2019.06.19

https://seekingalpha.com/article/4271150-micron-end-oligopoly-start-server-uptick?dr=1

Summary

The U.S.-China Technology/Trade War is preventing Micron Technology from selling DRAM and NAND chips

to China's Huawei.

미중 기술/무역전쟁은 마이크론이 디램과 낸드를 중국 화웨이에 판매하는 것을 금지했다.

If Korean memory competitors Samsung Electronics and SK Hynix fill the vacuum and sell to Huawei,

it will mark the end of a strategic DRAM oligopoly with Micron.

이런 공백을 경쟁업체인 한국의 삼성이나 하이닉스가 메운다면 3회사ㅢ 과점 체제는 종말을 맞을 것이다.

Cloud server companies should deplete excess DRAM inventories in Q3, marking a turnaround in the DRAM market.

클라우드 서버업체들이 보유한 과잉 재고는 3분기에는 소진될 것이고 디램 시장의 반등이 나올 것이다.

The escalation of the U.S.-China Technology/Trade War over Huawei has negatively impacted U.S. semiconductor companies, including Micron Technology (MU), which has further clouded the memory market.

Already mired by free-falling chip prices and excess inventory, some analysts subsequently suggested

the well-published 2H 2019 turnaround in ASPs (Average Selling Prices) could be pushed out into 2020.

This article will focus on two key aspects of the DRAM memory market - the end of the much ballyhooed

DRAM oligopoly and the start of a critical turnaround in the DRAM market, driven by cloud server companies.

End of the Oligopoly

Micron Technology is part of a DRAM oligopoly with Samsung Electronics (OTC:SSNLF) and SK Hynix (OTC:HXSCL). For a background, I refer readers to my December 17, 2018, Seeking Alpha article entitled "If Micron Is Part Of A DRAM Oligopoly, Why Is The Stock Down 55% From A High In May?"

The key premise to the DRAM oligopoly is that since there are only three major DRAM suppliers, they could adjust output, maximize earnings, and influence their stock valuations. In definitive terms, "competing firms providing do not explicitly collude on any feature (such as price, quantity, or product characteristics), but rather, observe and imitate each other's actions in a way that is mutually beneficial to both sides."

The oversupply of DRAMs, coupled with the significant drop in ASPs, significantly strained the boundaries of the oligopoly. The 8Gb DDR4 spot price, which was about $7 in early 2017 reached a high of about $9.50 at the end of 2017 before beginning a sustained drop to about $3.40 today.

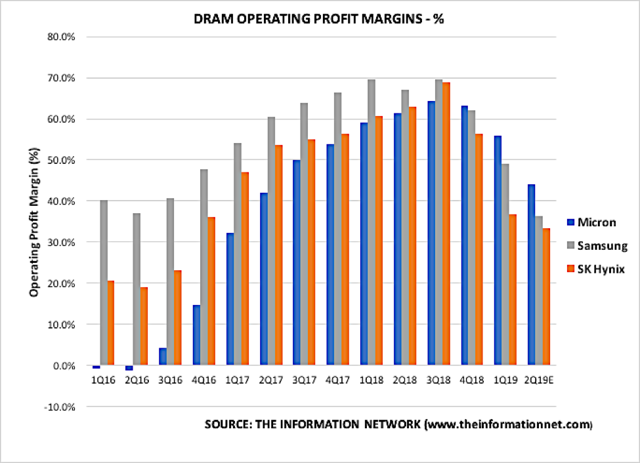

Micron's DRAM sales should reach $3.2 billion in FYQ3 (ending May 2019), down from $3.7 billion QoQ and $5.6 billion YoY. DRAM operating profit margin (OPM%) should decrease to 44.1% in FYQ3 vs. 61% YoY and 56% MoM. Chart 1 shows that for Q2 CY2019 (Q3 FY2019 for MU), Micron should maintain a significantly higher OPM% than competitors - 44.1% vs. 33.4% for SK and 36.3% for Samsung.

Chart 1

Factoring in the China Technology/Trade War

The U.S.-China Trade War escalated to a U.S.-China Technology War over Huawei and has further clouded the memory market, which has prompted some analysts to suggest the well-published 2H 2019 turnaround in ASPs could be pushed out into 2020.

The U.S. government in January 2019 accused Huawei of stealing trade secrets, violating economic sanctions, and concealing its Iran business dealings via an unofficial subsidiary Skycom in a 13-count indictment.

As a result, the U.S. has banned U.S. companies from doing business with Huawei. The ban applies to goods that have 25% or more of U.S.-originated technology or materials. A list of companies can be found here.

U.S semiconductor manufacturers Intel (INTC), Qualcomm (QCOM), ARM, and Micron Technology have announced they would stop supplying their products to Huawei. Samsung Electronics and SK Hynix are not on the list. They can replace MU as key suppliers of memory chips to Huawei, which represented 13% of MU's memory sales in the first six months of its recent fiscal year. Both SK Hynix and Samsung also count Huawei has a major customer.

마이크론 매출중 화웨이향 매출 비중은 이번 회계년도 6개월간 13%에 달했다.

Huawei is estimated to account for 10-15% of SK Hynix's total sales and is also one of Samsung Electronics' five biggest customers (includes display).

하이닉스 매출중 화웨이향 매출 비중은 10~15%에 달하고, 삼성에게는 5대 고객중 하나이다.

Table 1 shows specific purchases of DRAM and NAND chips as a percentage of total purchases by supplier.

|

Table 1 - Huawei's Share of Memory Purchases by Supplier |

||||

|

Micron |

Samsung |

SK Hynix |

Toshiba |

|

|

DRAM |

40% |

20% |

40% |

|

|

NAND |

20% |

10% |

30% |

40% |

|

Source: The Information Network |

||||

In early June, The National Development & Reform Commission of China told Samsung Electronics and SK Hynix to continue to supply their components to Chinese companies. Earlier, the Ministry of Foreign Affairs of China put the same pressure on South Korea as well. To date, both Korean memory companies appear to be still selling to Huawei.

The slowdown in the memory industry is further being exasperated by the technology/trade war. The average price of DRAM chips has been cut in half (so far) since peaking in the third quarter of 2018 and could still log double-digit declines in the third and fourth quarters of 2019.

To make matters worse, Chinese chipmaker Changxin Memory Technologies, formerly known as Innotron Memory, recently unveiled China's first domestically designed DRAM chip. I discussed Chinese memory technology in a November 6, 2018, Seeking Alpha article entitled "U.S. Restricts Exports Of Some Chip Production Equipment To China - Impact on Memory And Equipment Suppliers."

Although initial DRAM output from Changxin would be small and of inferior performance, output could ramp with investment by Huawei, which is in the process of redefining its supply chain because of the banning of U.S. companies. This move would increase competition and further the goals of China's 2025 program. To counter, the U.S. could restrict chip production equipment, like it did with Fujian.

The memory industry is in turmoil and faced with a great deal of uncertainty. Both Korean memory companies are faced with declining sales, inventory overhang, and stock that has lost half its value in the past year. The opportunity to unload record excess DRAM inventory, which increased from an oversupply of 0.5% in 2018 to an oversupply of 4% in 2019, would break the oligopoly.

Would this be a problem?

The NAND market is comprised of Samsung, SK Hynix, and Micron, as well as Toshiba Memory, Western Digital (WDC), and Intel (INTC), in addition to several smaller companies. The six major NAND companies make it nearly impossible to operate smoothly as an oligopoly to adjust output, maximize earnings, and influence their stock valuations. The three DRAM companies do enable these approaches.

As the China problem escalates and further damages the memory market, it is important to determine if indeed there is a DRAM oligopoly, what criteria is used to determine if there is a DRAM oligopoly, and what would happen if a DRAM oligopoly ended because of China.

Table 2 shows the under and oversupply of DRAM and NAND chips between 2015 and 2019. I've plotted the data in Chart 2 for clarity. on the question of whether an oligopoly mitigates over and undersupply, these data illustrate that there is no evidence of any advantages on the DRAM oligopoly versus the non-oligopoly NAND. Both chip types exhibited volatility in supply, and the amplitude of volatility was not mitigated by the oligopoly.

2016년과 2017에는 디램과 낸드가 공급 부족이었으나 2019년에는 디램과 낸드 모두 4%정도의 공급 과잉이다.

|

Table 2 - Under and Oversupply of DRAM and NAND Chips |

|||||

|

2015 |

2016 |

2017 |

2018 |

2019 |

|

|

DRAM |

0.5% over |

0.7% under |

2.7% under |

0.5% over |

4.0% over |

|

NAND |

1.2% over |

0.8% under |

0.9% under |

5.0% over |

4.2% over |

|

Source: The Information Network |

|||||

Chart 2

Chart 3 shows blended ASPs for DRAM and NAND between 2014 and 2019 (estimated). ASPs for both devices exhibit a cyclical rise in ASPs, but the peak in DRAM ASPs is clearly evident that, by controlling output and pricing, there are benefits of the oligopoly.

Chart 3

Chart 4 shows shipments of DRAM and NAND chips, based solely on the number of chips and irrespective of bit size between January 2017 and April 2019. Here, we see similar growth, so shipments are not influenced by whether the DRAM market is an oligopoly.

Chart 4

Chart 5 shows changes in bit growth. There is clearly a difference. The uptick in NAND bit growth in 2018 is due to the switch to 3D NAND.

Chart 5

Server DRAM

The problems in the memory markets are a confluence of several factors - high ASPs from undersupply, low ASPs from oversupply, a slowdown in PCs and smartphones, double purchasing by customers to avoid further price increases resulting in inventory overhang, and the U.S.-China trade/technology war impending demand.

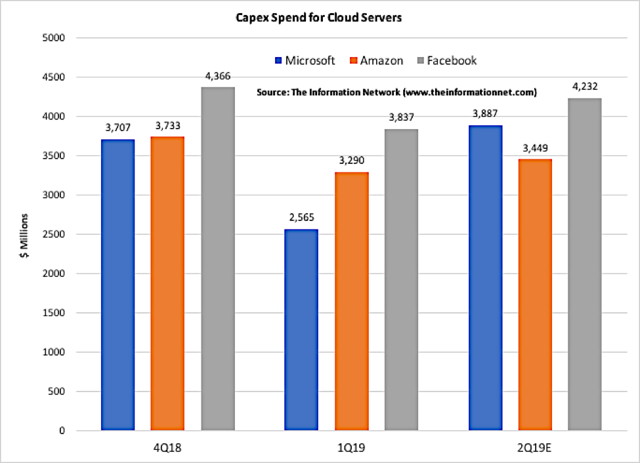

DRAMs for servers were a high flyer in 2018, but server companies began doubling up of purchases to avoid escalating ASPs. They now are burdened with inventory overhang that strongly impacted server capex for Q1, as shown in Chart 6. Adding to the inventory overhang in Q1 was the softening DRAMs by Huawei. Chart 6 shows overall growth in capex spend of 15% QoQ in Q2.

서버용 디램 가격이 2018년도에 고공행진을하자 서버회사들은 가격 상승을 우려하여

필요량의 2배를 구매했다. 이제는 이것이 과잉 재고로 서버회사들에게 부담이 되었다.

게다가 화웨이 사태는 2019년 1분기 수요를 더욱 약화시켰다.

2분기에는 1분기 대비 시설 투자가 15% 증가할 것이다.

Chart 6

In January 2019, I estimate that DRAM inventory at server companies exceeded 10 weeks, versus a normal level of 4 weeks. In June 2019, according to our report entitled "Hot ICs: A Market Analysis of Artificial Intelligence (AI), 5G, CMOS Image Sensors, and Memory Chips," most of the server companies are close to the normal historical level of 4 weeks. Alibaba (NYSE:BABA) still has 6 weeks of inventory, while Baidu (NASDAQ:BIDU), Tencent (OTCPK:TCEHY), Amazon (AMZN), and Microsoft (MSFT) are down to 5.5 weeks. Facebook (NASDAQ:FB) has an estimated 5 weeks of supply while Google (NASDAQ:GOOG) (NASDAQ:GOOGL) is at 4 weeks.

Investor takeaway

I questioned the efficacy of a DRAM oligopoly in my above-mentioned SA article entitled "If Micron Is Part Of A DRAM Oligopoly, Why Is The Stock Down 55% From A High In May?", particularly as it pertains to stock values. Readers have commented to me that they bought MU stock mainly because it was an oligopoly.

The "DRAM oligopoly" term has been written about extensively in the literature as well as other Seeking Alpha articles. Companies that can adjust output, maximize earnings, and influence their stock valuations can "collude" in a legal way to manipulate the market, driving up stock evaluations.

Data in this article show that the DRAM market has behaved differently than the NAND market in several respects and could be a result of the DRAM oligopoly.

However, chipmakers are struggling with inventory. Reducing supply to stem inventory increases seems a more realistic solution than waiting for demand to rebound. In its Q1 2019 earnings release, Samsung Electronics reported its worst operating-profit drop in more than four years. So, if Samsung and SK Hynix start selling to Huawei rather than side with its fellow oligopoly member, then the oligopoly will disband. And, if that happens, then one of the tenants of this oligopoly - competing companies banding together to maximize profits and revenues, will be broken.

With PC and smartphone sales languishing, servers are the key to a turnaround in the DRAM market. If my analysis is correct, DRAM inventory at server companies will normalize to 4 weeks in Q3 2019. At that time, we will see a surge in DRAM purchases by server ODMs, taking advantage of the lowest ASPs they will see in the next several years before prices will start ramping.

피씨와 스마트폰 매출이 약해지는 가운데, 서버는 디램 시장의 턴어라운드의 핵심 요소이다.

나의 분석이 맞다면 서버 회사들의 서버 디램 재고는 3분기에는 4주정도로 정상화될 것이다.

그때가되면 서버 ODM회사들은 서버 디램 가격이 상승하기전에 가장 낮은 가격에 서버 디램 구매에

나서므로 서버디램 가격의 상승ㄹ을 보게될 것이다.

'반도체-삼성전자-하이닉스-마이크론' 카테고리의 다른 글

| 메모리반도체-마이크론-메모리장착량 (0) | 2019.06.21 |

|---|---|

| 하이닉스..EPS..BPS..PBR.. 목표가 (메모리) (0) | 2019.06.21 |

| 메모리-수요-공급/ 연도별 웨이퍼 출하량 (0) | 2019.06.19 |

| 메모리분석-2017-11-24 (0) | 2019.06.19 |

| 연간 실리콘 웨이퍼 출하량 (0) | 2019.06.18 |