2022.06.21

6월21일 대만의 시장조사기관 트렌드포스는 최근 보고서를 통해 올해 3분기 D램과 낸드플래시 가격이

2분기보다 각각 3~8%, 0~5% 하락할 것으로 예상했다.

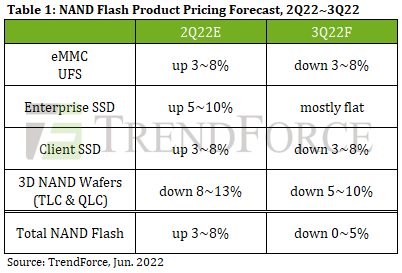

NAND Flash Market Oversupplied in 3Q22, Price Quotes to Drop by 0~5%, Says TrendForce

3분기 낸드는 공급 과잉이 되면서, 낸드 가격은 0~5%하락할 것으로 트렌드포스는 예상했다.

According to TrendForce research, as output from Kioxia and WDC grows month by month, it has become obvious that production capacity is sufficient to meet increased bit demand. However, post-pandemic demand for consumer electronics such as laptops will no longer lead to flagging orders. Coupled with slow destocking among Chinese smartphone brands due to the pandemic and rising inflation, these factors will lead to oversupply in the 3Q22 NAND Flash market, in turn affecting a price drop of 0~5% in 3Q22.

In terms of Client SSD, although a backstop for business notebook orders remains, demand for consumer notebook and Chromebook orders lags behind 2021, especially as PC brands stock more conservatively. Their intention to actively reduce inventory is obvious and the volume of orders in peak season may fall behind last year. However, as SSD production capacity gradually returns to normal, supply of client SSDs continues to increase. In addition, shipments of Kioxia and WDC products been delivered in succession. In order to avoid a sharp increase in inventory, the supply side is willing to let prices spike. Client SSD pricing is expected to reverse direction and move downwards approximately 3-8% in 3Q22.

In terms of Enterprise SSD, purchase orders from hyperscale data centers remain strong and, compared with other products, clients’ enterprise SSD inventory levels are still reasonable, inducing sustained growth in SSD purchases. Global enterprise SSD purchase capacity can be expected to grow by 10% QoQ in 3Q22. Due to rapidly weakening demand for other end products, enterprise SSDs are currently the preferred sales category for all suppliers. Increased supply will inevitably intensify price competition. As a result, enterprise SSD prices are not likely to rise in 3Q22 and remain roughly in line with 2Q22.

In terms of eMMC, demand for Chromebooks has continued to decline since 2Q22. Although the demand for Netcom products in 3Q22 is relatively optimistic, it is still no match for the downward trend of eMMC pricing. The impact of the prior raw material contamination incident on the broader market has gradually faded. In a climate of poor consumer product demand, it is difficult for suppliers to support 2D eMMC product pricing to maintain profitability. Due to the current state of oversupply, eMMC prices are predicted to drop by 3-8% in 3Q22.

In terms of UFS, the trends of sluggish smartphone shipments and cooling of the consumer market remain unchanged, suppressing the growth trend of bit demand. The impact of the Kioxia/WDC raw material contamination incident at the beginning of the year on the total output of 3D NAND has gradually faded. With the recovery of production capacity at the aforementioned companies, the supply of UFS products has been stable. Prices are starting to come under pressure amid a weak demand outlook and rising supply. Judging from the current demand situation, even if suppliers dole out large price reductions, the effect on demand stimulation remains very limited. Therefore, the price of UFS is predicted to drop by 3~8% in 3Q22 and the number of bits sold will remain at a low level.

In terms of NAND Flash wafers, expecting a drop in pricing, the number of wafer purchases in 3Q22 has an opportunity to rebound in comparison to 2Q22 as the curtain falls on peak season and the pandemic in China. At the same time, the impact of flagging upstream supply has gradually faded and the supply side has continued to expand wafer supply. Module manufacturers have begun to adopt an active price reduction strategy to reduce their inventories. In order to narrow the gap between the wafer contract and spot price, companies had begun to simultaneously reduce wafers contract prices in May, while a contraction in contract pricing in June may extend to nearly 10%. Therefore, as wafer pricing had already fallen in May, 3Q22 decline can be mitigated to 5~10%.

-----------------------------------------

Demand Remains Weak as Inventories Continue Moving Higher, DRAM Pricing Forecast to Drop by 3~8% in 3Q22, Says TrendForce

디램 재고가 높아지면서 디램 수요는 약해졌고, 3분기 디램 가격은 3~8%하락할 것으로 트렌드포스는 예상했다.

According to TrendForce research, despite the significance of peak season and rising DDR5 penetration, the 3Q22 DRAM market still succumbed to the negative impact of weak consumer electronics demand resulting from the Russian-Ukrainian war and high inflation, which in turn led to an increase in overall DRAM inventory. This is the primary reason for a 3-8% drop in DRAM prices in 3Q22 and a more than 8% pricing dip in certain DRAM products for PCs and smart phones cannot be ruled out.

In terms of PC DRAM, sustained weakening of demand has led to PC OEMs adjusting their annual shipment targets and also caused DRAM inventories to soar rapidly. In 3Q22, PC OEMs remain focused on adjusting and destocking DRAM inventories, making a rebound in purchasing momentum unlikely. At the same time, since the overall DRAM industry remains oversupplied, even if PC demand is sluggish, suppliers still experienced difficulties in reducing their PC DRAM supply, resulting in a slight quarterly increase in the number of supplied bits. Therefore, PC DRAM pricing is forecast to drop by 3~8%

In terms of server DRAM, current client inventory levels of 7-8 weeks is slightly high, and though direct sales is currently the server field’s primary distribution channel, clients’ bit demand is still not enough to fully consume the bit output derived from increased wafer input and process advancement. In addition, demand for consumer PC DRAM and mobile DRAM is uncertain in 2H22, forcing suppliers to transfer production capacity to server DRAM. As a result, suppliers have to adopt certain sales strategies such as two quarter price binding or increasing on hand inventory to suppress price declines. Server DRAM is forecast to drop by another 0~5% in 3Q22.

In terms of Mobile DRAM, as sales in the consumer market fail to meet expectations, suppliers are forced to incrementally reduce the proportion of mobile DRAM production quarter by quarter and switch to server DRAM, thereby stabilizing market inventory and prices. However, the supply of mobile DRAM bits did not drop significantly due to the increased manufacturing. In addition, average memory installed per machine failed to increase significantly, resulting in continued oversupply and expanding price decline to 3~8% compared to 2Q22. TrendForce also indicates, bit shipments were limited due to sluggish demand for smartphones in 2Q22 and the urgency of smartphone brands to deplete inventory. Under pressure from both revenue and inventory, pricing will see greater flexibility and suppliers will strive to negotiate pricing on some orders before the end of June to alleviate their inventory concerns.

In terms of Graphics DRAM, as buyers face increasing inventory and uncertain subsequent demand from distributors, the market's stocking momentum has become weak. Although Micron only retained a sporadic supply of GDDR6 8Gb in 3Q22, the current graphics DRAM supply is secure due to increased production volume from Korean manufacturers and the weakening of demand, which caused prices to drop marginally by 0~5% in 3Q22. TrendForce believes that weak demand is a key inhibitor of rising graphics DRAM pricing this quarter. However, if suppliers see that a price drop in 3Q22 will not stimulate demand, they will try to keep prices as flat as possible.

In terms of consumer DRAM, the purchasing of consumer electronics has been adversely affected by factors such as the Russian-Ukrainian war, China's pandemic lockdowns, and rising inflation. Consumer DRAM-related applications such as notebook and TV shipments are facing downward revision. In addition, since DDR3 is at a relatively high point, pressured by inventory and cost, buyers’ purchasing power has obviously weakened. Demand for DDR3 and DDR4 is forecast to decline simultaneously and market stocking momentum will continue to weaken.

Korean manufacturers’ plans to withdraw from DDR3 supply remains unchanged but, in 2H22, Chinese and Taiwanese companies will continue to create new production capacity. With weaker demand and increased supply, sellers lose their bargaining advantage, making consumer DRAM prices difficult to support in 3Q22. DDR3 and DDR4 prices are forecast to drop by 3-8% QoQ.

'메모리 관련 데이터' 카테고리의 다른 글

| 메모리 공급업체들이 가격 하락에 대해 더 동의할 의사가 있다(2022.07.04) (0) | 2022.07.05 |

|---|---|

| 2022년1분기 삼성 파운드리 점유율 16.3%로 하락(2022.06.20) (0) | 2022.06.22 |

| 2022년1분기 기업용 SSD 매출은 전분기대비 14.1% 증가 (0) | 2022.05.27 |

| 1Q22 글로벌 낸드 매출은 전분기대비 3.0% 감소/2분기는 10% 증가 예상(2022.05.25) (0) | 2022.05.26 |

| 2022년1분기 글로벌 디램 매출은 전분기대비 4.0% 감소한 240.35억달러(2022.05.19) (0) | 2022.05.19 |