2022.06.23

IDM(종합반도체)은 삼성이나 하이닉스처럼 반도체 설계부터 생산까지 모두 자체적으로 운영하는 회사.

팹리스는 엔비디아나 AMD처럼 반도체 설계만 하는 회사.

파운드리는 TSMC나 UMC처럼 팹리스가 설계한 반도체를 생산해 주는 회사.

2022년 캐파 증설은 12인치 파운드리 공장 증설에 집중하고, 28나노 이상의 성숙 공정 캐파 증가율은 20%에 달할 것.

2022 a Focus for 12-inch Capacity Expansion, 20% Annual Growth Expected in Mature Process Capacity, Says TrendForce

According to TrendForce data, global wafer foundry capacity will increase by approximately 14% annually in 2022.

Since expanding 8-inch capacity is not cost-effective and its growth rate is much lower than the overall industry average, 8-inch capacity will grow approximately 6% annually, while 12-inch capacity will grow 18% annually.

트렌드포스 데이터에 따르면 2022년 글로벌 파운드리 생산 용량 증가는 14%에 달할 것이다.

8인치 공장 증설은 비용면에서 효과적이지 않기때문에 전체 파운드리 공장 증가율 보다는 적을 것이고,

8인치 캐파 증가율은 연율 6%, 12인치 캐파 증가는 18%에 달할 것이다.

Of this new capacity, approximately 65% of new 12-inch capacity will be in mature processes (28nm and above) with an annual growth rate of 20%. It is obvious that in 2022, most wafer foundries will focus on 12-inch wafer production capacity, with the main driving force behind production expansion coming from TSMC, UMC, SMIC, HuaHong Group’s HHGrace, and Nexchip.

12인치 신규 캐파중에서 12인치 캐파의 65%가 28나노이상의 성숙 공정에 사용될 것이며,

이로서 성숙공정 캐파는 20%정도 증가할 것이다.

2022년에 대부분 파운드리업체들이 12인 캐파 증설에 집중하는 것은 명백하다.

As the recent expansion activities of process nodes above 28nm focus on the diversified development of specialty processes, TrendForce has analyzed the recent trends of these specialty processes based on products

such as Power-related, MCU, and AMOLED driver ICs.

스페셜티 공정의 다양한 개발에 집중한 최근 28나노 공정의 증설은, 파워관련 반도체,MCU와

아몰레드 구동 반도체등의 스페셜티 공정에 관련이 있는 것으로 트렌드포스는 분석했다.

First, power semiconductors can be roughly divided into two categories: power discrete and power IC.

첫째, 전력반도체는 크게 두 가지 범주로 나눌 수 있다: 별도의 전력반도체와 전력반도체.

Power discrete, with power transistors such as MOSFET and IGBT as mainstream products, is affected by 5G infrastructure, consumer fast charging, automotive electronics, and electric vehicles where the consumption of power components per unit of product has increased and demand has grown rapidly.

MOSFET 및 IGBT와 같은 전력 트랜지스터를 주류 제품으로 하는 전력 디스크리트는

제품 단위당 전력 부품 소비가 증가하고 수요가 빠르게 증가하는 5G 인프라, 소비자 급속 충전,

자동차 전자 및 전기 자동차의 영향을 받습니다.

The overall market has long been dominated by international IDMs, such as Infineon, On Semi, and STM.

Global IDMs account for approximately 80~90% of the market while fabless firms account for approximately 10~20%.

전체 시장은 오랫동안 Infineon, On Semi 및 STM과 같은 글로벌 종합반도체 회사들이 지배했습니다.

글로벌 IDM회사가 약 80~90%, 팹리스 업체는 약 10~20%를 찾지하고 있다.

In terms of foundries, in addition to increasing demand from existing fabless customers, due to the relatively conservative expansion process of IDMs’ own factories in recent years, capacity shortages have been commonplace and IDMs have also successively outsourced products to foundries.

파운드리의 경우 기존 팹리스 고객들의 수요 증가와 더불어 최근 IDM 자체 공장의 상대적으로 보수적인 증설 과정으로

인해 Capa 부족이 일상화되면서 IDM도 파운드리에 제품을 잇달아 아웃소싱하고 있다.

HHGrace's power discrete revenue scale in 2021 was the greatest in the pure-play foundry field with the steady release of new 12-inch capacity in Wuxi to perpetuate revenue performance. PSMC and Vanguard have also recently increased their 8-inch capacity to undertake related orders.

2021년 HHGrace의 전력 디스크리트 매출 규모는 매출 실적을 영속시키기 위해 Wuxi에서 새로운 12인치 용량을

꾸준히 출시하면서 순수 파운드리 분야에서 가장 컸다.

PSMC와 Vanguard도 최근 관련 주문을 수행하기 위해 8인치 용량을 늘렸습니다.

In terms of PMIC, BCD (Bipolar-CMOS-DMOS) platform technology has mostly been adopted at this stage and mainstream manufacturing is performed at the 8-inch 0.18-0.11µm nodes.

전력관리 반도체면에서 BCD(Bipolar-CMOS-DMOS) 플랫폼 기술이 이 단계에서 대부분 채택되었으며

주류 제조는 8인치 0.18~0.11µm 노드에서 수행됩니다.

Benefiting from upgraded technical specifications for 5G smartphones, data centers, and electric vehicles, demand for PMICs has spiked in recent years.

However, due to limited growth in 8-inch production capacity and the need to update peripheral ICs in response to the release of a new generation of SoCs, each foundry has also successively assisted clients in migrating certain PMICs to 12-inch production. The plan is to migrate these PMICs to the 90/55nm nodes, focusing on applications such as smartphones and servers. TSMC, UMC, PSMC, HHGrace, and SMIC, all have such plans.

5G 스마트폰, 데이터 센터 및 전기 자동차에 대한 업그레이드된 기술 사양의 이점을 활용하여 최근 몇 년 동안

PMIC에 대한 수요가 급증했습니다.

그러나 8인치 생산 능력의 한정된 성장과 차세대 SoC 출시에 대한 응답으로 주변 IC를 업데이트해야 하는 필요성으로

인해 각 파운드리는 특정 PMIC를 12인치 생산으로 이동하는 고객을 성공적으로 지원했습니다.

계획은 이러한 전력반도체를 스마트폰 및 서버와 같은 애플리케이션에 중점을 둔 90/55nm 공정으로

이동하는 것입니다. TSMC, UMC, PSMC, HHGrace, SMIC 모두 그러한 계획을 가지고 있습니다.

The eNVM (embedded Non-Volatile Memory) process possesses relatively diversified technology and eFlash is currently its mainstream process. In addition, eNVM process applications are mostly used in smart cards and MCUs.

eNVM(embedded Non-Volatile Memory) 공정은 비교적 다양한 기술을 보유하고 있으며 현재 eFlash가 주류 공정입니다. 또한 eNVM 프로세스 애플리케이션은 주로 스마트 카드 및 MCU에 사용됩니다.

An MCU has a wide range of uses.

For example, industrial/automotive and consumer electronics such as information communication products, home appliances, and IoT products requiring simple functional commands to diverse complex applications, will use MCU components.

MCU는 다양한 용도로 사용됩니다. 예를 들어, 다양한 복잡한 응용 프로그램에 간단한 기능 명령이 필요한 정보 통신 제품, 가전 제품 및 IoT 제품과 같은 산업/자동차 및 소비자 전자 제품에는 MCU가 사용됩니다.

In addition, embedded memory technology for MCU will also vary based on slight differences in functionality.

Although the demand for consumer MCUs is relatively flat due to weak market conditions, MCU stocking momentum to meet automotive and industrial equipment demand is still strong, leading to a relative shortage of MCUs in the currently market.

또한 MCU용 임베디드 메모리 기술도 약간의 기능 차이에 따라 달라집니다.

소비자 MCU에 대한 수요는 약한 시장 상황으로 인해 상대적으로 평평하지만 자동차 및 산업 장비 수요를 충족시키기 위한 MCU 재고 모멘텀이 여전히 강력하여 현재 시장에서 MCU가 상대적으로 부족합니다.

In addition, IDMs have been increasingly outsourcing orders driven by the short-term consequences of the pandemic on the supply chain and the cost factors of MCU products moving to more advanced process nodes in the medium and long term, especially as the cost of expanding processes below 40nm (inclusive) has increased significantly.

또한 IDM은 공급망에 대한 팬데믹의 단기 결과와 MCU 제품이 중장기적으로 보다 고급 프로세스 공정으로 이동하는

비용 요인으로 인해 점점 더 많은 주문을 아웃소싱하고 있습니다.

특히 40nm이하 공정 증설 비용이 크게 증가했습니다.

This, in turn, stimulates the MCU application development and deployment of wafer foundries.

With an earlier mass production for processes below 40nm (inclusive) and process maturity, Taiwan's foundries have also accepted orders from IDMs, while the technology utilized by SMIC and HHGrace lag by approximately one generation, though HHGrace possesses the greatest production capacity among Chinese foundries.

이것은 MCU 애플리케이션 개발과 웨이퍼 파운드리 설치를 자극한다.

40나노이하와 성숙 공정의 대량 생산으로 대만 파운드리업체들은 종합반도체 회사의 주문을 받았다.

반면에 중국의 HHGrace는 중국 파운드리업체중에서 최대 생산용량을 보유하고 있음에도 불구하고,

SMIC와 HHGrace이 사용하는 기술은 대만업체에 비해 거의 1세대정도 뒤쳐져있다.

HV (High Voltage) process technology is mainly used in the production of display driver ICs.

At present, the mainstream includes the production of large/small size driver ICs at the 8-inch 0.18-0.11um process nodes, the production of TDDI at 12-inch 65/55nm, and the production of smartphone AMOLED driver ICs at 40/28nm.

고전압 공정은 주로 디스플레이 구동 반도체 생산에 사용된다.

Since the beginning of 2022, smartphone and consumer electronics market conditions have continued to be sluggish, balancing the supply of large-size driver ICs and TDDI. However, since the overall penetration rate of AMOLED in mobile phones is still rising steadily, continued growth momentum is forecast in the medium and long term for AMOLED driver ICs. Samsung, TSMC, UMC, and SMIC all have plans to develop 28nmHV. The process technology of remaining players including HHGrace or Nexchip remain dominated by the 65/55nm nodes and they have yet to be able to mass produce AMOLED driver ICs.

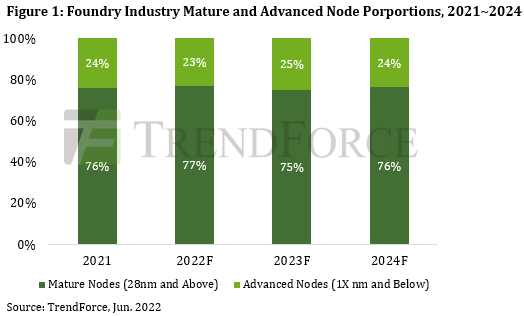

Mature processes are estimated to account for nearly 75~80% of production capacity in the next three years

According to TrendForce investigations, the compound annual growth rate of global foundry capacity will reach 11% from the period of 2021-2024, of which 28nm capacity in 2024 will reach 1.3 times that of 2022, the most active process node for mature process expansion. More specialty process applications are expected to be migrated to 28nm and the global production capacity of mature processes above 28nm (inclusive) will stably maintain a 75-80% proportion of overall production capacity from 2021 to 2024, showing the market potential and importance of creating specialty mature processes.

At the same time, TrendForce indicates, due to the impact of the pandemic on the global supply chain and geopolitics, regional "short-chain production" and supply chain autonomy have become key considerations for foundry expansion. For example, in order to ally with regional production and improve the flexibility of capacity scheduling, Taiwanese foundries have corresponding expansion plans in the United States, Japan, China, and Singapore. Except for TSMC's U.S. fab, which focuses on advanced processes, remaining expansion plans focus on specialty process technologies. In addition, recent expansion activities clearly show that foundries in mainland China are actively expanding mature process technology and capacity. These companies are allocating the production of key peripheral ICs such as HV, MCU, PMIC, and power discrete, in order to enhance the autonomy of their supply chains and meet the needs of the domestic automobile, consumer electronics, and information and communication industries.

--------------------------------------

GlobalFoundries CEO Thomas Caulfield said Thursday that the semiconductor sector will require

"trillions of dollars" of investment to reach a point where it can meet global demand.

3위 파운드리업체인 미국의 글로벌파운드리 사장 콜필드는 글로벌 파운드리 수요를 맞출려면 수조달러가

필요하다고 말하였다.

Speaking to CNBC, the head of GlobalFoundries (NASDAQ:GFS) also predicted that the computer chip industry will double in size over the next eight to 10 years.

CNBC와의 대화에서 글로벌파운드리는 8~10년내에 컴퓨터용 반도체 산업은 2배로 성장할 것으로 예상했다.

Caulfield added that this rapid expansion will happen "independent of some of the macro issues we're seeing right now," such as supply chain bottlenecks. The GFS CEO believes these problems will "settle down" eventually.

콜필드는 이런 빠른 증가는 공급망 병목현상이 일어나는 것과는 별도로 생겨나고 있다고 덧붙였다.

As part of the build-out of additional production in the industry, Caulfield reported that GlobalFoundries (GFS) is expanding manufacturing capacity in the U.S., Singapore and Germany, which will allow the company to increase its output by 60% from its 2020 mark to the level it expects in 2024.

쿨필드는 글로벌 파운드리는 미국, 싱가포르와 독일에 공장 증설을 하고있고,

이로써 2020년 매출대비 2024년 매출이 60% 증가할 것이라 하였다.

While the company already has orders to match its total production capacity for the next two years, Caulfield acknowledged that there has been some softening of demand in parts of the technology space, such as PCs and low-end handsets. He noted that GFS has low exposure to these markets.

Caulfield stressed that demand for chips already outstripped supply by about 20%, which creates a "shock absorber" if the desire for the firm's products dips.

"If we do see some softening, it allows us to better meet the demand our customers have placed on us," he said.

GFS came public last year and has seen bumpy trading early in its career on Wall Street. Shares reached a high of $79.49 in late March but have since lost significant ground. The stock is now trading below $46, hovering near its lowest close as a public company.

The recent slide in GFS is part of a general downturn in the semiconductor sector, as the tech industry has been hit hard during the selling that has shaken Wall Street in 2022. So far this year, NVIDIA (NVDA) and AMD (AMD) have dropped more than 40%. Intel (INTC) has shown a year-to-date retreat of about 30%.

'파운드리-TSMC-난야-UMC-DB하이텍' 카테고리의 다른 글

| 디램 제조업체 난야는 2분기 매출이 전분기대비 9.6% 감소(2022.07.12) (0) | 2022.07.12 |

|---|---|

| 주문 취소로 8인치 팹 가동률이 하반기에 가장 많이 감소할 것(2022.07.07) (0) | 2022.07.07 |

| 대만 파운드리 공장 가동률은 3분기에 하락할 듯(2022.06.21) (0) | 2022.06.22 |

| TSMC의 2022년 매출은 30% 증가할 것(2022.06.09) (0) | 2022.06.09 |

| 2022년 파운드리 점유율, 대만내 생산이 48% 차지할 것(2022.04.25) (0) | 2022.04.26 |