugged the latest financials into my valuation model, which uses the DCF method for valuation. I have estimated conservatively that the firm will grow revenues 25% next year (they have grown revenues by 29% in the year prior). Afterwards, I have predicted revenues to grow at 15% for the next 2 to 5 years (most analysts predict 23%). I have also estimated margins to maintain stable at 24%, they actually are increasing.

Micron Valuation (author Ben at Motivation 2 Invest)

Micron Valuation (Created by author at Motivation 2 invest)

Given these factors I get a fair value of $111/share, the stock is currently trading at $73/share and thus is 35% undervalued.

PE Ratio Micron (created by author Y chart)

The firm is also trading at one of the lowest P/E ratios and EV to EBITDA ratios over the past year.

The P/E Ratio looking backward is 6.5, is much lower than the US Semiconductor industry average 15. From the competitor analysis I have completed below, the firm has one of the lowest PEG ratios and is comparable to SK Hynix in terms of size and growth.

Competitor Micron (Created by author at Motivation 2 invest)

Risks?

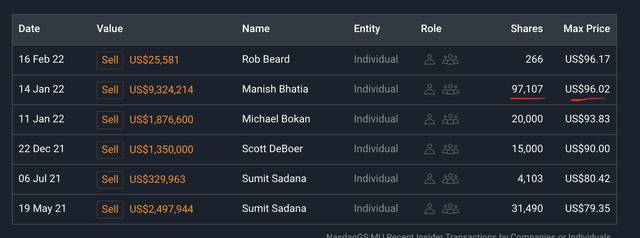

1. Insider Selling

The CEO & board all own shares in the company which is great to see. However, this is fairly low at just 0.081% of shares by the CEO. I would ideally like to see a larger insider holding. In addition, I noticed some insider selling at $90/share in Q1 2021.

Insider selling Micron (Simply Wall St)

2. Production issue (Intel problem)

If there is a production issue & the company doesn't keep innovating, then they may fall behind & lose business. This would be comparable to what happened to Intel when they fell behind with their 7nm chip.

3. Intense Competition

The firm faces intense competition from, Intel, Kioxia Holdings corporation (formerly Toshiba Memory), Samsung,

SK Hynix, Western Digital (WDC) etc.

4. Complex Supply Chain

The firm has a complex supply chain with 13 Manufacturing sites and 14 customer labs across the USA, Europe, India, Malaysia, Taiwan, Singapore, Japan and China. Thus with supply chain constraints and the trend toward "deglobalization" there is a lot of room for things to go wrong.

5. China is a sleeping Dragon

China has increased semiconductor production and wishes to become independent electronically. According to Micron's Investor presentation:

The Chinese Government may restrict us from participating in the Chinese Market and may prevent us from effectively competing with Chinese Companies

Basically the Chinese government can back local companies and then undercut Micron. China has also been poaching talent from Taiwan and there are increasing geopolitical tensions in the region. The Ukraine Russia Crisis, has caused a comparison to be drawn between Taiwan and China. However, China's foreign ministry has responded strong in Feb 2022, they stated:

Taiwan is "not Ukraine" and has always been an inalienable part of China

Increasing Tensions or even war in the region could affect Micron substantially. Although the firm does have facilities in Idaho in USA, the UK/Europe and other parts of the world which should help to mitigate damage.

Final Thoughts

Micron is a fantastic company and a true leader in the Semiconductor industry. The firm is ahead of its competitors in many technological areas and continues to innovate. They are growing fast with increasing margins.

The semiconductor industry is tremendously fast paced, volatile and cyclical, thus I would expect lots of this moving forward. The valuation is looking tasty after the company had a bad quarter and thus could be a buying opportunity for the long term investor.

'반도체-삼성전자-하이닉스-마이크론' 카테고리의 다른 글

| SK하이닉스(000660/BUY/155,000원) (0) | 2022.03.22 |

|---|---|

| SK하이닉스-키움증권(2022.03.17) (0) | 2022.03.18 |

| 마이크론은 번스타인의 목표가 상향으로 폭등(2022.03.16) (0) | 2022.03.17 |

| 삼성 파운드리, 성숙공정 투자 확대(2022.03.14) (0) | 2022.03.14 |

| 3분기, D램 가격 오른다(2022.03.14) (0) | 2022.03.14 |